From what I know, TWLO doesn’t have a true competitor.

Bought full on 12/26, Not intending to buy anything, enjoying the run sometime.

Cramer pimping cloud kings and princes again.

“These days, if you want performance, the cloud kings and their smaller heirs apparent, the cloud princes, are where it’s at,” Cramer said on “Mad Money.”

Who are the cloud queens and princesses? ![]()

We’re in Internet 3.0 bubble. Any companies doing cloud are WINNERs. Buy!

Forget internet 1.0 CSCO… (remember SUN ![]() )

)

Forget internet 2.0 GOOG… (soon…)

Cloud Kings. Owned 500 SPLKs, sold 200, left with 300 ![]() Is the lowest market cap king.

Is the lowest market cap king.

Cloud Princes. TEAM market cap is fairly high! Choose NEWR, lowest market cap ![]()

I am not sure Cramer picked the right cloud stocks. These days all enterprise software will be done in cloud. So “cloud stocks” are pretty much the same as enterprise software.

I am starting to learn more about this space. It’s humongous. Some of these names play at the lower end of the stack like Palo Alto Networks that deals with security, or MongoDB that deals with database. One big risk is some 800 lb gorilla like amazon developing their own solutions, which it has in both cases.

Another question I ask myself is how many users that piece of software has. Splunk is clearly very useful but it’s used by a relatively small number of backend engineers. How big a TAM is that? Compared that to Alteryx which makes it easy for business users to query their data. It seems the TAM is bigger in AYX’s case?

The whole space is pretty complicated. I am just starting to learn. So far I t has been a lot of fun. Hopefully it will be profitable as well.

When I first say cloud computing is in, you said is passe’. Now you say you just started to learn about this space? You have been shooting off your hip previously

?

?

I’ve closed PANW, SQ and SHOP position. Not that I think they are not good, is easier to make money trading options of F10 then messing around with hot stocks. Liquidity of options of mega cap stocks is much higher than cloud kings, queens, princes and princesses. Trading options require high liquidity in order not to pay too much premium and allow you to run in/out without incurring too much commissions and bid/ask slippage. Options of hot stocks also have high IV and some don’t even have weekly series.

I am always a hip shooter. I thought everyone knew that?

IMO, Cramer is right on those stocks (I have also listed some of those stocks here), but the issue is that Cramer telling the world after the fact, i.e. when all these stocks are at possible peak values now.

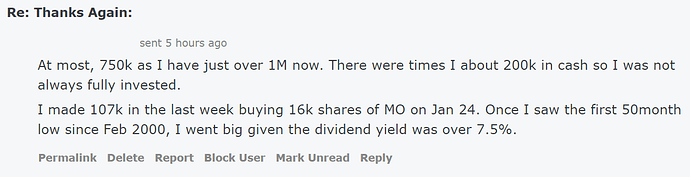

For example: Last week, I suspected lowest dip point for MO (Altria) and shared with another unknown blogger in reddit.

While I made $1000 he made $107k. Here is the feedback. He took risk (he also made a parallel analysis - which is important) and got the windfall !!

Basic concept is buy low and sell high. If Cramer is true clairvoyant, he should have indicated this during Christmas period when the stocks were at too low. Now, we need to wait for a dip.

The main risk I see, with cloud stocks, is not liquidity, but they are all not making net profit. They are in startup stage, potential winners to make future profits.

Net profit makes the company stable and financially independence status - i.e., they can survive any headwinds or downturn on their own finance.

Net profit :This is equal to over all positive cash flow we talk on rental real estate over PITI+expenses.

SHOP has accumulated lot of cash position using repeated equity secondary offers, making gross profit, but not the net profit. Similarly, TWLO, AYX, COUP, MDB are not making net profit, but gross profit margin is high. With this, we can buy and sell speculative way than buy/hold as long term. Such NO net profit stocks are vulnerable for bankruptcy during downturn or bear down fall happened last oct-dec.

Total investment risk = Company fundamental risk + Macro risk + Financial instrument risk + Media/ FUDs

So long Trump is POTUS, he is the main risk ![]()

10x portfolio had appreciated more than 40% ![]() since Christmas, ~20% from eve to end Dec, another 22% in Jan. However, is 6% below

since Christmas, ~20% from eve to end Dec, another 22% in Jan. However, is 6% below ![]() ATH achieved last year.

ATH achieved last year.

I wonder long-term about Alteryx. You can do the same with python and even financial firms are requiring analysts to learn python. It’s becoming a required skill for everyone not just data scientists or software developers.

We have python training. Also, the data science team has office hours to get help with python projects.

I learned about Qlikview last week which is free open source. I think it’s similar to Alteryx, but I haven’t had a chance to use it yet.

Coupa amazes me in that it’s just as bad as all other purchasing software, but it’s web-based. They literally ported over all the flaws to a new format. It lacks a lot of really, really basic functionality. I can’t even look at my open req list and filter by location code, cost center, or anything useful. They are growing like crazy though.

AYX was in my watch list and will be reviewing fundamentals soon.

I know python+stock data pullers.

I am more or less convinced about my programs, see next screen shot, but needs to scale further. Planning to take an AWS server to create my own repository to run my exclusive algorithms. It will take 3-6 months time frame.

No doubt 40% is excellent percentage, but did you take big dive in it? As you increase your amount, you need to be confident and ensure your original investment is protected. Hard to push at higher cash handling as it may introduce nervousness and sleeplessness unless you have absolute confidence in that company.

Like WQJ said, it is absolute cash gain (you do not need to tell me or post here) is important.

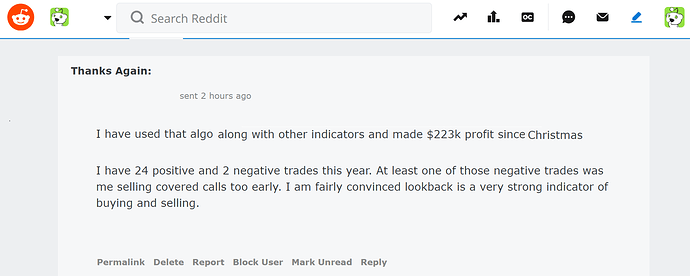

See here, the same person thanked me again with his own results. He made almost quarter million in last 40 days, lucky person !

Any way, I won’t be updating any more about this algorithm (or results) here-after, Lot of work to do.

This is my opinion (right or wrong, members decide)

He is an egoist, but he is not against his country or country people, rather pro-US person by heart. His ideas are basic to US Growth. which many congress+White House ignored many years.

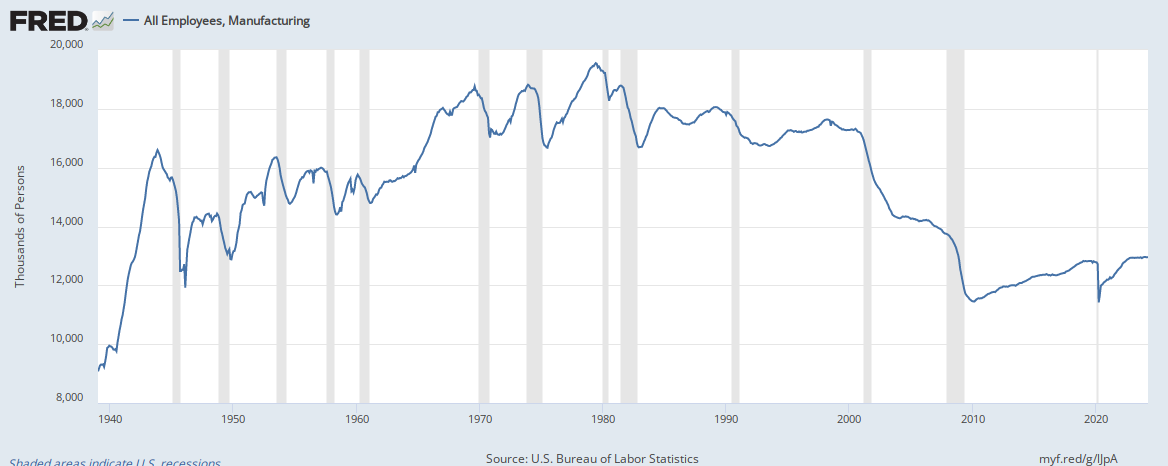

He has strengthen the economy by introducing tax reduction and tariff introduction (affects China, but encourages US local manufacturing). Instead of tariff towards China, he has to do it for all countries except those who do not charge tariff on US products.

Economy will enter into recession/downturn, he may be blamed for it (by media/news), but he is not the real reason for it (Reason:Credit Market+Global Economy)

Even if he leaves the office now or make a truce with China, nothing can stop the falling economy.

Had he not come, we would have been already in recession by now.

Any way, I do not want to go too much political as it creates lot of controversy.

Tax cuts would happen regardless of who is POTUS. Democrat President won’t have tariff war that create uncertainty, so global and US economy would be booming, and market would be ATH after ATH ![]()

There no way Hillary would have signed tax cuts. She’d have vetoed, and there wouldn’t be the votes to override it.

Tariff war is short-them negative for a long-term gain. I doubt we’d have all the manufacturing job gains without the tariffs. For decades, we were weak on trade allowing countries to implement more and higher tariffs on us than we had on them. It’s way past time to fix it.

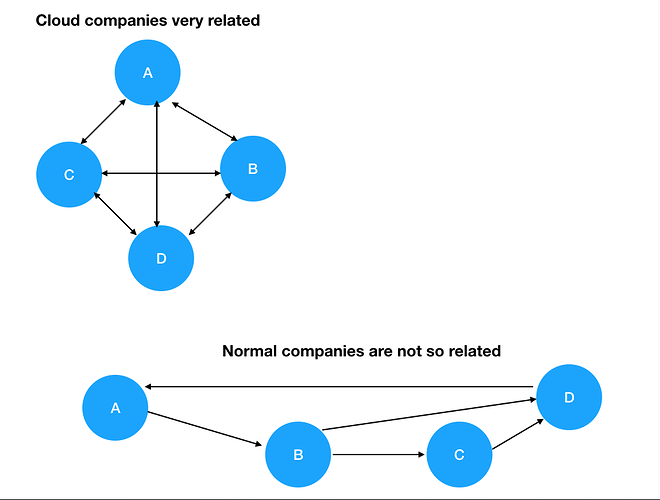

How stable are these users? Will they disappear in a recession? Subscription is low initial cost, suitable for startups, as such it makes me wonder whether these cloud companies are each other customers and suppliers. For example, imagine a scenario of there are only 5 companies and 1 non-company in a closed society. Each company has the other four companies as customers and also their supplier. Only one company directly deal with the non-company. Am I close to the truth?

Thinking aloud ( no facts),

TWLO subscribes to COUP? PANW? SLACK? DATA? NEWR? OKTA? TEAM?

TEAM subscribes to TWLO? COUP? SLACK? DATA? NEWR?

Did you manage to find out how they are related?

Btw, I think most of these cloud royalty run on AWS, right?

My fishy feeling is these enterprises subscribe to each other services. This feeling + perpetual besieging from @Jil induce me to sell into current rally.

Everything is related. So there is nothing immune from a recession. Everything goes down together. The most essential ones will get cut last.

Yeah there is some truth to that. Cloud companies tend to be younger and thus more willing to try new things like other cloud software.

But the secular direction is clear though. All software is migrating to cloud and pay via subscription. Even odd guards like oracle is moving.

That reminds me. I need to study SAP. I know nothing about it.

Also why is AYX short interests so darn high? It’s over 24% of float according to yahoo finance!