Data says more people move from California to Texas than the other way around.

Agreed. But what sort of people are leaving versus the ones coming matters. What I found in my research is that lot of IT (meaning not core engineering) guys are going to Austin but the ones coming this way are Ivy League grads who wanted to give Austin a try and hated it.

Forty-two states have had a net loss of people to the Austin area, according to the data. The U.S. cities outside of Texas with largest net migration to Austin include New York, Los Angeles, and San Francisco — with a net flow of more than 3,500 people from those three cities alone.

The Austin metropolitan area population has grown by an average of more than 150 people per day — or about 55,500 people annually — since 2010

What is the implication for your intended RE investment approach? Are they your intended tenant pool?

Lets say someone just got her PhD in machine learning from MIT. Where would she more likely to go? Bay Area or Austin?

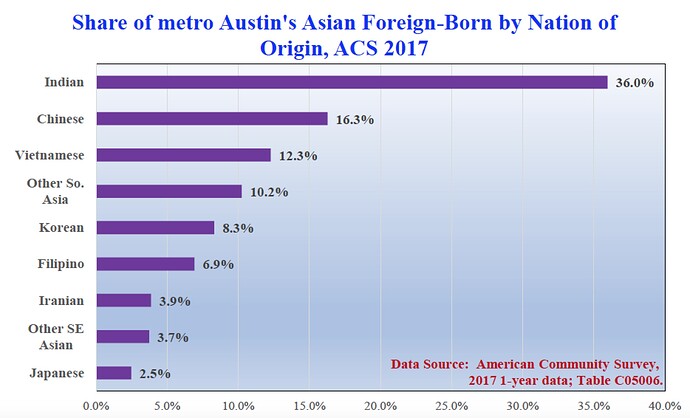

If more leave than are moving in, then home prices won’t stay high forever. Right now, immigrants from outside the US are making up the difference. Will that continue to happen?

BA. It is well documented that most of SWEs going to Austin are IT (previously known as MIS or IM) and for core engineering, mostly the semi-guys. Above has been mentioned many times in this forum. The issue is how does it affect your RE investment approach? What might the picture be in the future? You’re an ex-Hong Konger, have you ever expect Shenzhen would overtake HK in tech and entrepreneurial spirits? Do you know the main reason that brought down Detroit?

BA is the goose that lays golden eggs: startups. As long as it remains the place where the world’s best come to start tech companies it will continue to do well.

Relevancy to your RE investment approach? Do these guys rent your houses? How might this opinion affect your targeted tenant pool? Expand or shrink it or no effect?

One of my tenants makes more money than me back in my engineer days. So yes, it’s relevant. But I don’t see why anyone needs to pick one locale and put all their eggs in one basket. I don’t mind holding RE in both Austin and the bay.

All my CU tenants make more money than me. Their titles are from Director to VP. So I believe my tenant pool could be a little too small.

That is what I’m doing ![]() My tenant pool in Austin is bigger, IC to SM. Only one couple is from tech.

My tenant pool in Austin is bigger, IC to SM. Only one couple is from tech.

Just got a Zestimate email on my SJ house. Value dropped more than I expected…  but on the flip side rent went up more than I expected…

but on the flip side rent went up more than I expected…

Yes, rent is going up. My hypothesis is more people prefer to rent than to own. Including those intended to buy once they have the necessary downpayment, now they are waiting for the right time. So better enjoy while it lasts.

That means you should buy in BA now like there’s no tomorrow, to front run the crowd.

I’m already over-exposed to BA. This is the actual reason why I’m diversifying to Austin. YMMV.

Tech industry slumps. Tech stocks crash. BA economy in shambles. RE tumbles. Rent torpedo. Hanera goes pan-handling.

My fear, may be irrational, is this. I wonder if companies are trying the nearshore Austin for moving IT jobs. Then when things start slowing they can easily move them to India. They won’t be able to do that to the core engineering.

Your fear is valid  Well those that build their own buildings there such as Apple would still have many Apple badges around. Moreover, Austin economy is very diversified: Tech, Texas Capital, medical, service, entertainment, UT and navy researchers. RE prices hardly budge during the financial crisis because of the diversified economy. Tech guys are not really my prospective tenants, more like my competitors for RE purchases and rental biz.

Well those that build their own buildings there such as Apple would still have many Apple badges around. Moreover, Austin economy is very diversified: Tech, Texas Capital, medical, service, entertainment, UT and navy researchers. RE prices hardly budge during the financial crisis because of the diversified economy. Tech guys are not really my prospective tenants, more like my competitors for RE purchases and rental biz.

The new age of tech companies have far fewer employees than prior tech waves. So even if you get the same number if startups, they are creating fewer jobs and higher concentration of wealth.

Bay Area economy is getting less diversified over time as lots of long time SF/Bay Area non tech companies are leaving for other states. Standing on one leg and when(not if) that leg breaks will be a big problem.

From Economist

Companies are also moving. Last year McKesson, a medical-supplies company, and Core-Mark, a supplier to convenience stores, shifted their headquarters from California to Texas, as did Jamba Juice, a smoothie company. Many Californian firms are also adding jobs outside the Golden State. Charles Schwab, a financial-brokerage firm based in San Francisco, received more than $6m in incentives from Texas, and by the end of this year will have more employees there than in California.