How much revenue is there in the traditional checking and savings account business though? People even expect free brokerage trades now. GS tried to start a consumer brand and realized there are no profits there. The revenue and profits are in the higher end services.

SQ is the leader in the FinTech group. Bottom together with the market on Oct 12, 2022. Rest bottoms much later.

Laggards COIN and AFRM ![]() from Jan 6… if you can catch the bottom… appreciates much faster than the leader SQ from Jan 6.

from Jan 6… if you can catch the bottom… appreciates much faster than the leader SQ from Jan 6.

wtf? who is Hindenburg? SQ no more golden cross and price is not below cloud, below 50-day SMA and below 200-day SMA.

Two bad news in one day.

Most issues highlighted of cash app is similar to cash. Has nothing to do with the platform.

No actual red flags.

Even with banks, there were no real red flags as long as they hold until Maturity ( in fact profitable), but market dropped them as this is bearish time.

Compared 2008, banks are stronger now. That is an opportunity, no one will believe it!

Same way, any company shorters will shoot down with some negative news and retailers are scared to touch that stock!

FinTech would eventually disrupt the banks completely.

FinTech stocks that I own that have golden cross.

SE SHOP COIN

Note: I include SHOP because e-commerce company tends to provide many “banking” services.

V MA have golden cross too.

SQ lost its golden cross.

Last week, Chamath favorite crashed. Today UPST ![]() Still down a lot from ATH

Still down a lot from ATH ![]()

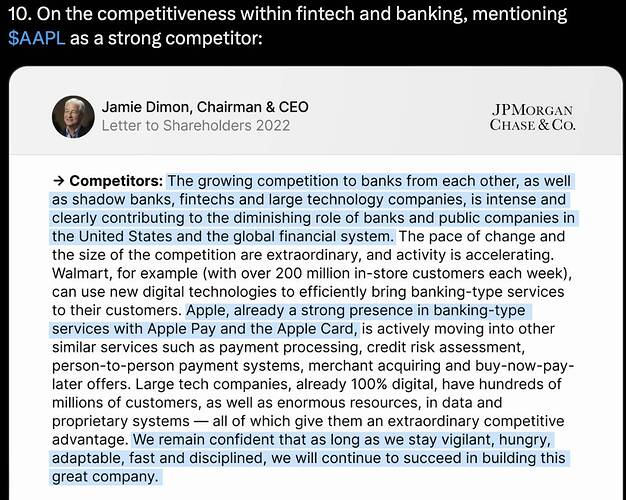

Apple (ticker: AAPL) doesn’t aspire to be a bank, but it’s pushing deeper into financial services, aiming to generate extra income while keeping its one billion-plus iPhone users hooked on the Apple ecosystem.

Longer term, if Apple succeeds in building a full-scale digital wallet, it could also be another killer app embedded in the company’s two billion installed devices, keeping consumers buying more hardware, software, and other services through the sheer convenience of having it all in one place.

![]()

Hedging my bets with SQ and SOFI.

.

Keep ![]() because…

because…

Many reasons why CEO sells but there is only ONE reason why he buys.

SOFI vs UPST

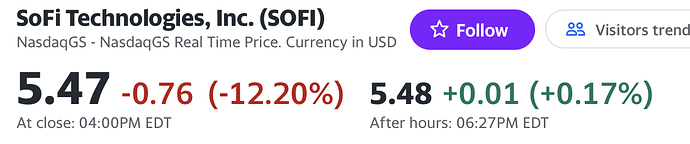

He chose SOFI ![]()

Disclosure: Added 1000, now holding 2000 shares ![]() worth about $10k

worth about $10k

.

Hopefully. According to experts, banking is about relationship… SOFI is working hard on this.

My bet is SQ and SOFI… this two for now, will see how this sector develops… so might not be these twos if more promising Fintech comes along.

Banking is archaic, need urgent re-inventing, either banks re-invent themselves or crypto/ FinTech/ Mega caps would replace them.