Ok sure… but also sell to me your apple shares at 50% discount too

Last dip was Aug 2015 to June 2016. So the low might not be until June 2019.

You got it backward. Yield curve inversion is a symptom. It comes about because investors park their money in long maturity treasury like the 10 year instead of putting it in more productive use.

Root cause is global growth is slowing.

So what’s the root cause for global growth slowing?

Trump, who stole our Christmas by killing Santa. A little bit of Xi too with his heavy hands in China.

We’ll see when Q4 GDP is out, but US GDP growth accelerated in Q3. The fed is artificially raising short-term rates beyond what the free market would price them. That’s why the yield curve is in danger of inverting.

I believe the stock market got too fat, too quick. The famous tax cuts created an aura of everybody receiving lots of money for free. Thus, inflation is taking ahold of that extra $ that in reality is not in the hands of most Americans, at least those in red states.

It could be for a reason, the powers to be, know how to buy and sell in the stock market. Anything applies, inside trading, greed, careless brokers, etc.

Warren Buffet may be smiling while millions lose their retirement.

Same as we guys mumbling jumbling why, “they” may be sitting at a table playing cards, enjoying a drink and planning to dump or buy stocks. You never know. You may be doing that already.

I want you guys to watch this program. It will tell you how a few guys can conspire to rescue or sink an economy.

Which is the cause, which is the effect? Is there a positive or negative feedback loop?

Please don’t talk like a liberal arts. Talk like a STEM

Q2 was 4.2. Q3 was 3.5. It slowed down not accelerated.

Most predictions including the Atlanta fed’s GDPNow point to high 2 for Q4. If true it’s a very sharp slowdown from the Q2 sugar high.

The Fed did cut the number of hikes from 3 to 2. So at worst it will be done in June 2019. There’s a pretty good chance it will stop after March, just one more hike.

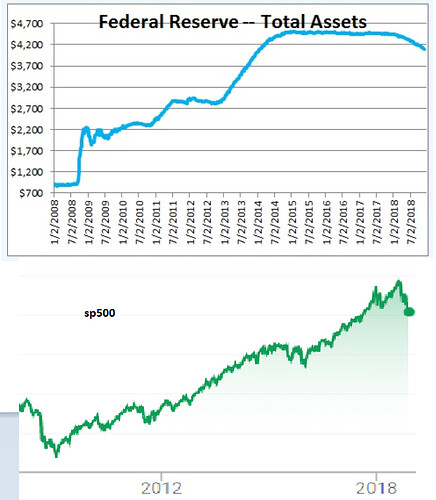

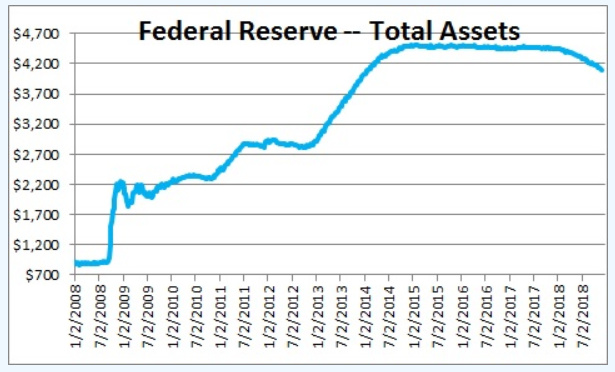

I was watching CNBC closely… the markets started to really go down when Powell said the rate of Balance Sheet Reduction by the Fed was going to stay the same. The Fed has bought trillions in assets to support the economy after 2008 (QE). They have been the “last buyer” that made sure the market functioned, knowing someone was there at the end to buy something if nobody else wanted it, keeping the panic from happening again.

They have just started to reduce their balance sheet… so they have a long way to go… Another big buyer of assets from the US China (treasuries)… It’s like the bubble never really went away, it was just “postponed”. The Fed will not be left holding the bag.

http://www.numbernomics.com/nomicsnotes/?p=7375

It seems to me the private sector has no trouble at all buying Fed’s assets. That’s why the rate for long maturity treasury is so damn low. People are buying that crap.

Are there smart guys at the helm of the government? It seems that all we hear and see is the fight and attacks between the cry baby president and Powell. I believe that is the problem right there, an apprentice figure trying to pitch and catch at the same time. These are matters that only economist should take on their hands, no more time for tweets.

Watch the program I suggested you. I believe Warren Buffet was in the process of buying Lehman brothers. And the government not rescuing the brothers may have been the biggest blunder of all.

From CNBC:

“Fed Chairman Jerome Powell also rattled markets by saying the Fed was satisfied with its program to shrink its balance sheet and has no plans to change course.”

Wrong comparison to be putting these two charts side by side. More fearmongering than anything.

typical dismissive reply without any explanation on your part.

Markets benefited tremendously from QE and Fed buying of assets. Now the Fed is selling those assets. Are you sure there is no correlation?

Low interest rates led to trillions of dollars in stock buybacks that raised stock prices by reducing PEs, etc. Are you sure higher rates will not affect that?

please provide explanations to your assertions other than “i don’t like it, so it must be wrong”

I don’t need to explain anything. Time will tell.

I don’t know. Maybe you work for it!

Well, you like to brag about how low you bought your stocks… many of us did too and here trying to figure out what is going on with the market and make wise decisions, not just close our eyes and let “time tell”.

Time has told us quite a lot about the market and BA RE in the 18 months since I arrived here… maybe we should listen.

don’t confuse a “good run” with expertise and wisdom