If one quarter’s results are analyzed and debated so much, how are people able to hold the same stock for decades?

Huh? Is there a direct cause and effect between holding a stock with stock debate?

I’m an investor, not a gadget chaser…

At least for me that’s true. For some reason when I analyze my investments I tend to do something about them, and that proved to be always a problem for me. May be my problem is unique to me. That’s why I was asking.

@zensri, the day you said sold, I was telling that it is wrong move. I understand you have long track record, but You need to know volatility.

Since I expected the fall, I safely moved some cash and re-booked nicely with well known companies and diversification.

As of date, I almost got back 3%-5% below my previous peak and I will be crossing (my guesswork) my previous peak before Nov 30th.

See my PM.

WSJ gives this

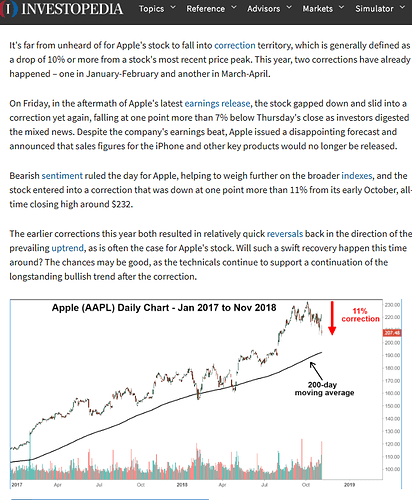

Apple, which in August became the first U.S. company to surpass $1 trillion in market value, had been faring far better than many other tech titans in the recent swoon. As of Thursday’s close, before the earnings report, its stock had fallen less than 5% from its all-time high on Oct. 3, shedding less than $48 billion of its valuation. That compares with declines off their peak values of about $180 billion for Amazon Inc., $139 billion for Google-parent Alphabet Inc., and $192 billion for Facebook.

Apple Watch Heart Study With Stanford Signs Up 400,000 People

-

Clinical study aims to spot undiagnosed heart rhythm problems

-

Watch finds irregular pulse and sends alert to get follow-up

AAPL touched below $200, got more automatic buy at 199.50 !!! ex-dividend 11/08/2018.

Short put (Jan 2019 $200)@$9 yield an annualized return of 30%

Units have been flat for almost two years now. Apple has been saved by selling ever more expensive phones. How much longer can you go with that strategy though? How high is too high? Can Apple sell a $2,000 phone?

I say there’s a limit, and we are already there. iPhone rev growth may have already peaked.

So far your crystal ball has not shone. ![]()

No need to sell more expensive iPhones to increase asp ![]()

![]()

Usually Wed is the lowest price. Advice manch to either GTC $195 or GTC short put (Jan $200)@12. If those prices are not hit on Wed, buy AAPL immediately.

Fb and Amzn users peaked as well. Time to buy some Tsla now…

Mr.Market wrongly dropping the AAPL shares, hope shorting, telling the above, but very likely they mis-interpret and provide us an opportunity.

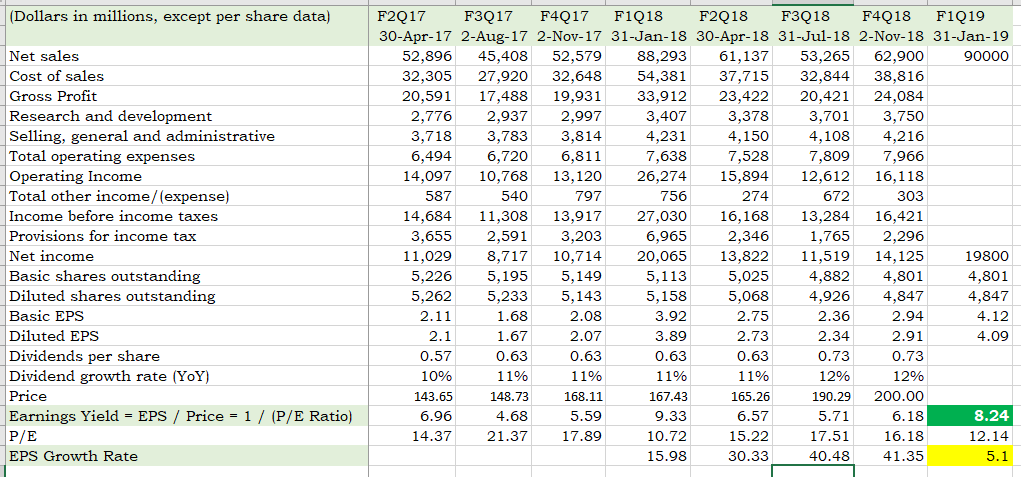

Look at the fundamentals.

Assume net income is share holder income as eventually it will come back to them by dividend and buyback and reinvestment.

AAPL Last qtr is 62.9B sales, 14.1B as Net Income.

AAPL next qtr is appx 90B sales and likely income is 19.8B, which results EPS appx 4.12. This means If I buy one share at $200, I get return of $4.12 which is 8.24%.

Shares dropping from 228 to 200 is a great opportunity to get higher return

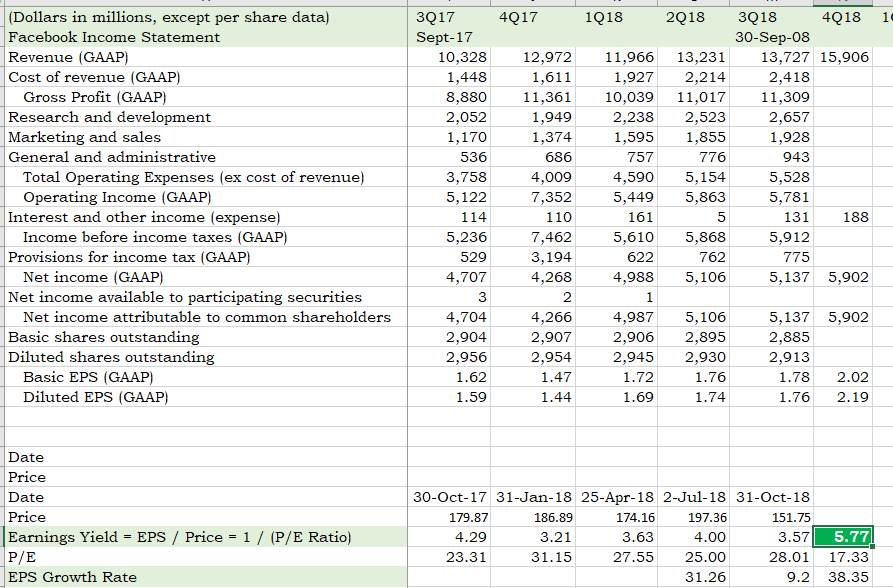

For comparison reason, here I am posting FB’s data which is 5.77% Return

Someone posted in reddit (not mine) today

Title: After reading through Apple’s Q4 transcript here’s what i think about the reaction by analysts

Body: The obsession over this report is a blatant attempt to cool the stock off and lower the price of a company that is executing at the highest level, and AAPL will probably replace FANG as the stock that can cover up a shitty portfolio with its gains.

The report was very clear: Apple has built a business that has so much going for it now and focusing on how many new phones they sold is missing the point. I think they knew eventually the smart phone market was going to cool honestly because they have perfected it to the point that upgrading is not really as necessary as it used to be.

I have the Iphone XS and it can do pretty much everything you could possibly want it to: Its fast, its well designed, it’s durable, the camera is awesome, face id is seamless, and the apps can literally recognize things that they need to do before you even think of doing it yourself. It’s just… hard to really imagine needing something better, thats why their customers will pay a premium to upgrade, but really it is what the customer does with the phone and after that Apple sees a much bigger opportunity:

The apps, the music subscription, apple pay, icloud, the camera, messaging, streaming, you name it, all of that can be monetized; those aren’t as cyclical as iphone sales so they’d be stupid not to make that part of their business the focus.

People use the phone everyday, they will only shop for the phone what once every two years? Why is that 1 transaction so much more important than the other 600 days the user spends on the device. It’s like judging the profitability of facebook by how many people downloaded the app on a particular day.

Anyone that thinks the iphone slowing has anything to do with the actual profitability of the company is clueless and Cook even said if the unit number was significant in some way he would mention it so it’s not about transparency really. I think it was just something to nitpick at and distract from the fact that services, the watch, the laptop, music, pay and everything else was so strong that it can carry the business.

The guidance really wasn’t that bad either. They are expecting to hit new record profits and continue to introduce a bunch of new products to their customers.

Thought they killed it but the stock is selling off like they did something wrong. I’d be a buyer here for sure. The analyst community knows it was a great quarter and they saw a chance to get it for cheap. Cook I guess could have been an ass like Musk and told them to stop asking dumb questions, but he actually answered questions about it multiple times. He argued that if 1 unit generates more revenue than 100 used to why does it matter? It has always been a number used by the analysts to bury the company and that is probably something Cook just doesn’t want to deal with anymore.

Who cares? The company will buyback the panic any way and beat estimates again, so why are people selling the stock based on one very small part of the report? The downgrades yesterday were really suspect; I’m sure there are a few more to come, but you guys should read the report. It was pretty good.

Manch have missed the 4th chance to buy AAPL😫

Manch is a newbie investor who happened to get lucky with the boom from last year. He has a long way to go…

Still cheap at $202