SQ works with Apple Pay. Stores still need a device ro accept Apple Pay.

Yup that is what i mean.

Narrative cycle has shifted in apple’s favor. Now everybody is singing praises for Apple. Complete 180 from before earning.

How much does Apple make out of those Apple Pay transactions?

Do a web search ![]()

According to a new report from The Financial Times, Banks and payment networks pay hard cash for the privilege of being involved: 15 cents of a $100 purchase will go to the iPhone maker, according to two people familiar with the terms of the agreement, which are not public.

green just like consumer staples and utilities.

green just like consumer staples and utilities.

Apple laptops last so long. Granted, I don’t use it daily, it’s still faster than my new windows laptop for work. My laptop must be close to 4 years old now.

A typical iPhone user is charismatic ![]()

Like clockwork the narrative on Apple is starting to shift:

New Street expects iPhone revenues in 2019 will be 10 percent below the Wall Street consensus. For his part, Ferragu believes that Apple’s 2019 and 2020 earnings per share will be 9 percent and 6 percent below the average analysts’ projections, respectively.

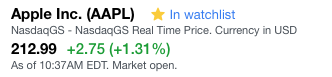

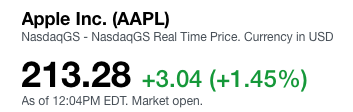

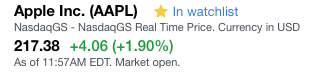

Shares of Apple fell 0.8 percent on Monday. New Research’s price target of $165 represents roughly 25 percent downside from Friday’s close at $217.58.

No worries, profit will hit stratosphere after Tesla is acquired.

WS always force young graduates to write bearish articles.

iPhone X is so popular that we should sell AAPL?

Thomas has big forehead like me. Must be a smart man.

Analyst Looks to $2 Trillion Valuation

Long-time Apple analyst, Ming-Chi Kuo, now at Hong Kong-based TF International Securities, has put out a note naming the next two genres that will take Apple to a $2 trillion valuation. In his words, "Services, AR and Apple Car will create Apple’s next trillion-dollar market cap.”

manch,

Still very lucrative to get on the gravy train. Few years to $2T.

I like my own positions more than AAPL. Let me see what this year’s new iPhones look like first.

Did not know Ming Chi is now in HK.

Also if history is any guide there will be a bear period of AAPL coming soon. Narratives already turning from euphoria to cautious.

Don’t know about men, but women with big forehead is a curse to her parents, according to Chinese palmistry.

Get your ass back to 21st century.

Smart man + smart woman = smart kids.

You’re the superstitious one. Beware of your forehead.