manch like to go over the same issue again and again.

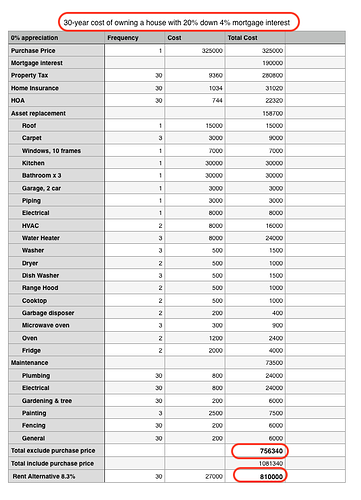

Does buy better than rent for primary works outside Bay Area - a financial perspective of course. Table below show the detailed computation for owning a house with a 20% downpayment and a 30-year 4% fixed mortgage interest. To breakeven, house price needs to appreciate at the same rate of mortgage - intuitively obvious? Please don’t say at the end of 30 years, return is 5 (leverage) x 3 (price appreciation) = 15 times ![]()