Apple stock could reach $275 over the next 12 months, GBH Insights’ Dan Ives says.

So I am not the only one who think AAPL would hit near $300 before end of next year.

The forecast they have provided is peak record in its history. As long as Tim Cook is not reducing his forecast, AAPL is an excellent buy with current range or below $175. Waiting for opportunity to load some Calls when it dips further.

Apple: Don’t Buy The Bounce $AAPL

I am fair and balanced.

Manch,

Both says buy AAPLs even though the title is diifferent.

Correct ==> So while Apple shares have bounced a bit off their recent low, I fear that investors will have another chance to buy at a lower level.

Analysts are doing a free service for buyers and disservice for scared sellers (Major supplier issues significant warning.)

Any suppliers order cut does not affect the current quarter sales of AAPL, but the next Jan-Mar qtr.

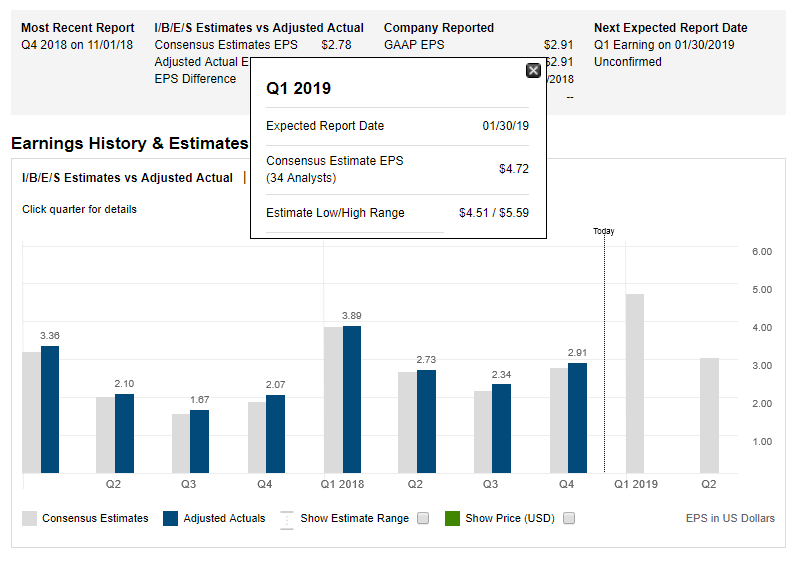

The average estimates of current qtr (Q1) is 4.72 and Next qtr (Q2)is 3.0 - which shows exactly why apple reduced future orders. In addition, they may change supply chain equation with vendors which is very common.

Unless Tim Cook reduces outlook or entire market crash, with FED rate hikes, to S&P 2400 or S&P 2000 , AAPL is a good buy $170 or below

Much awaited 5G is coming to users at last in 6 months, Again AAPL is slow to react.

Where is Tim Cook ? I am unable to bet on you

Despite the speculation, it’s worth keeping in mind that the first phones to support a brand-new radio interface tend to feature compromises in areas such as battery life, weight, thickness and heat dissipation.

And yield is unlikely be high enough.

it can’t be ignored that high-end phone buyers tend to pay attention to specs when looking to upgrade their devices –

Apple needs to find a solution to cater to these low volume demand yet will not be viewed as a failed product.

Apple’s big issue is fighting with QCOM, on royalty, which Samsung make use of it. On any case, Samsung comes with 5G and then Apple comes with it. If they release 5G enabled iphone by next thanksgiving, it is great break for Apple. I hope Tim Cook also knows about this !

Apple Analysts Are Sounding a Historically Rare Note of Caution

Manch rehashes previous views to amplify FUDs😠

Just fair and balanced reporting on my part. Too much cheerleading in this thread.

Shoot, I called the downfall of Apple eons ago when the Iphone pricing strategy went haywire. Sure, I expect Apple to be able to weather the storm BUT it really needs to develop new products right? Selling overpriced phones is not exactly cutting edge…

I agree on your balanced reporting, but why too much cheerleading?

First: Almost all analysts/articles presented about negative analysis of AAPL are not sound or foolproof.

If entire stock market is not crashing and If Tim Cook is not revising (i.e., reducing) outlook, we can fairly say AAPL meets the committed EPS = 4.72 and likely 3.0 (Q2).

This means ROIC = 4.72*100/176.69 = 2.67% in a quarter which is way better than other companies.

Believing analysts negative opinion, people are going away from AAPL including Hedge funds, that results drop in price.

All we need is Citron vote down to bring further AAPL now so that we get deeper discount.

Every dollar drop in AAPL price is an opportunity to gain one more dollar.

At least, in TSLA, I knew what is the status as I monitored since IPO. But, for AAPL, hanera & WQJ (and Warren buffet) are better than me.

AAPL may drop any time between now and Dec 31st, watch out…

I am only skeptical on entire market - continuously dipping month after month which is not a good sign. I have not seen such issues previously except during the downturn periods.

If market recovers, AAPL holding (or buying at low price) is a boon.

Market has to stabilize for AAPL to stabilize because when traders short DJ and S&P ETFs, all stocks which are components of those ETFs would fall regardless of fundamentals. Also, many hedge fund managers are locking in profits of their winners, their year-end bonuses is depending on % profit made in their portfolio under management.

Interesting ! Learning for me !!

This is well-documented ![]() Thought you know, thought was educating manch

Thought you know, thought was educating manch ![]()

Hope you are also aware of the triple expiry (can’t remember the actual name).

I have always seen last week of Dec fire sale - thought of tax loss harvesting, but never heard hedge funds profitability bonus linked - but makes sense, they do not hesitate to kill the bird (gold egg geese) to get the bonus ![]()