Bad start. Lost 10+% in just two days of trading.

Coin is interesting. Most of their revenue is subscription based now. They are becoming less and less dependent on trading volumes. The subscription revenue is also growing quickly. They should benefit from other exchanges being closed. There’s no way I have enough conviction to make it a large position.

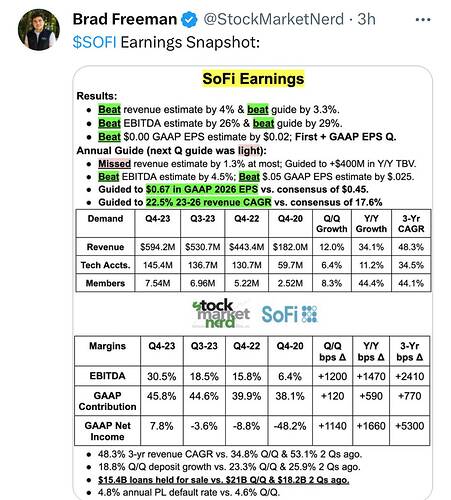

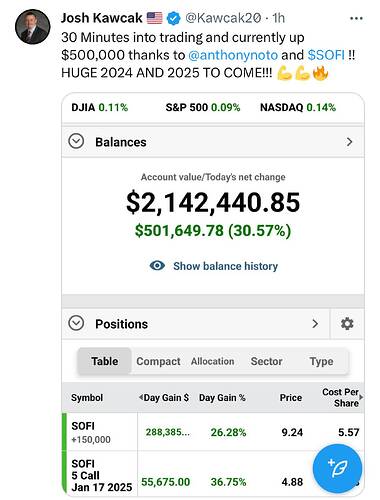

As a customer, SOFI is great. I could see them continuing to take market share from legacy banks. Especially as their client base gets older and their incomes grow. Old people are less likely to switch, but their young client base will earn more and more money as their careers progress.

.

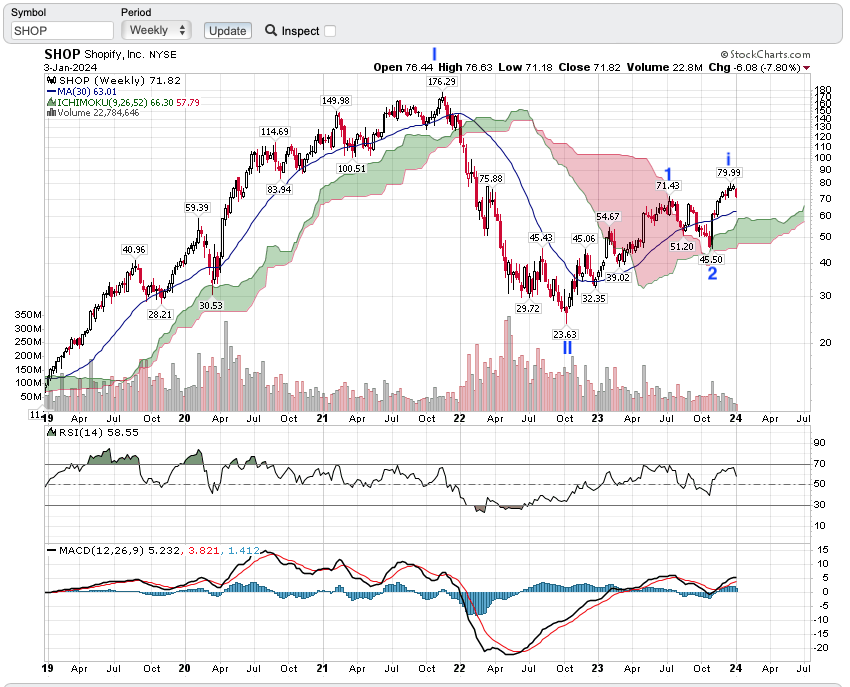

Have cut position by 50% when it was trading $170s-$180s. Still my third largest after NVDA and SHOP… Position size for NVDA and SHOP didn’t change… feel like they are buy n hold (hopefully forever) materials… if there are deep retracement, would add.

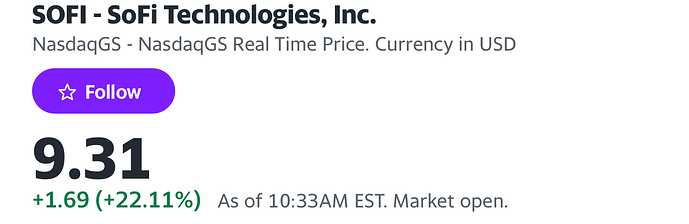

No comment on SQ? I have cut position size by 75% and wondering whether I should cut all off. SQ is popular amongst mom & pop businesses. Their overseas expansion don’t seem to be that successful. Position size of SQ is now about the same as for SOFI, use to be 4x the size. Btw, have cut position size of SOFI by 25% when it rockets to $10s… waiting to buy back.

Growth stocks are so volatile, no choice but to trade them opportunistically.

This downgrade, SoFi stock downgraded by KBW, warns shares could drop 20%, causes SOFI to tumble by 12+%.

In wave ii, probably completed, if not, unlikely to decline below $7.30. Started scaling back what I have sold around $10s.

I don’t see what the next growth catalyst is for SQ. They tried to do operations software for small businesses. It didn’t catch on. I think SHOP is superior. More and more of their revenue is from their payments platform. Also, e-commerce is growing while brick and mortar is at best stagnant.

Looks like Buy Now Pay Later is easy to implement. The market leaders are 30 year old firms like PayPal and Amazon, not those shiny fintechs whose sole purpose was BNPL.

For those who don’t research the past…

“The surge in use of buy now, pay later comes as credit card debt is at a record high and delinquency rates have nearly doubled over the past two years”

This is with super low unemployment.

“ Klarna, PayPal and Affirm all declined to share buy now, pay later delinquency rates with CNBC.”

I’m amazed people invest in these stocks without knowing that. That’s a key metric for credit. Banks and CC companies report it. They also have to book reserves for bad debt. I have no idea how these companies are exempt from that. The regulators are asleep at the wheel. We have how many regulatory agencies? They are all failing here.

I’m not a fan of heavy regulation, but I think at some point we’ll need to eliminate many credit products just to protect consumers from themselves. We’ve increased standard length of mortgages and car loans to make them “more affordable”. It hasn’t actually achieved that. All we’ve done is make it easier and easier for people to get into trouble with debt.

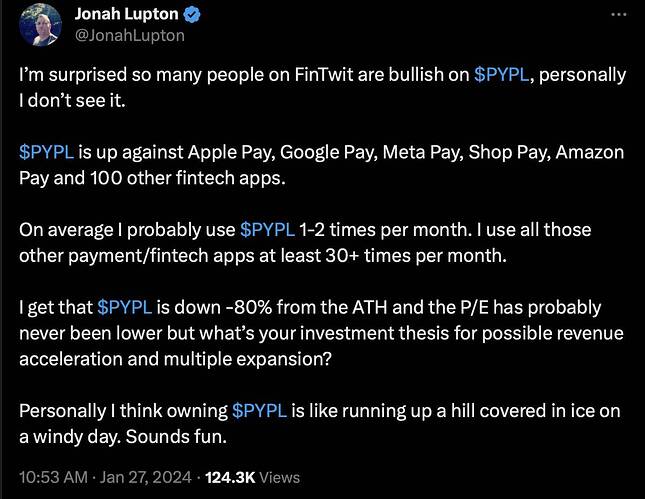

Social media is full of rumor about X is partnering with PYPL for X payments e.g.

Social media is an echo chamber full of parrots.

PYPL gained 17% over three days.

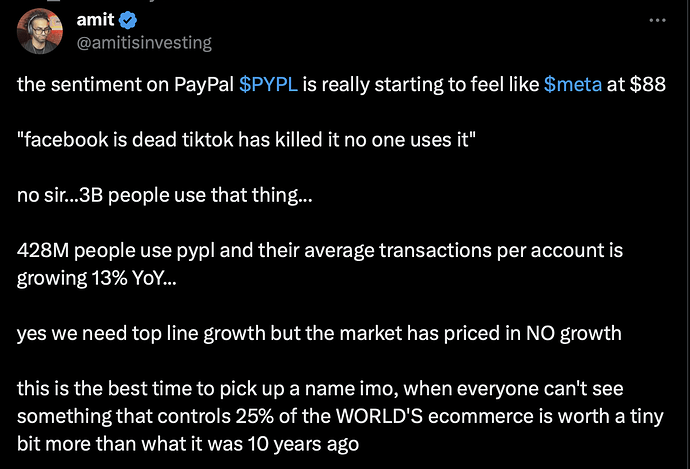

Sorry, Amit. You didn’t answer his question, “What is the investment thesis for possible revenue acceleration and multiple expansion?” In fact, sound like you agree that there is no revenue acceleration.

Meta turned around because of massive cost cuts that increased profits.

They’re on my bad list. They claim they allow wire transfer for home purchase or transaction. I figured that included refinance. They refused to do a wire for my refinance. I’m a big enough customer that most banks would give me access to all sorts of perks. I’m currently shopping for a new bank. To be fair, I told them if they don’t do a wire for me, then I will take all of my business elsewhere. They escalated to a supervisor and still didn’t budge.

.

That’s probably the problem. Their system is set up for high paying but not yet rich ![]()