@manch is especially biased because he actually sold all his AAPL in anticipating of a big drop or at least subpar growth. So no need to reason with him. He has already sold his soul to the devil…

Is Elon in jail yet?

Not before Bezos gets hit by that bus.

I sold AAPL last year. For me that’s all that matters.

What did you do with the proceeds though? Moved to Amzn?

Don’t remember. It’s all part of the pool. Maybe some went to FB, some to Amazon and some got eaten up by the many crashes in between.

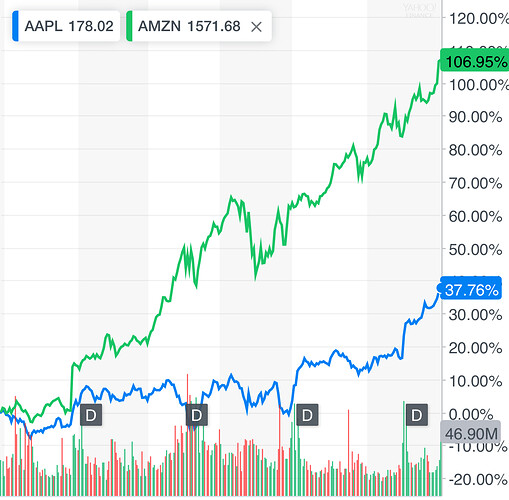

Overall return may not be as good ![]() is the problem of switching, unless you are so damn lucky to switch all to a higher return.

is the problem of switching, unless you are so damn lucky to switch all to a higher return.

Cloud & AI craze led to 7x gain for AMZN NVDA NFLX from early 2015. This theme is still going strong after 3.5 years😋 all my 10x is riding this theme

My one year return is 61% and YTD is 37%. This year has been difficult. AAPL performs better than I expected, yes. But I still have the same concerns for it today as last year.

What’s your YTD return of your net worth?

That’d be a good comparison since 1997. Either one would make someone rich.

Better than AAPL 40% but lower than AMZN 120%![]()

10c just put me down another 4.5%, on top of the 20+% it cost me. 2018 has been pretty volatile.

I don’t see how your method of investment can survive a recession.

Agree but his thesis is recession would be eons away. Should he be right he would be making tons more than those who are in constant fear of a recession is around the corner. Last year he made 300%, this year 60%, way ahead of probably all hedge funds.

No. YTD is only around 30%.

Not sure how I will perform in a recession, but 2 of my biggest portfolios Facebook and Tencent went down by more than 20% very rapidly. My Chinese education companies went down 40% in one day. Maybe I can survive after all.

Also I didn’t say a recession is eons away. What I said is that we are in a young secular bull market, and recessions within a secular bull market will be short and shallow. The last secular bull market from 1982 to 2000 is a great example.

One day difference?

Ytd AAPL 31% ![]()

So this year, your trampoline approach didn’t produce extra return over buy n hold I.e. you are not been paid ![]()

Can’t expect to outperform in any given year. Also we still have 1/3 of 2018 left.