I took one AAPL $215 option expiry Jan 17, 2010 just at the start of market ! AAPL is coming up and TDOC came up already as both results are better.

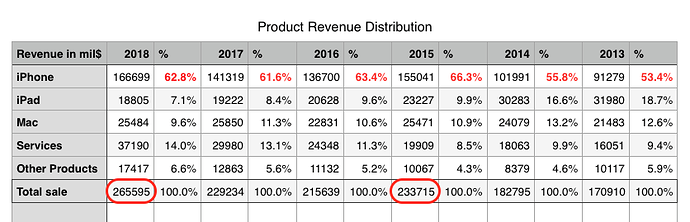

Apple revenue is at a new ATH, $266B, top 2015 $234B.

Service & other products continue to grow. Now total 20.6% of annual revenue.

services are the future!

Yes, in fixing obsolete products…

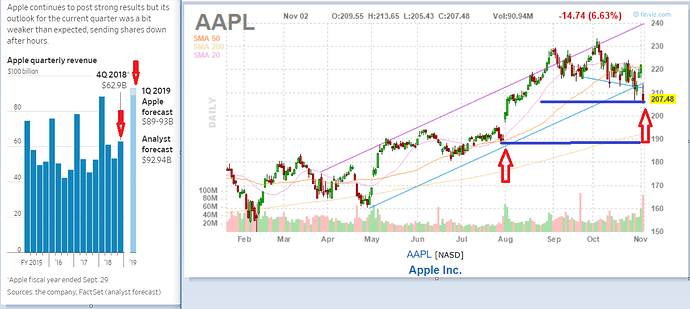

Apple is still worth $1 trillion despite worst stock drop since 2014

By Emily Bary

Published: Nov. 2, 2018, 4:14 pm ET

Shares of Apple Inc. (AAPL) closed down 6.6% on Friday after the company delivered a disappointing December-quarter forecast and announced that it would no longer provide unit-sales figures in its earnings reports. The drop, Apple’s worst single-day percentage fall since January 2014, left the company with a closing market value of just over $1 trillion, based on the 4.83 billion share count it disclosed in its most recent 10-Q filing in July, though Apple will likely disclose a lower share count in its forthcoming 10-Q for the September quarter. Apple’s decision to end unit-sales disclosures sparked debate among Wall Street analysts, and the report prompted price target cuts from Morgan Stanley and BMO Capital Markets, among others. Apple shares have gained 22% over the past 12 months, while the Dow Jones Industrial Average (^DJI) of which Apple is a component, has risen 7.4%.

Tracking the pulse of the markets

Copyright © 2018 MarketWatch, Inc. All rights reserved.

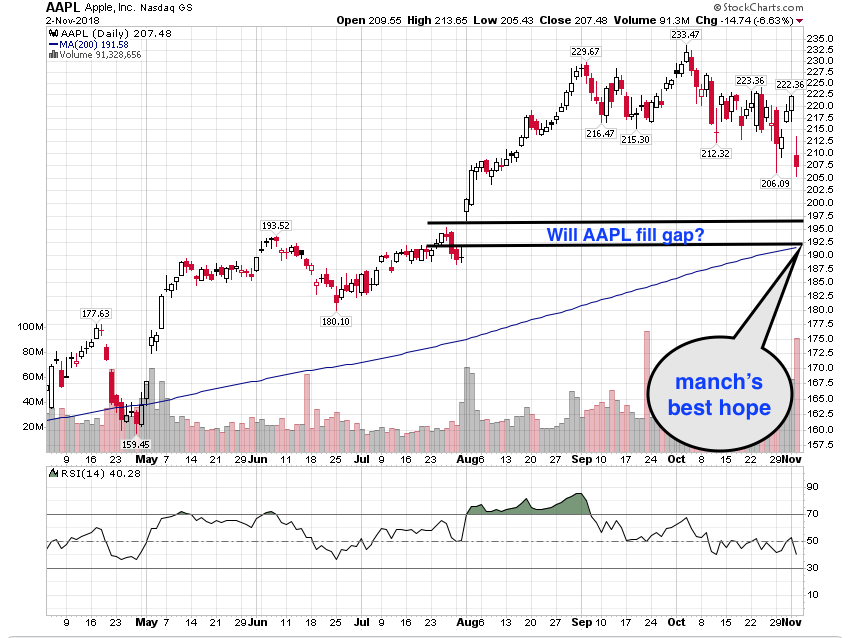

Today low is a hair below recent low, pretty sure Manch didn’t take advantage of it. Looking at the option, best opportunity is short put (Feb $210) for $15 for an annualized return of 30%  not as good as 100% when TSLA is at $250s.

not as good as 100% when TSLA is at $250s.

Still waiting for the narratives to change for the worse. Not there yet.

Didn’t you sell all your Aapl earlier? What was that price point? You probably want to buy it back at below that price point.

I’ve conveniently forgotten that already.

FAANMG roared, Chinese tech tanked.

AAPL shot up, BABA tumbled.

Should be around Sep-Oct 2017 so between $147-$162. Avg $150 ![]()

But didn’t @manch exit Apple completely one time and posted his decision here? I forgot when that was and couldn’t find that post anymore either.

He did but can’t find the post.

I might have deleted that…

Conveniently?

Maybe…

iPhone units did peak and are heading lower just like what I expected when I sold. Obviously I didn’t expect it can hike ASP so much. I still think stock will likely head lower as Peak iPhone is finally upon us. Pretty soon iPhone rev will head lower too.

That means little. When was peak PC? How come Msft is at its highest ever?

Most Wall Street analyst are reactionists. They justify - after the fact - with some reasons. They also promote echo chambers by telling people what they want to hear.

Never never trust them, believe in your Due Deligence That is the only way to bring excellent gains.

I have captured some screen shot from various data point. The current qtr and next qtr is a great win for AAPL. Falling 6% down is an excellent opportunity to get in.

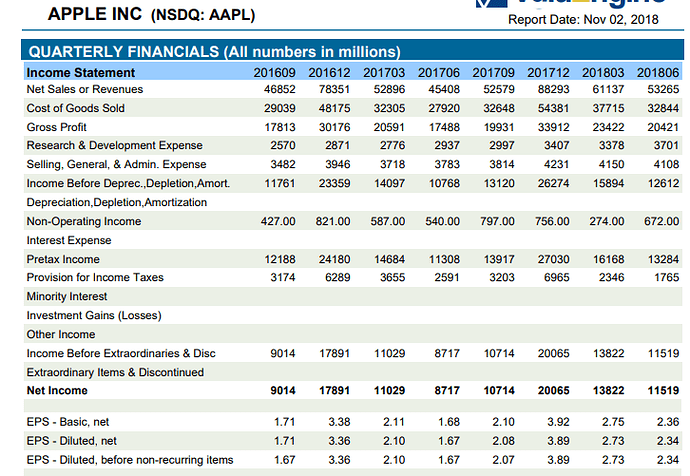

Current qtr sales is $62.9 billion from the same period a year earlier, Apple said Thursday. Profit soared 32% to $14.13 billion.

The forecast is between $89 billion and $93 billion. Analysts’ consensus estimate is for revenue at the high end of that range, $92.94 billion according to FactSet. Assuming apple maintains similar profit margin, this is huge profit.

The down fall is temporary effect and it will not long last. It is unlikely to go down further other than temporary volatility.

Gene Munster had opined that unit sale would stable for many quarters. However, he predicted that ASP would continue to rise.

IMHO, given that there is a core group of iPhone users that would upgrade whenever there are new models, Apple is spending effort to keep the installed base growing by tailoring iOS (including the infamous battery throttle) to work on and providing repairs to older iPhones. Also, using good enough material for iPhone such as iPhone XR. So we should continue to see increasing iPhone revenue (constant unit x increasing ASP) and increasing service revenue (due mainly to increasing iPhone installed base)

That is what pundits say for iPod, iPhone and iPad replace iPod. Similarly there would be other revenue sources. Right now, pretty clear that Apple Watch and Air Pod are selling very well. IMHO, still pretty of room to increase sale.