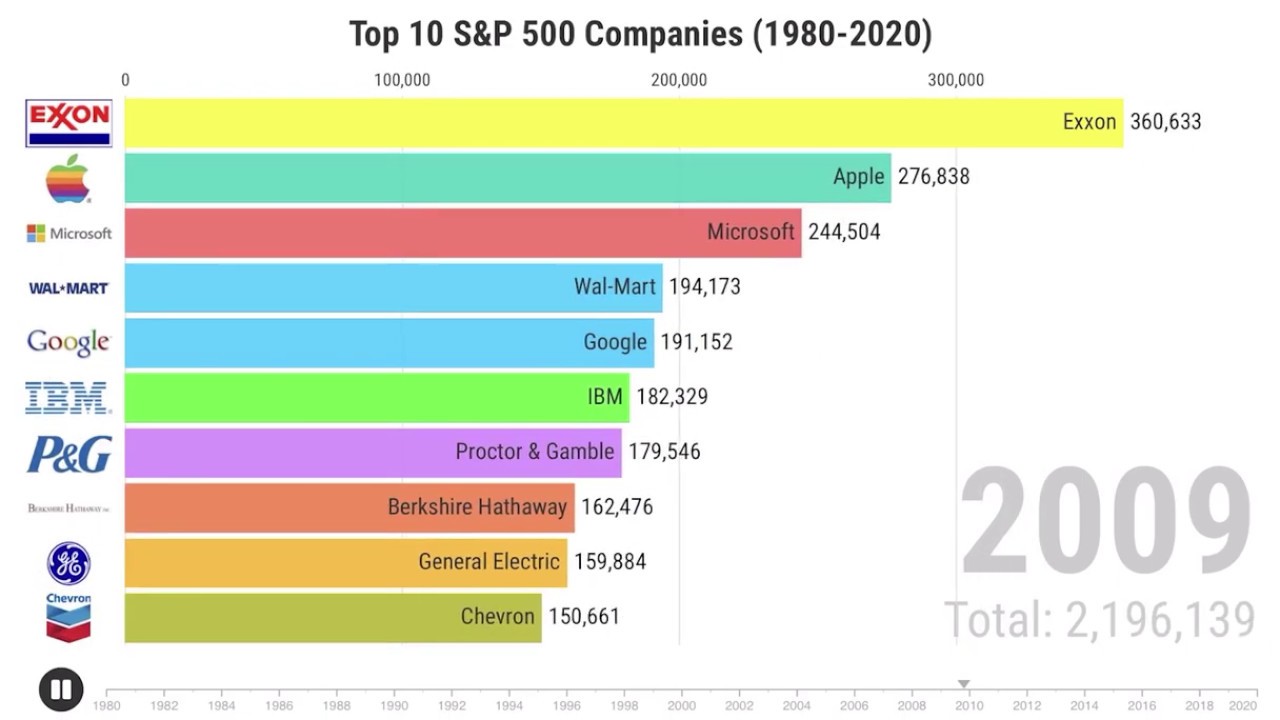

Rise of FANGMANT is very recent. How long can they stay on top?

CCP wants to regulate all financial institutions and instruments.

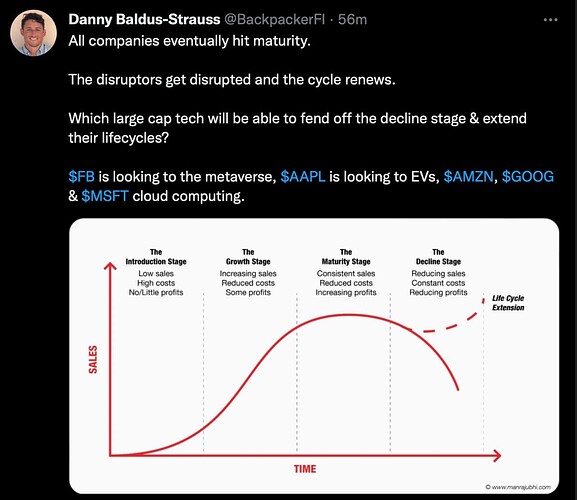

Apple is into mother of all AI projects, more like AVs not EVs. And Apple is into metaverse and fintech too.

I am OK being wrong. Hopefully I will learn from my mistakes.

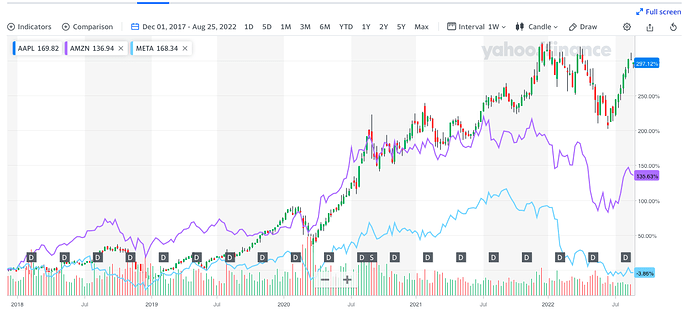

META the company has gone nowhere in the last 5 years. I thought they could easily leverage their multiple market-leading chat apps to broaden their utility. Just copy WeChat. But they didn’t do nothing.

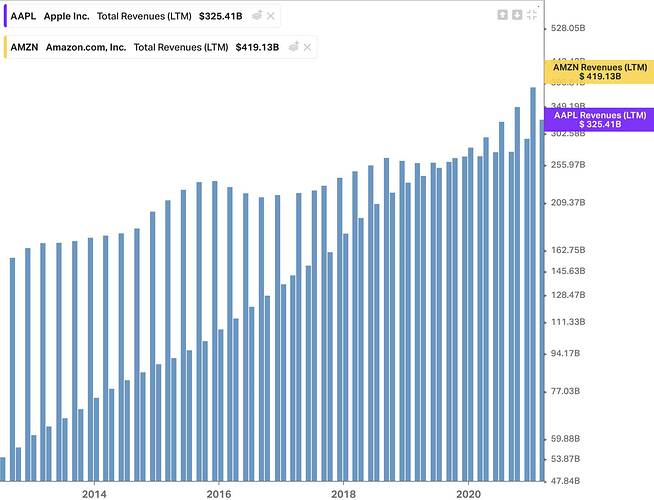

I am still bullish on Amazon, and that they will eventually overtake Apple. They are almost uniquely ambitious among big techs, and are not afraid to try out new things. Amazon’s revenue is growing much faster than Apple:

I think I got Apple’s product side right. Revenue has slowed sharply. I was in an Apple store recently and my overall feeling was that it’s very boring. Same old products. I can’t tell what’s the difference between this year’s iPhone vs last year, or the year before.

What I was wrong on Apple is that Tim Cook is very skillful in financial engineering, and the deep moat around iPhone allows him to wring every dollar out of iPhone users. Doesn’t matter if the product is stagnant. The sheer network effect and momentum will carry it forward. For now.

May not be consistent with…

![]()

Revenue can’t be compared ![]() because of margin differences.

because of margin differences.

For matured companies, should use P/E, earnings ![]() not revenue.

not revenue.

That’s the thing. Apple is mature, but in my view Amazon is not. Its revenue growth rate is still pretty much the same from 10 years ago.

Put it in another way, Amazon is still adding on TAM aggressively, while Apple is content with capturing every last dollar from its iPhone users.

Maybe I am wrong. That’s fine, but this is my current view.

.

Are you talking about annual? Quarterly is low. Revenue is meaningless. High revenue growth with no earnings is for startup to hype the company to attract investors. So don’t believe in TAM too much. Can easily expand it by acquiring companies.

Say, Company A makes $100k, expenses $99k, left with $1k.

Company B makes $50k, expenses $40k, left with $10k.

I will choose the latter.

You follow too many modern analysts. They are mostly wrong. Don’t believe in them. Go the old fashioned way.

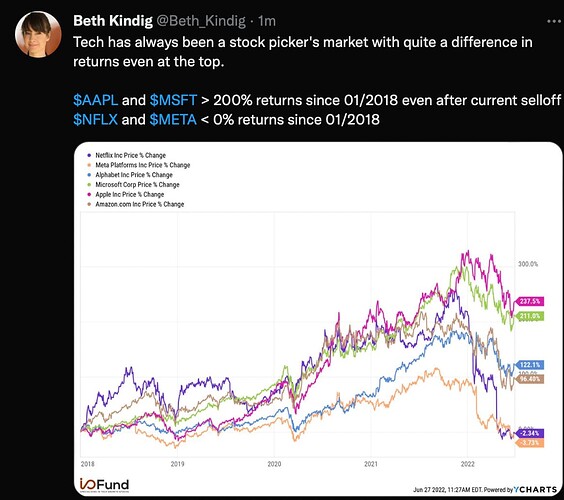

ROE

AAPL = 162.82%

GOOG = 29.22%

AMZN = 9.43%

Levered free cash flow (TTM)

AAPL $83.3B

GOOG $51.1B

AMZN -$13.4B - What happened?

EBITDA

AAPL $129.6B

GOOG $96.9B

AMZN $52.6B

Amazon has great margins on AWS. The margins on the rest of it suck. How much would the rest of Amazon be worth as individual companies? It similar to when the entire value of HP was equal to the value of printer business. There was an argument that they were severely undervalued. There was talking of spinning off printers. Years later, they finally split consumer and enterprise. At least Amazon generates revenue from their other businesses though. Google/Alphabet still can’t seem to figure out the revenue part.

AMZN is in capital intensive businesses (AWS and warehouses). AAPL let’s others spend all the capital building the factories. They do pay for tooling, but that is tiny compared to building the whole factory and buying the equipment. That’s why I never bought into AAPL building cars. Making software to be a car OS and selling that makes far more sense.

TSLA manages to build factories using monies from governments, hedge funds and private equities.

I recalled reading somewhere that Google Cloud and MSFT Azure are pressurizing the margin of AWS. Also, is not worth it when a company has grown to a certain size, many such companies are demanding AMZN to lower prices or they would build their own DCs.

Amazon’s own retail has low margin, but third party FBA has great margins. It’s leaning on it hard in recent years. Its ad business, which is almost all margin, is also built on 3rd party sellers.

The big dollars going in to build infrastructure gives companies big moats. That’s why Shopify is having problems. Its sellers still have to store goods in some warehouses and paying UPS or FedEx to ship them out. Shopify doesn’t help their sellers in any way other than building their rudimentary storefront. Meanwhile Amazon is investing 10s of billions building out its warehouse and logistics.

I still think apple’s lackluster revenue growth is a big problem. You can’t just keep on milking your base. At some point you need to grow your business.

So how many of their sellers use this network? In which cities does it offer same day or two day shipping?

How much and how long did it take Amazon to roll out 2 day shipping in the US? Do you expect Shopify to replicate that? And at what cost?

Is the same reasoning you use to say AAPL won’t double and that AMZN and META would overtake AAPL in five years. Since, AAPL quadruple and TSLA overtakes META and closing in to AMZN in market cap. Think you should review your assessment.

You used to claim no one ever buys anything on a Shopify run website….

Of course I didn’t say that. I just said I myself never bought anything on Shopify.

Shopify realized it needs to build out infrastructure to compete with Amazon. But it used to be billed as a capital light SaaS play. It would be tricky to manage investor expectations.

There is a link between Shopify, Apple and Facebook. The recent Apple crackdown on tracking has made Facebook ads less effective, and that has a huge impact on many Shopify merchants.