I already said Slack. Whatsapp is not organized enough.

In simple terms, Cloud is synonymous to a virtual computer.

Lyft may use the cloud (computer), but lyft is not provider of cloud(computer).

Cloud companies means cloud service providers, but not cloud usage companies.

Bitcoin is virtual coin, not virtual computer service !

Cloud service providers have been around for quite some time, I didn’t realize it is the hottest stocks now.

Seems the list is mostly enterprise software in cloud.

Amazon AWS is the biggest cloud business, but it focuses on low level service

Big players like AMZN, GOOGL and MSFT are in that business and they are too good, profitable…

But Mr.Market artificially jack up all small caps, and non profit makers, higher with vested interests. They will keep it UP and UP always until one day. This is very common in stock games. This is what Seth Klarmann states in his book, Margin of Safety, wall street conflict of interest.

The only way to escape is go through fundamentally strong companies avoiding all hyped companies. People have to understand the difference between Hype and Fundamentals.

Do not just look at daily stock prices, but review the company fundamentals. Real investor must understand the difference.

What do think of NRZ, NLYand OXLC REITs? High yield. High risk?

First two are mortgage REITs. Risk is mortgage defaults in case of recession. Otherwise, it is fine.

You can presently ignore NLY until it comes down between $8.5 to $9 which is appx decade low (Higher yield will result at this price). Presently, they are not in good shape.

Preliminary review, NRZ the best one, we should have got it during Dec low, but it is attractive even now, considering low P/E, Payout ration, high yield and profit margin.

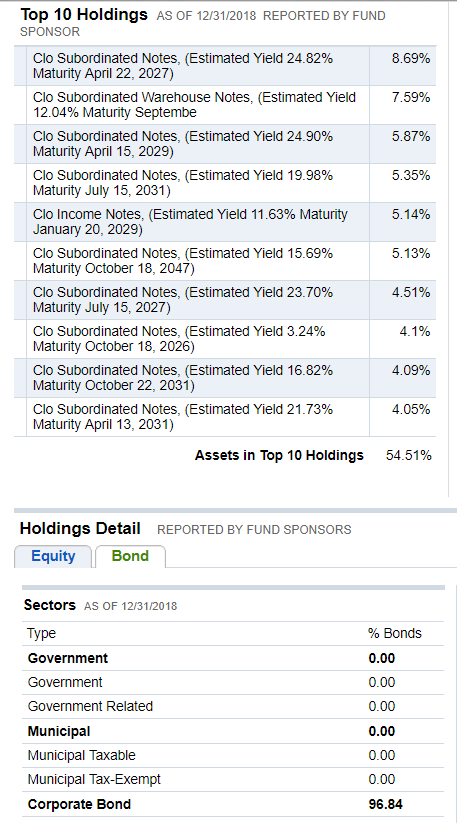

OXLC is closed-end fund, some broker may not have access to buy. They are also best considering high yield 15%. They hold debt/corporate bond yield, but need to review/deep dive further. Again, corporate bonds, do not know the securities behind it.

OXLC holdings are

Thank you very much

You need to know more about CLO for OXLC (Risky loans), Collateralized Loan Obligation (CLO) Structure, Benefits, and Risks

AAPL was a chicken during 1998 when you got it !

Was a dying hen ![]() in 1997. The

in 1997. The ![]() was born in 2003. Start to lay eggs from 2007

was born in 2003. Start to lay eggs from 2007 ![]()

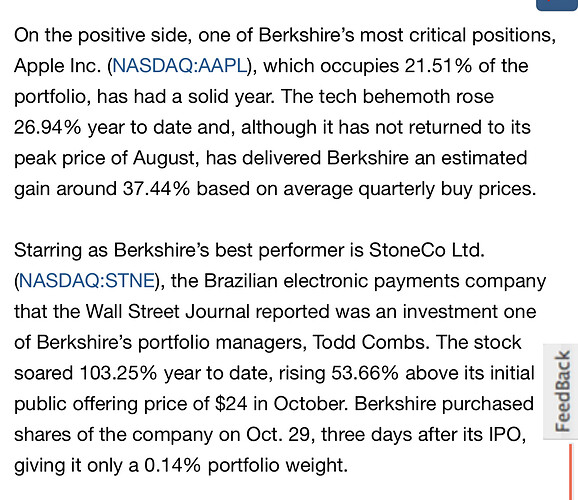

AAPL has Steve Jobs. What is Stones secret sauce?

None whatsoever.

Competition amongst men is about ego, not about money or who is right. We are not women or feminists like @manch. WB doesn’t understand tech, bad to follow him. AAPL is a consumer staples stock ![]() so he is right to buy.

so he is right to buy.

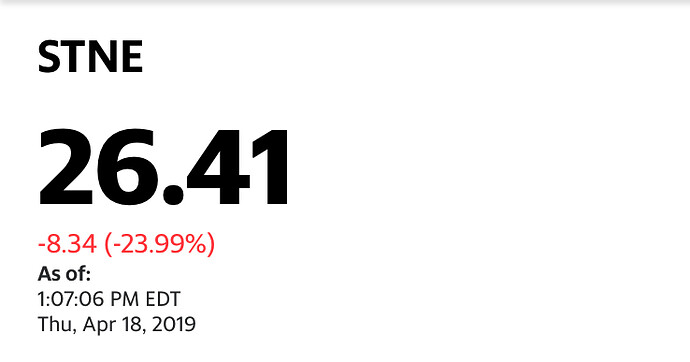

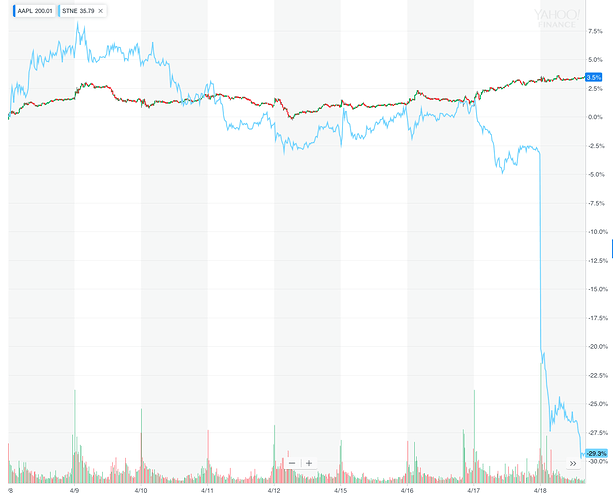

Correct, Risky bet, but fine for me, bought good amount today. Reason for drop, competition war.

Today is an excellent opportunity to get the shares at lowest price, how can I miss?

Brazil rate is 8%, but ITUB reduces to zero % to break competition, yet to see sustainability

ITUB is big bank challenging small players like STNE and PAGS.

It is not about my ego, but opportunity to grab at low. Same thing I do with TSLA, STNE whatever I follow.

That is why I safely bet for 5 years with you as I know both stocks will go down and up, but after 5 years let us wait and see.

Stone got stoned. Buy canopy

Wrong suggestion and that is what most of the forum (either here or elsewhere) members, reddit or any others, do. They do not know the concept of “Margin of safety”.

It is safe to buy a fundamentally good company at dip than sell.

The basic formula is buy low and sell high, i.e. buy when it is dipped. I am always in favor of catching the knife. I do not buy stocks with FOMO, but buy when others fear about it, that too the stocks I follow dips, it is a hot cake to me !