The next day after the head tax passed in MV. Is it related?

Look like big guys are moving a lot of their (existing? new?) employees out of SV. It means we no longer can expect much appreciation  Would prices start to decline after whatever remnant demand is absorbed? Where are these big guys spreading their employees to? Austin? NYC? Rayleigh? Atlanta? Denver? Dallas?

Would prices start to decline after whatever remnant demand is absorbed? Where are these big guys spreading their employees to? Austin? NYC? Rayleigh? Atlanta? Denver? Dallas?

Mountain View only charges $149 a year per head. That’s peanuts for Google. It spends that much on lunch a week I guess.

Prop C in SF is much more serious. It’s 0.5% of gross revenue once a company goes above 50M. It may kill the startup scene there.

0.5% revenue is huge. Is it based on HQ location? Uber and AirBnb can relocate their headquarter to Oakland.

This is the baby version of “repeal profit”.

Fake news. Property tax here is 1% of home value and values are lower.

Prop C is getting challenged due to some other props from June that won with less than the needed 2/3 majority for taxation related legislation. C was voter initiated which does not require the 2/3 min or so the argument goes.

Also, state sales tax is 6.5%. King county has a 3.0% adder, so we pay 9.5% total. Santa Clara is 9.0%, so we pay 0.5% more.

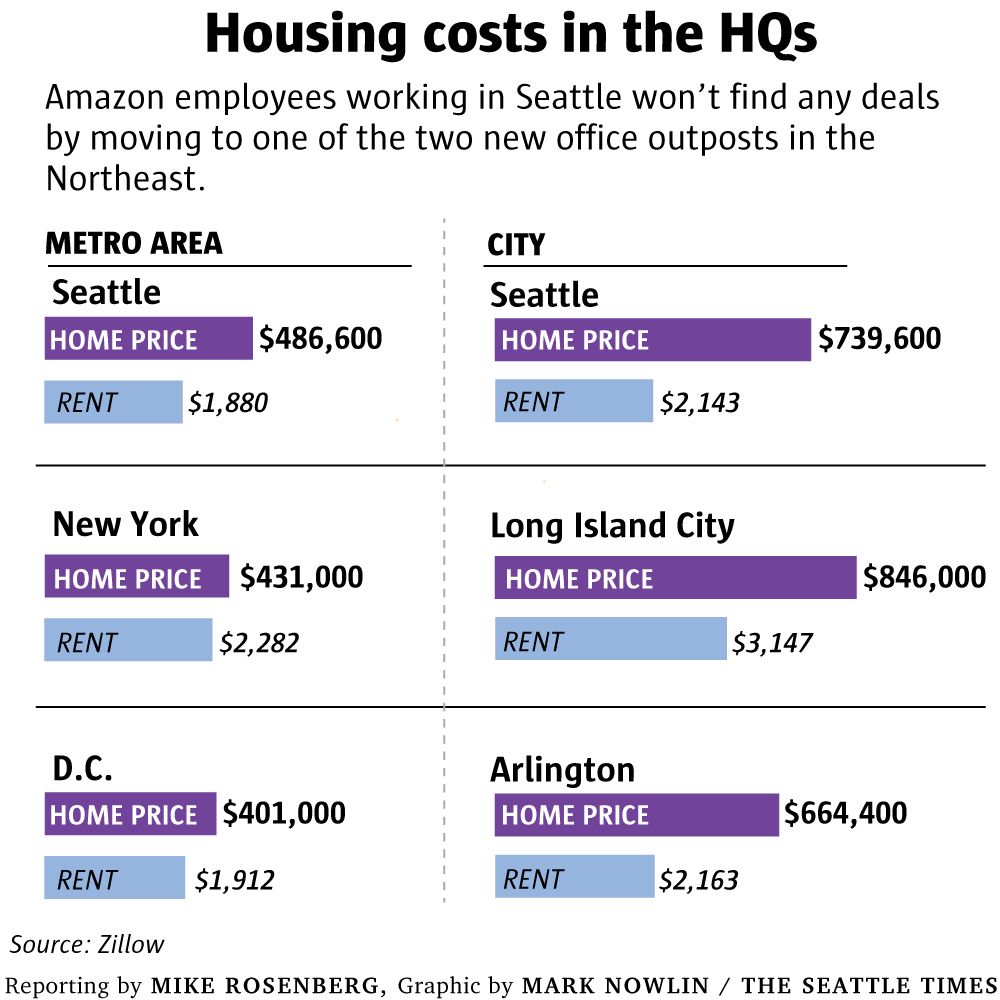

Based on where employees live, buy a luxury apartment building walking distance from the proposed offices. Rents will increase a ton.

NYC has rent control

Speculative hot money. I will not buy Northern Virginia not Queens. Let’s review price appreciation after one year. Those were slow moving market before, also Amazon HQ2 will take decades to staff

Amazon pulled off a big con. Every competing city gave their offers under the assumption that they alone will get all the jobs and investment. Turns out they only get one half. Can they now only pitch in half the tax subsidy they promised?

Goes to show lowering housing costs for employees is never a goal for companies.

Now it’s official plus 5,000 jobs for an operations center of excellence in Nashville.