If ARKK is a leading indicator of high growth tech stocks, bull market for growth stocks might have begun. Ofc, basing or bottoming process is more likely since Fed hasn’t U-turn.

MooMoo… sounds like bullshit.

Cathie is sounding pathetic whining about the Fed.

Don’t fight the Fed… Econ 101

Auntie still around. Did you always see the world with an inverter?

Rule 1: Make sure you don’t lose.

Rule 2: Refer to rule 1.

Matured companies don’t mean sunset companies.

New high potential companies don’t always live to maturity.

Worse than SBF. And I wonder why media still gives her face time. A man loser like her will be shoved into oblivion or even behind bars.

Isn’t Elizabeth Holmes who was put behind bars, a woman?

She stole from the rich plus the scandal became too big to be buried.

But remember that she got fewer years than her male Indian subordinate. And she is still out by the way. As long as she keeps pushing out babies. What a low life she is, bringing kids knowing fully well that they will end up without mother when she goes to jail. God bless America!

Lesson learnt. Don’t listen to @manch favorite auntie.

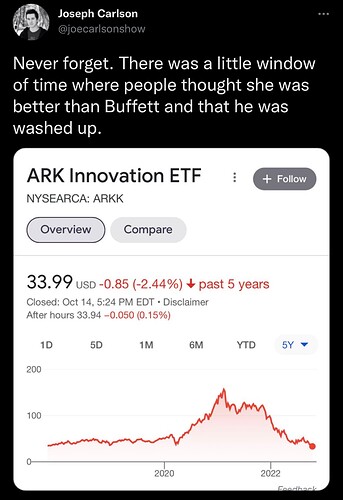

Moving 5 years. ARKK underperforms S&P and AAPL by a lot.

That is, ARK funds have to close down. No more innovation ETF.

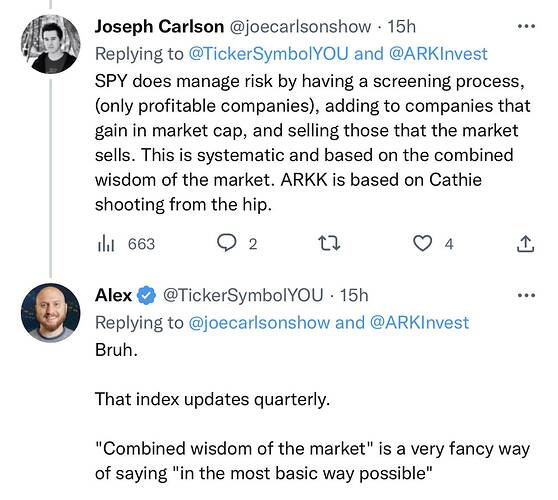

Sparring continues. Alex seems to agree with Joe that market wisdom one up Cathie’s highly competent kids.

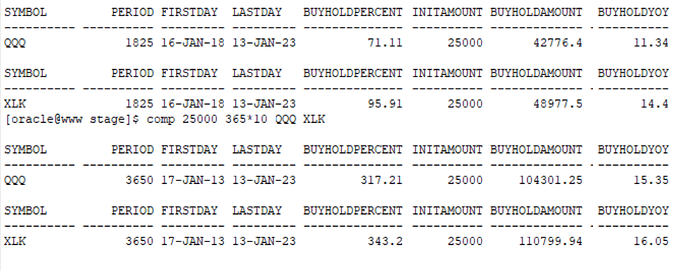

This is some interesting data:

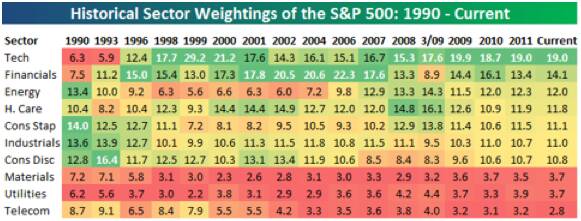

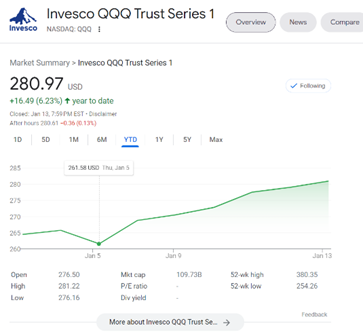

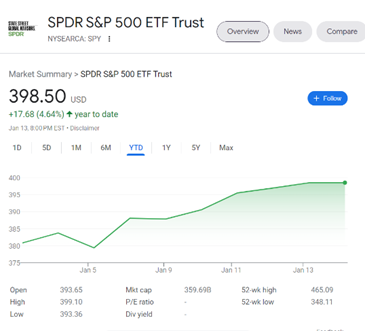

It shows just how big the dotcom bubble with tech as a percent of total S&P 500. Even with that, tech has outperformed since 1990. This is probably why QQQ has outperformed SPY. QQQ isn’t the same as the tech sector of SPY. The correct ETF would be XLK. QQQ and XLK have different criteria.

I thought S&P also rebalances sector weightings to closely align with GDP. I can’t find any documentation of that though. I only did a quick search though.

First, QQQ and SPY are high volumes, that helps the buy/sell spread at low one cent level, we can even buy pre or after market level easily without big spreads (as spreads are eating our profits even for buy/dca investors).

Based on backtest, 5 & 10 years, XLK outperforms QQQ with slight margin, and they are almost equal with spreads and liquidity considerations.

However, I ran 5,10,15 years back test for SPY, QQQ and SMH (spread high compared to other two), recent years (last 10 years) SMH outperforms both QQQ & SPY.

Still choice is either QQQ or SMH for buy/dca and hold.

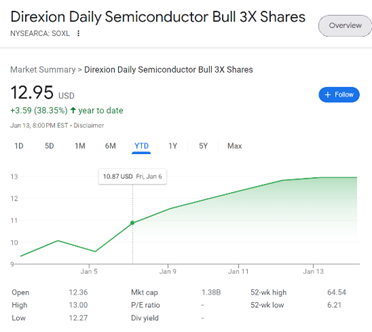

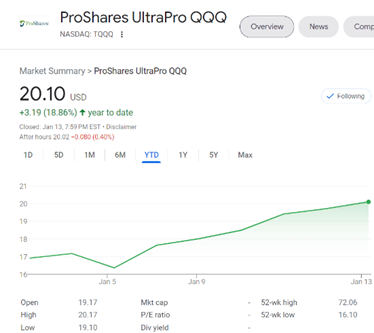

Using these calculations, I stay with QQQ/SMH or TQQQ/SOXL (wherever allowed)

See YTD performance!

Nice summary of Cathie ARKK performance

https://twitter.com/chrisbloomstran/status/1616933739082153984?s=46&t=nSr0lQ8KJNP8o52nA_AQmg

What a piece of shit is Cathie woods

Bitcoin to $1M

TSLA to …

AI to dominate… we know but how fast and how extensive?