Munster on Apple: There’s a disconnect between the fundamentals and headlines

Munster added Apple would ultimately be the best-performing FAANG stock, noting that others like Amazon (AMZN) and Google (GOOGL) are likely to come under regulatory pressure this year.

Hold only 1 AMZN and 1 GOOG in DimSum (F10) portfolio, unlike manch throwing his fortune into AMZN after reading many media hyping AMZN, the one who would disrupt all businesses and eat them alive - yes, the same narrative as for the once mighty DELL, GOOG, MSFT (recovered)…

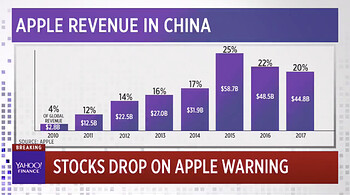

Other analysts are less bullish on Apple, pointing to signs of a possible erosion in customer loyalty, the high cost of iPhones, and growing competition from Chinese smartphone makers.

Now and then, change to this narrative. iPhone is too expensive has been around since day 1, yes, from the first version in 2007. So is competition from China smartphone makers, Xiaomi used to be the leading competitor, now is Huawei.

Apple has responded by offering promotional programs for new customers to trade in their Android phones for credits that can be used to buy iPhone XS and XRs, hoping to lure competition away from Chinese brands like Huawei, Oppo, Vivo and Xiaomi.

To boost iPhone sales, Apple launched a “GiveBack” trade-in promotion offer for its new iPhone XS and iPhone XR devices in the U.S. in November. In late December, the promotional program for the new models went live in China, adding one major perk: users in China can not only trade in their old iPhones, but also Android phones made by Apple’s major competitors in China, including Huawei, OPPO and Xiaomi.

marcus’ idea is implemented in China only. Feel like a direct response to anti-Apple campaign by Huawei.

It’s also harder to lock in users within the iOS system in China, where proprietary Apple services, including iMessages and iTunes, aren’t as popular as in the U.S.

Big issue. WeChat is extremely popular and iTunes don’t have many Chinese songs.