I think so over time. I’ll move it in stages.

Have faith ![]()

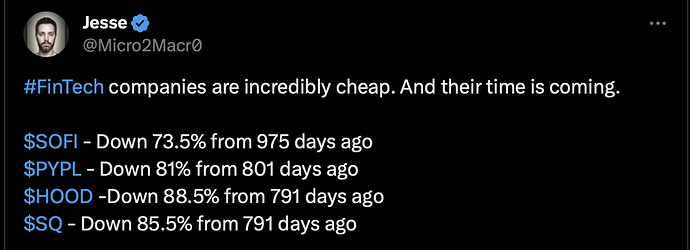

Assumption is they are fairly valued 791-975 days ago. What if they are excessively overvalued then? Or xxx days ago and today are fairly valued based on interest rates? Bear in mind, valuation using DCF is sensitive to interest rate.

I think it’s a pipe dream that prior valuations were fair value.

PayPal was founded in 1998…

Robin Hood is a brokerage firm that doesn’t offer IRA and other retirement accounts which is where most investable assets are. If they started offering retirement accounts, then I’d be more bullish. They were the first to offer free trades, but everyone has copied that advantage. So what’s their advantage now?

Square is mostly a credit card processor. Exactly who’s lunch are they eating? Their market cap is already almost as big as the biggest CC processors while their volumes is far less.

SoFi is a maybe. They at least offer a comprehensive list of financial offerings where people can get it all in one place. Can they do those things more efficiently than legacy banks to create better margins? I’d love to know how different their back end tech is from legacy banks. Their app experience is light years ahead of banks.

![]()

Jack Dorsey Is Back In The Saddle At Block

By Andrew Kim

Research Associate

Last Thursday, Block Inc reported third-quarter revenue growth of 24% year-over-year, surprising on the upside of expectations. When former Square CEO Alyssa Henry departed in October, CEO Jack Dorsey committed to a more active role in the day-to-day operations of Block’s seller ecosystem. During the call, Dorsey made several commitments:

-

Reaching the Rule of 40 in 2026 with an initial composition of mid-teens gross profit growth and mid-teens adjusted operating margin in 2026.

-

Leveraging generative AI to minimize operating expenses as top-line growth reaccelerates.

-

Remaining CEO until Block reaches several milestones, including a “significant return to growth.”

-

Introducing a collaborative commerce initiative between Square and Cash App early next year.

Dorsey’s focus on their deeper integration should support Square’s local businesses on Cash App. In August, Block launched Square Go, a consumer-facing app powering a marketplace for local beauty and personal care sellers that, in one interface, enables consumers to book appointments directly. Soon, Dorsey and team will debut Square Go for all 55 million monthly active users (MAUs) on Cash App’s platform.

Dorsey’s integration of Square and Cash App seems to be putting into motion ARK’s digital wallet thesis, facilitating the growth of closed-loop payment ecosystems across merchants and consumers and disintermediating legacy financial intermediaries.

Full quote before your cherry picking:

Highlighted the keywords for you. Many, not all, fintech companies have very little tech.

Learning English from ChatGPT?

Ethos

https://twitter.com/HolySmokas/status/1726255272081944872

Disclosure: Didn’t have any PYPL. Have SQ and SOFI.

Watching it now ![]() Very long.

Very long.

Most excited about in 2024…

Amit: PLTR

Jeremy: PYPL

Carlos: Bitcoin

Vitaly: AMZN (beginning 2024), Bitcoin & Eth (late 2024), ENPH (2025)

Tannor: SOFI

MattMoney: RocketLab

Kris: VZ

Nobody is excited about TSLA?

Their app is legit good.

Cathie keeps buying SOFI. I added to Leaps call ![]()

SOFI getting out of crypto.

Twitter/ X are full of traders pumping PYPL. Below is an image justifying the pumping. Is it time for the leaky dinghy, PYPL, to be seaworthy? How come is in Depression and not in Anger?