Increase those damn dividends!!!

Today is the day. We’ll all find out just how well the iPhone is selling. No more speculation.

Why does Apple want to be cash neutral? That sounds rather lacking in ambitions.

The business generates far more cash than they need for operations and investment. The cash will be returned to shareholders via buybacks and dividends.

Dividends!!! Dividends!!!

Victory lap? Shark fin soup tonight?

“Apple (AAPL) announced its Q2 2018 financial results on Tuesday. Apple sold 52.2 million iPhones during the quarter, which was just about in line with analysts’ estimates, which called for the company to sell 52.3 million iPhones.”

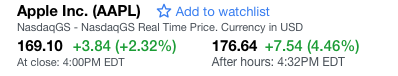

I guess all those predictions of doom turned out to be full of BS. 16% revenue growth was the fastest Y/Y growth in 2 years. EPS grew 30%. Always good to see EPS growing faster than revenue for a company Apple’s size and age.

““We’re thrilled to report our best March quarter ever, with strong revenue growth in iPhone, Services and Wearables,” said Tim Cook, Apple’s CEO. “Customers chose iPhone X more than any other iPhone each week in the March quarter, just as they did following its launch in the December quarter. We also grew revenue in all of our geographic segments, with over 20% growth in Greater China and Japan.””

Hmm, so much for iPhone X being a flop. Also, there was talk of Apple being dead in China.

The company also increased its quarterly dividend 16 percent, compared with a 10.5 percent increase last year.

Pay rise of 16% ![]() from $2.52 to $2.92 per year per share

from $2.52 to $2.92 per year per share ![]()

For every $10k dividends, now got extra $1,600, way more than enough to pay for dim sum lunch.

Why can’t Google learn a thing or 2 from Apple and start paying some dividends…

Google wants to like BRK, capital allocation, so no dividends.

Better luck with FB.

Revenue of Services and other products continue to grow at over 30%.

Unit and revenue of iPhone continue to grow.

Year over year revenue in China grows at over 20%.

Didn’t he own a bunch of IBM and WFC… he is no longer the trend setter.

About IBM

The episode has highlighted just how badly Buffett missed opportunities in tech companies that have come to dominate the ranks of the world’s most valuable enterprises. At the annual meeting, he issued a mea culpa, adding that he “blew it” by failing to invest early in Google despite having plenty of chances to learn about and understand its business model.

I’ve had the Barclay’s iTunes reward card for years. I guess I’m going to lose the rewards. It was nice, since it provided rewards with zero annual fee.

Nothing exciting. At. All. Meh thru and thru.