When we goto into negative interest rates, we can borrow 30 years at 0% !

- Auto loan payments can be deferred for up to 120 days. No late fees will be charged, but finance charges will accrue. New auto customers will have the option to defer their first payment for 90 days.

- Mortgage payments for existing customers can be deferred for up to 120 days. No late fees will be charged, but interest will accrue.

So those living paycheck to paycheck are still screwed on the 121st day.

At least they can still live rent free in California ![]()

![]()

Just checked. Zero open houses this weekend.

How about rental market? I suspect is cool since is not wise to change houses now. Anyhoo can forget about selling houses for the next few weeks.

By the way the inverted yield curve has a perfect record of predicting recessions. I am now a believer.

At lease now I understand why a friend of mine does not like investing in SFBA. Less Rent, and Higher Price Swings. At least in other states, prices wont swing big if they do.

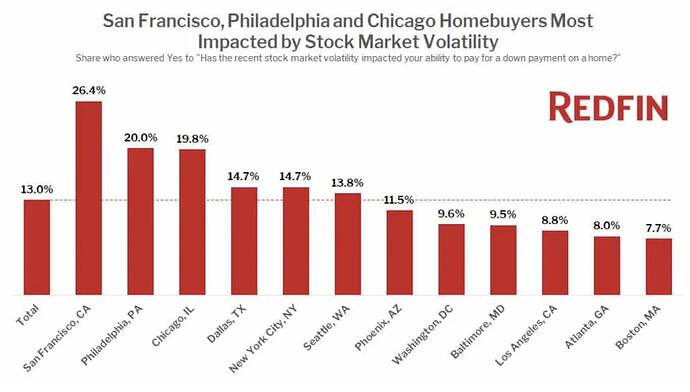

Survey was done between 3/9 and 3/11, or 4,000 Dow points ago. Still the result is interesting:

In the San Francisco metro area, where the median home price is $1.3 million and many workers in tech and other industries receive some of their compensation in stock, the impact of the stock market declines is being felt more acutely. Among Bay Area homebuyers, 26% said the volatility has impacted their ability to afford a downpayment, twice the national average.

“I had a listing go on the market on Thursday, March 5, got a ton of traffic at the open house, and ended Sunday with three strong offers. By the time I went to review them with my seller on Monday morning, two had withdrawn citing stock market concerns,” said Kalena Masching, a Redfin agent in Palo Alto. “In Silicon Valley, a majority of buyers use money from selling their employer’s stock for their down payment or pledge the stock to strengthen their loan backing, so many are in vastly different financial positions today than just a few days prior. For buyers with adequate cash resources, it’s a great time to get into the market because I believe you won’t be competing against as many buyers. A lot of folks don’t have that purchasing power, however, and have no choice but to sideline their searches until the stock markets recover a bit.”

It proves the obvious: there’s a strong link between the stock market and the housing market in SV. The stock market is in an even deeper hole now. Many deals may be falling through.

I have to put a new build on market for sale in north los altos.

the stagers can only stage after 7th. fingers crossed

I am surprised how many of people are keeping their money in company stock even while they are actively looking. But history taught that’s a good thing with climbing stock price.

Best of luck and let us know what you see in the market.

From the California Association of Realtors.

https://www.carcovidupdates.org/stay-at-home-guidelines

C.A.R.'s Guidance on Governor’s Stay-at-Home Order

Updated March 20, 2020

“Yesterday Governor Newsom and the State Public Health Officer issued Executive Order N-33-20 requiring all Californians to stay home except as needed to maintain continuity of operations in 16 infrastructure sectors. This supersedes all existing local city and county orders that are less restrictive. The real estate industry is not exempt from this prohibition except as needed to maintain “continuity of operation … of … construction, including housing construction.” Therefore, REALTORS® should cease doing all face-to-face marketing or sales activities, including showings, listing appointments, open houses and property inspections. Clients and other consumers are also subject to these orders and should not be visiting properties or conducting other business in person.

Property management and repair work, which generally involves maintaining sanitary and safety conditions is permissible. Additionally, many other aspects of the real estate industry can continue to occur without in-person contact, including documentation and signing, and in many circumstances, closings. Other activities may also be managed remotely, though there may be some difficulties.”

Impact on MLS Statuses, Showing Instructions and DOM

In light of the Governor’s order on March 19, 2020, it would be appropriate for the MLS listing status to be changed by the listing agent to hold or withdraw— but if the listing agreement is still in effect, one would not select cancelled.

Also, it would be reasonable under the circumstances, if so desired, for an MLS in its discretion to alter its usual showing instructions and/or DOM approach, either by taking a unilateral approach systematically in the MLS or simply to offer participants the option to alter their status designation into a field that suspends the clock, ex: hold or the like in one’s system. An MLS could also decide to make no changes to its offerings because it’s a given that all California listings are subject to this same order of March 19, 2020, such that those active during this time would be assessed in the same light.

If an MLS does alter or suspend the DOM, keep in mind, however, portals like Zillow, Realtor.com and others that also calculate their own DOM might not be changing their DOM calculations. That raises the concern of having two differing, publicly available DOM sources, possibly causing the buying public to lose confidence in the MLS reporting and/or creating potential liability situations for agents for inaccurate reporting. Thus, if an MLS does decide to pause the DOM calculations, best practice would be to keep measuring things both ways so that future evaluation of this current marketplace will be possible. When this is all over, it will still be important to keep an accurate tracking of what happened, so even if the DOM clock stops, the CDOM clock should keep going so the total picture is still there.

Also, the following Inman article may be of interest regarding what some other MLSs are doing: We Talked To 21 Multiple Listing Services About Their Coronavirus Preparations. Here's What They Said - Inman

Based on that which is set forth above, the MLS has various options to consider depending on what works best locally and within the fields and functionality of its system.

Disclosure of Potential COVID 19 Exposure

What to do if an agent learns that a visitor to the property, including potentially another agent, tested positive to COVID 19 — is disclosure required or recommended?

This information would be material to anyone at risk for potential exposure but raises the question of whether it’s a property concern or a people concern. Is the concern that the property site itself might have been or is contaminated? Or is the risk of having been around a particular person? And was this person on or offsite from the property?

Legally, known material conditions related to the property should be disclosed. Per the CDC, it’s possible the virus can spread from contact with infected surfaces or objects on a property, meaning a person could get COVID-19 by touching a surface or object that has the virus on it and then touching their own mouth, nose, or possibly their eyes, but this is not thought to be the main way the virus spreads. However, the more relevant aspect to potential exposure pertains to the timing of contact with the property and the infected person and any others who came for a period thereafter. This is not purely or a per-se property condition. But to be on the safe side, a disclosure could be made. Disclosing through the MLS would not be the most effective way to communicate this information because (a) no further showings should be ongoing under the order of March 19, 2020, and (b) the concern at issue is backward-oriented and person-focused (and not a permanent property condition) for those potential visitors and/or agents identifiable from lockbox or other records as having been at the property during that time period with the exposed person. Notice could then be given in a targeted way.

If making a disclosure, it should be done in a generic way so as not to invade privacy or implicate personal information. This would mean not using names but a general description along the line of “a visitor to the property on Xdate has tested positive for COVID 19.”

The CDC provides the following notice advice in the employment context — albeit it’s not an apples to apples comparison for the fact pattern described above, but it could be looked to for guidance: If an employee is confirmed to have COVID-19, employers should inform fellow employees of their possible exposure to COVID-19 in the workplace but maintain confidentiality as required by the Americans with Disabilities Act (ADA). Employees exposed to a coworker with confirmed COVID-19 should refer to CDC guidance for how to conduct a risk assessment of their potential exposure.

I am starting to think we may not see too much of a discount in Bay Area properties. I may not want to wait to end of year. Maybe better to start earlier to beat the crowd.

RE is sticky. I may be very wrong, what I see in past behavior,

-

hardly drop for x number of months, - I think we are here. There is a stress point where it will do the next phase. If stock market recovers before that, resume rally.

-

then sudden drop by a large percentage,

-

increasingly slow decline,

-

bottom.

I feel like I’m seeing softening and it’s only been two weeks since the SHTF. The houses selling now were in contract before the market drop so aren’t a meaningful indicator. There are three houses in the area I’m interesting in, all reasonably priced by late February standards but sitting now for >30 days.

Check out this one:

https://www.redfin.com/CA/Burlingame/3035-Canyon-Rd-94010/home/1304521

Weird, but enormous. Au pair unit. Garage space for 5 cars. Three story wine cave. I thought it would go for over 4. Sitting…

more and more back on market from contract… did you guy seeing this trend?

We’re backing out of ours. Talked to a lawyer and he said he’s had 10 people call him in last few days wanting to get out of contracts…

I see the potential for a huge drop. Contracts are being canceled and closing are failing due to cold feet and to lack of staff at loan companies title companies and even recorder offices.

The RE market is not immune from this economic crisis and it could be years before recovering.

This is the black swan event we all feared.

If not over in 8 weeks we will see a severe recession or even a depression. There needs to be extraordinary leadership. Not likely from Trump or Biden.

I just thought sellers can always wait it out. What do people expect? 10% down?