I am the momo guy, remember?

Use the right term, buy at support ![]() either horizontal or SMAs or Fib. Depends on which one you should, can be refined to swing trader or position trader

either horizontal or SMAs or Fib. Depends on which one you should, can be refined to swing trader or position trader ![]()

Buy high sell lower ![]()

That’s a weak selling point. Every ERP has open PO reporting that shows amount approved, total spend so far, remaining amount, etc. We literally don’t use any of Coupa’s reporting. We do all reporting out of our ERP which is Oracle.

Then why did your department pay for Coupa? If you don’t use any of its features?

The whole company uses it, and I have no idea what was used before it. It really, really sucks. Seriously, you have to click each req 1 at a time and wait for it to load to approve it. Then it goes back to your inbox and not to the next req. It literally wasted an hour a day, and I couldn’t delegate it due to spending approval limits by job level. Ours are absurdly low.

Twilio: The action in shares of Twilio, a cloud-based communication enabler that works with the likes of Airbnb and Lyft, concerned Cramer ahead of the company’s Tuesday earnings report.

“[Twilio] represents, I think, maybe the best growth stock in tech right now,” he said, adding that he’d like to buy shares for his charitable trust. “But […] the stock is running right up into what we call ‘the print’ — it gained more than 4 [basis] points today alone.”

“I want this stock to be lower to buy, but I bet the quarter’s a legit blowout like the last one,” he added.

Salesforce makes it difficult for users to customize the platform to their own liking so they can force them to buy their consulting services.

Saw a job posting requiring Anaplan experience. That’s my next study subject.

Anaplan is not comparable to Salesforce. Much more disposable.

FP&A gal? Who’s the king of financial planning software?

A guy who used to work for me has been at Anaplan for awhile now. He’s done really well there. I don’t know anyone that uses it though. Business objects (SAP) and Hyperion (Oracle) are the two big names.

We use Cognos (IBM) which is awful. I dread every time I have to use it. The excel intergration is terrible compared to business objects. The excel cells have formulas to know what to retrieve. That means you need to stay connected the whole time or your formulas error. I make a connection tab to retrieve then paste all the values into an actual working tab. That way I don’t have to stay connected and deal with how badly that impacts excel performance. Cognos has a web based version too which is terrible as well.

I actually really liked business objects, and I had a guru on my team for making templates.

There is no king. Big companies use SAP/IBM/Oracle as outlined by Marcus while smaller shops use Anaplan/Host Analytics/Adaptive (acquired by Workday) etc, whereas Salesforce is used by companies big and small.

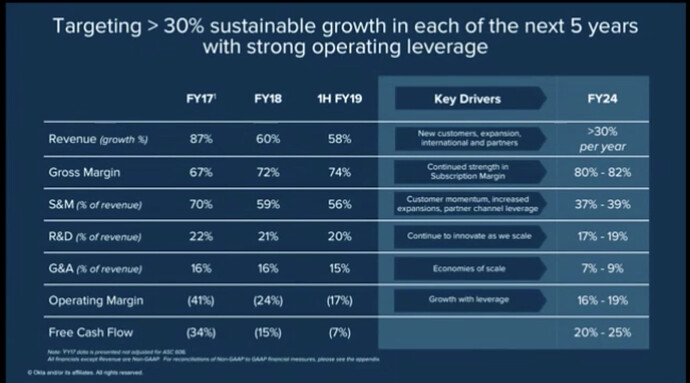

Okta Investor Day Webcast. Pretty long at 2.5 hours, but very informative.

Here’s their 5 year financial roadmap. Pretty aggressive.

Too long, give up. Declining revenue growth? So increasing gross margin is from reducing R&D? Passed.

Operational leverage, aka economy of scale.

They’re assuming they can better leverage sales and marketing by increasing spend with existing customers vs acquiring new ones. The better leverage dramatically decelerates in 2019, but they think they can accelerate it some.

R&D stays pretty high. G&A as a percent of revenue declines a lot. They think they can scale it with pretty small investment.

Someone posted, I am just copying here

Twilio (TWLO) - Hit a new ATH last week. One of the top tech stock and overall one of the biggest gainers in 2018. Motley Fool is extremely bullish on Twilio and wrote about their 280% growth in this post. ER: 2/12

Okta (OKTA) - Hit a new ATH last week. Okta provides cloud software that helps companies manage their employees’ passwords, by providing a “single sign-on” experience. ER: 3/7 AH

Smartsheet (SMAR) - Hit a new ATH last week. This is a relatively unknown company & stock, but reached new ATHs this past week. Smartsheet is a software as a service application for collaboration and work management. It is used to assign tasks, track project progress, manage calendars, share documents, and manage other work. ER: 3/4 AH

Salesforce (CRM) - Trending to hit new ATH. The blue chip stock of tech/cloud/SaaS. Currently has a share price of $156.67 and has a median price target of 175.00 and as high as 190 (Piper Jaffray). Expected ER: 2/26 AH

Zendesk (ZEN) - Hit a new ATH last week. Zendesk expects revenue of $178 million to $180 million for the first quarter, and $795 million to $805 million for the year. Analysts had forecast revenue of $172.8 million for the first quarter and $779.3 million for the year. Expected EPS: $0.03. Actual EPS: $0.10.

Coupa Software (COUP) - Hit a new ATH last week week. Coupa Software is a global technology platform for Business Spend Management. The company is headquartered in San Mateo, California. Goldman resumed coverage with a buy rating and price target of $96 Expected ER: 3/6 AH

Zscaler (ZS) - Hit a new ATH last week. Zscaler is a global cloud-based information security company that provides Internet security, web security, next generation firewalls, sandboxing, SSL inspection, antivirus, vulnerability management and granular control of user activity in cloud computing, mobile and Internet of things environments. Expected ER: 2/28 AH

MongoDB (MDB) - Hit a new ATH last week. MongoDB is an open source database management system (DBMS) that uses a document-oriented database model which supports various forms of data. It is one of numerous nonrelational database technologies which arose in the mid-2000s under the NoSQL banner for use in big data applications and other processing jobs involving data that doesn’t fit well in a rigid relational model. Instead of using tables and rows as in relational databases, the MongoDB architecture is made up of collections and documents. Expected ER: 3/5 AH

Splunk (SPLK) - Hit a new ATH last week. Splunk captures, indexes, and correlates real-time data in a searchable repository from which it can generate graphs, reports, alerts, dashboards, and visualizations. Splunk’s mission is to make machine data accessible across an organization by identifying data patterns, providing metrics, diagnosing problems, and providing intelligence for business operations. Splunk is a horizontal technology used for application management, security and compliance, as well as business and web analytics. As of early 2016, Splunk has over 10,000 customers worldwide. Expected ER: 2/28

VMware (VMW) - Trending to hit new ATH. VMware, Inc. is a subsidiary of Dell Technologies that provides cloud computing and platform virtualization software and services. It was one of the first commercially successful companies to virtualize the x86 architecture. Expected ER: 2/28 AH

Ubiquiti Networks (UBNT) - Hit new ATH last week. The Ubiquiti UniFi system is an enterprise platform comprised of wired & wireless network devices, as well as a centrally-managed software controller, with hybrid support for secure, Cloud-hosted services. The family of UniFi enterprise technology features the latest network hardware at cost-disruptive prices, including 802.11ac, dual-band indoor/outdoor access points, high-throughput switches, and powerful security gateways. Compared to other enterprise platforms, UniFi enables network administrators with a robust, all-in-one package to quickly set up, manage & monitor network devices—without any licensing costs or fees. You can freely download and install the UniFi software to any Windows, Mac, or Linux machine. Expected EPS: $1.08 Actual EPS: $1.33

Nutanix (NTNX) - Nutanix enables IT teams to build and operate powerful multi-cloud architectures. Their Enterprise Cloud OS software melds private, public and distributed cloud operating environments and provides a single point of control to manage IT infrastructure and applications at any scale. Expected ER: 2/26 AH

TWLO was mentioned by marcus 2 years ago, regrettably didn’t pick it up at $25. Only myself to blame, because don’t understand the business model even though marcus had explained to me at least twice.

How is Okta a thing when you can use Microsoft exchange authentication in third party apps? Is it popular, since people are migrating away from exchange? I was able to exchange authentication for users on file maker server. I was amazed how easy it was to setup. It even understood organization hierarchy.

@hanera I sold TWLO too early. It was in the down from Uber dumping it and developing their own tech. Once the yr/yr comparisons were without Uber, then people realized how fast it was growing. I got back in a bit ago. I think NTNX will do the same once yr/yr comparisons don’t include hardware revenue. UBNT has been strong. I bought more on the Citron report.

This whole thing makes me wonder if the trend is best-of-breed vs going with a SAP or Oracle to run everything. That or there will end up being a ton of mergers and acquisitions in the space. I was part of this debate 15 years ago. Back then, the trend was to have general managers running businesses. You moved up by being general manager of a bigger business. It was the GE model.

Apple was agaisnt the trend with a functional structure. All the management experts said you couldn’t run a company that big with a functional structure, because it’d lack accountability. Clearly, Apple figured it out, and others are going more functional. That leads to wanting best-of-breed tools for each function.

Is a cycle. Industry moves from best-of-breed to integrated and back. Now is best-of-breed.