Implication to FANGMANT? Will this lead to overall lowering of personnel cost and hence increase in profits?

Not a financial advice. Not an advocate for his approach. Just sharing interesting view.

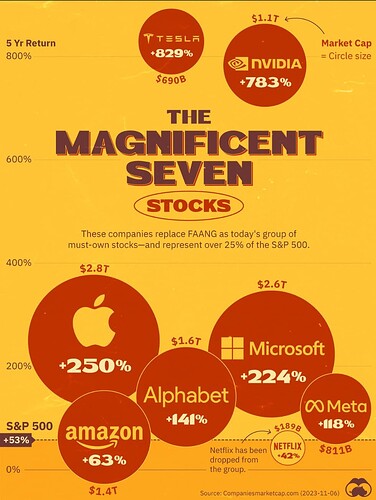

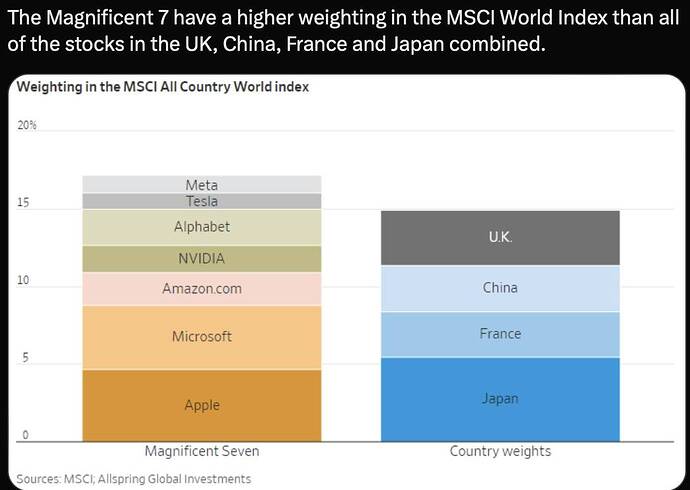

Adam opines that the AI and robotics wave would drive the economy and stock market up for the next 10 years and Mag7 are the best stocks to ride this wave. Should add in any weakness.

Disclosure: Have been waiting to add NVDA in any “weak” enough decline. So far, it is moving sideways for about six months.

To me these people are just extrapolating from the most recent past. Mag 7 did well in the last two years and all the growth names tanked, so they are predicting the same will happen going forward.

Personally I think a rotation back to growth is more likely if Fed cuts rates this year.

.

Your view is the belief that leaky dinghy would be seaworthy this year. This leaky view is the prevalent view, Adam is the alternative contrarian view. The reason why Adam ask the question, “Is the magnificent 7 dead?” is because the prevalent view is that they would underperform the growth and small cap in 2024.

IMHO, many growth stocks won’t return to their glory even if there are many rate cuts because of generative AI. Generative AI has the potential to disrupt many software businesses, starting with those expensive vertical SAAS. Such SAAS software can be replaced with generative AI + generic/open source software.

The public cloud era changed the game for startups. They no longer needed to raise massive amounts of capital to invest in building data centers. They could also scale much FASTER via public cloud vs. building out data centers. SWE comp skyrocketed during that era. Valuations of software companies soared.

AI is different. The HW is VERY expensive. The markup on GPU time in public clouds is insane. The cost to train and then run models is VERY high. The cost of ASR (automatic speech recognition) is very high, and that’s a required input if people are going to use voice to input. I think that will favor the mega caps with tons of cash over startups.

I’m still not convinced anyone has built a viable business product with AI. MSFT co-pilot is $30/mo. That’s a lot more expensive than an O365 subscription. CRM’s AI product is $50/mo. Are these tools going to unlock so much value that companies will pay more money for the AI license than the core product?

IT budgets aren’t going to grow enough to enable purchasing of AI products. That means companies will have to consolidate and eliminate other software products to fund it. That trend already started when everyone started to tighten budgets and do layoffs. There will be clear winners and losers from consolidation of software tools.

It would require eliminating several software tools to offset the cost of one AI tool. There’s a 0% chance teams will give up headcount to fund buying AI tools. Having more headcount is what gets people promoted.

I think something will have to be low cost to become the killer app for AI. Right now, Zoom is the only one trying that. The AI tools are free for paying customers.

I am fascinated by the Google’s Pixel 8 which is supposedly doing the ASR and AI on device. That would be game changing in terms of cost structure, since Google would only need to pay for training models not running them. I’m pushing our engineering team to buy one and test how accurate it is. They are claiming it’s not possible to be accurate without server levels of compute.

A simplified SWOT of Mag7.

Agree. We are still at the early “picks and shovels” tool making stage of AI. Companies are investing heavily at the hardware and foundational software levels, but there are still no killer apps yet.

Disagree. Vast majority of companies don’t have the tech skill to integrate all these different software tools. Remember, AI also needs data. So you are asking companies to manage their data warehouses as well. It’s a not a trivial task even for the biggest of big techs.

Vertical SaaS companies have large amount of data. You can argue it’s not really their data. It’s their customers’. But SaaS companies have access to all their customers’ data. They can redact out the identification details, run AI on all these data, and sell those AI capabilities.

Tag: Vertical SAAS. Jan 7, 2024

Just wait and see what happened over the next few years.

Without permission? You think like Mark Zuckerberg, Larry Page and Sergei Brin.

Thinking like the most successful tech entrepreneurs of our generation? Thanks for the compliment.

Which vertical SaaS do you have in mind that will do poorly in the next 5 years? Give us some examples.

Enterprise customers FREAK over their data being used for training. It’s a non-starter for most. It’ll work for Google and Facebook who have consumer data. It won’t work for Salesforce and Microsoft who have enterprise customer data.

Agree with the enterprise customers being reluctant to use their data for ML training. Experienced this first hand at my current employer. This, even with us laying bare how we would build a clean room and with strict privacy and retention principles in mind. Then chatgpt happened and we just chose the easier path of integration with openAI which customers wanted. (Revenue addition from OpenAI is still TBD for us. We are spending non negligible amounts of $ per user on it.)

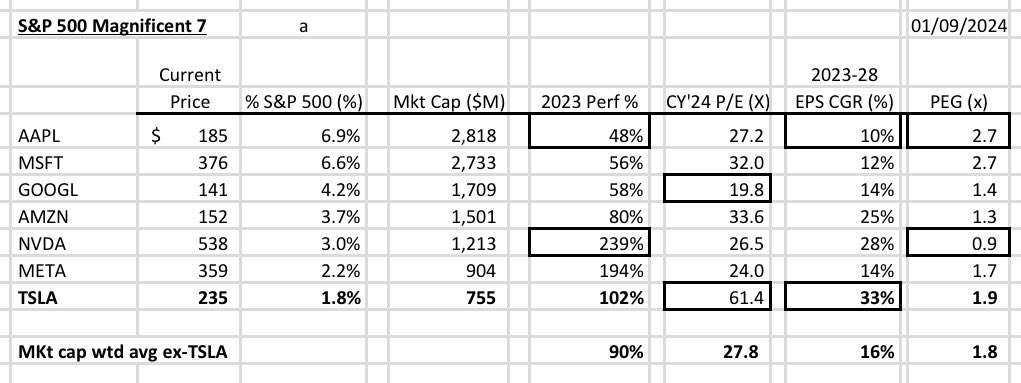

Gary Black’s chart. NVDA has the lowest PEG while AAPL and MSFT have the highest.

No idea where he pulls the growth rate from. And projecting all the way to 2028 seems unwise.

The CY24 PE is more interesting. Google, Meta and Nvidia are cheap. TSLA is out of this world ridiculous.

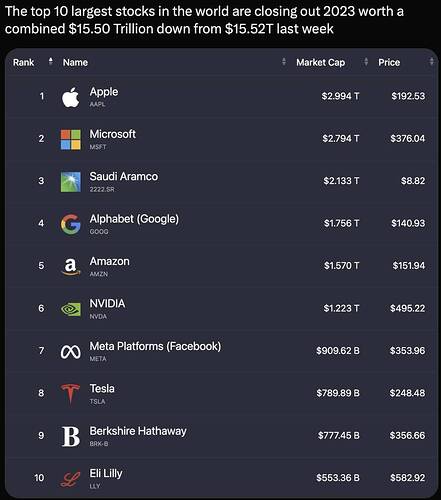

Jan 10, 2024. At market close.

Ticker… Market Cap

AAPL… $2.896T

MSFT… $2.845T

GOOG… $1.789T

AMZN… $1.589T

NVDA… $1.342T

META… $0.9521T

TSLA… $0.7437T

NFLX… $0.2094T

Market Cap of NVDA is almost twice that of TSLA.

When would NVDA catches up with GOOG and AMZN in market cap?

This year. 2024.

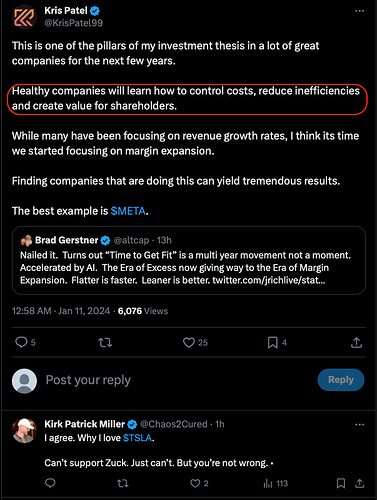

Above underscore why you should hold (hopefully forever) a compounder. Don’t di-worsificaiton.

Inaction trumps unnecessary action.

无为而无不为

Now then you know? Since 1997, return of late SJ, Apple has been doing that.

Focusing on revenue growth is a recent phenomenon by growth investors eager to get rich VERY fast.

They still have to grow revenue though. Cost efficiency only gets a company so far in EPS growth.

The idea of investing in high revenue growth is the profits will follow. Not all companies are efficient enough to scale correctly though.