I don’t have income from flipping, don’t intend to sell S&P/ AAPL/ rentals or re-balance stock portfolio. AAPL dividends + rents are directed towards buying SFHs for rent. Where do I get funds to buy TQQQ? I am thinking of using a little margin off AAPL holdings. So I need to be careful, if in doubt, do nothing. I am not changing my carefully thought out strategy of asset allocation/ strategic investment approach, just want to do a little “gambling”. That is, I can read, watch, blog and debate but don’t have to act.

It is not about income or investing money. Even if you have 1M extra cash, you are looking answer from outside world for your purchase.

You want confirmation from Jim Cramer, Cathie wood or Puru or Mark Minervini. This shows you do not have confidence to pull yourself.

When you buy AAPL, do you expect an answer from outside from Jim Cramer, Cathie wood or Puru or Mark Minervini? No, right as you closely watch AAPL price and you know what is deep discount price.

You have to have similar confidence, with the market or indexes, on your own. This is not for you alone, for everyone.

Unless investor believe his/her own decision, there is no way to grow money other than random luck.

BTW: I do not want to update any more today. I stop.

Unless investor believe his/her own decision, there is no way to grow money other than random luck.

I want to ‘gamble’ not invest so need plenty of luck. Not obvious? After so many years of interaction?

I am not changing my carefully thought out strategy of asset allocation/ strategic investment approach, just want to do a little “gambling”.

My asset allocation/ strategic investment strategy is…

以不变应万变

No change to deal with all changes since have already considered all possibilities when crafting a strategy.

Jim Cramer, Cathie wood or Puru or Mark Minervini?

I am too lazy to follow macro news in detail. Easier to read their opinions. That is, instead of spending 24hrs to read, only need few minutes to watch and listen. Guess we have different personality, I like to listen to other’s opinions. I don’t use a judge’s perspective or assess the benefits I can get.

I would only buy TQQQ for long hold if there is a crash.

Bought 1st tranche: 500 TQQQ

QQQ might have bottomed.

Conservative conditions for confirmation would take awhile. So, slowly scale in.

Can’t be aggressive here… Mar also looked like a bottom but no confirmation… RSI didn’t cross above 50, MACD didn’t cross above signal and price dropped back below the cloud and 52-week EMA.

Leaders need to emerge for the market to recover. That’s always the key. The leaders will have much bigger gains than the overall market.

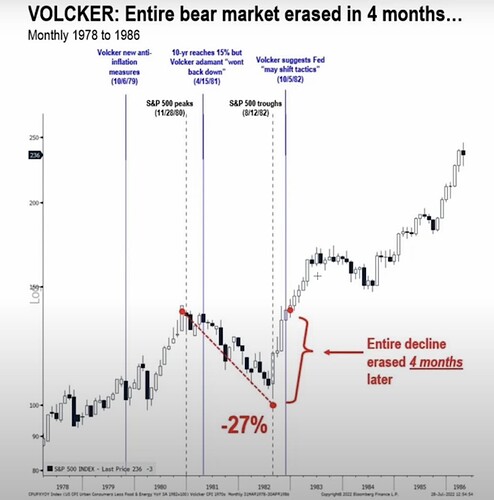

Volcker’s bear market’s decline was erased 4 months from Fed U-turn. Could same happen to the bear market started from Nov 2021 (Feb 2021 for high growth stocks)? That is, new ATH for S&P before end of 2022. Assuming that Jul Fed mtg is a Fed U-Turn.

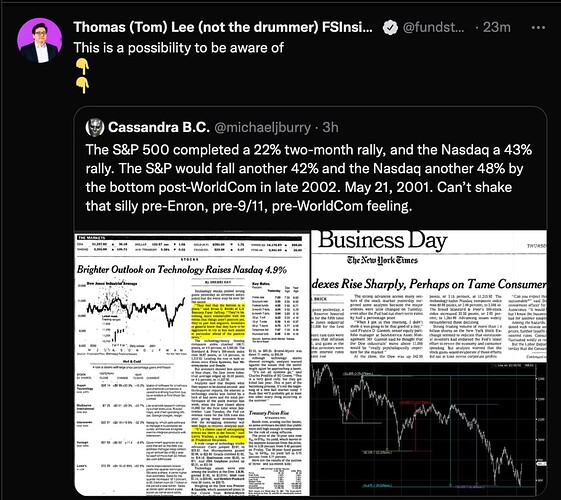

This Elliottician has a bearish count. Bold call. Is he right or Tom Lee is right? Ofc, we don’t want to know that at the end of the year. We want to know asap.

Daily chart of QQQ.

Only bearish indicator is daily RSI is overbought.

Cloud bullish. Price above cloud.

ADX bullish. ADX up trending while DI+ is above DI-.

MACD bullish. MACD above signal and above zero.

Price action:

Above $330 = ecstatic

Below $308 = worried

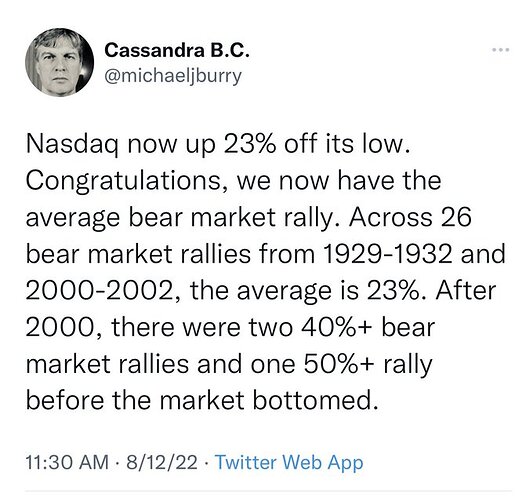

I presume Michael is referring to S&P. What I do know is, you don’t know it is a bear rally till the previous bottom is taken. Similarly, you don’t know is a new bull market until a new ATH is established.

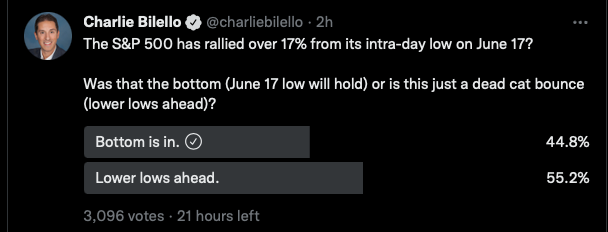

Majority of retail investors are usually wrong. Contrarian take is bottom is in.

The thing I don’t get about people like him is what is his plan? Is he mad he’s missed this rally, so he’s trying to convince himself it’s a bear market rally?

It seems silly to sit out and miss this run. Why not trade it and use stops in case it’s a bear market rally? I see a lot of people talking about market drops across multiple asset classes. It’s exceptionally rare to see someone actually articulate how they are positioned to take profit off it. It’s people who are waiting and hoping they’ll again see prices they missed last time. People who are always waiting for a big decline are just bitter losers.

Price memory holds people back. They remember a few months ago when the market was lower. They didn’t buy and regret it. Now price memory is convincing them to wait for those levels again. They won’t buy them either. They’ll be waiting for 10% more.

Adam is in the camp of once market (S&P) has retraced more than 50% of the decline means market has bottomed. He also touched on some TA, time on the market trumps over timing the market#, merits of investing immediately*#.

*His example of DCA is faulty. DCA requires you to invest immediately too ![]() whenever your pay check arrived.

whenever your pay check arrived.

#Also note that this axioms only work on broad based index and blue chips (as long as they remained as such).

Yet another call that market has bottomed.

Please note that market tends to front-run fundamentals by 6-9 months. Assuming market bottoms in mid Jun, market is expecting Fed to U-turn in Q1 2023.

I don’t think it needs a fed u-turn. It just needs the fed to stop raising rates. It doesn’t need to start cutting them.

.

Btw, from here, it is highly possible that TQQQ would outperform most “high growth” stocks for many years.

QQQ thus TQQQ bottoms on Jun 16, 2022. Seven stocks RBLX U COIN NET TEAM CLFT TTD outperform TQQQ since Jun 16. Tracking them for 3 years. See whether they can still outperform for that long. My belief is TQQQ would eventually overtake.

Disclosure: Own RBLX U COIN NET, no TEAM, no CFLT, no TTD. Ofc, own TQQQ ![]() Must own TQQQ in a bull market, ofc if it is a bear market rally then

Must own TQQQ in a bull market, ofc if it is a bear market rally then ![]()

10 days ago…

Price action:

Above $330 = ecstatic

Below $308 = worried

Ecstatic ![]() However, I can see a pullback next week, might push up a little more first. If pullback below the cloud, bull run is suspect. Below is the daily chart of QQQ. All TA are indicating uptrend. My current view is:

However, I can see a pullback next week, might push up a little more first. If pullback below the cloud, bull run is suspect. Below is the daily chart of QQQ. All TA are indicating uptrend. My current view is:

Multi-year uptrend ![]() obvious

obvious

Multi-month uptrend

Multi-week uptrend ![]() obvious

obvious

For those astute, you would realize ADX didn’t indicate uptrend and price couldn’t stay above the cloud during the Mar counter-trend. Wasn’t paying attention to QQQ chart then… watch too much TV serials… now that I reduce watching significantly, got time to look at charts more deeply.

Below is the weekly chart of QQQ. QQQ is trading above the stage analysis 40-week EMA yet QQQ is still below weekly cloud. So weekly cloud lags? Weekly MACD is also below zero, another lag indicator?

The thing I don’t get about people like him is what is his plan? Is he mad he’s missed this rally, so he’s trying to convince himself it’s a bear market rally?

It seems silly to sit out and miss this run. Why not trade it and use stops in case it’s a bear market rally?

Here is the issue: It depends on their situation.

For those who has low investment, like says less than 2M, easy to sell and buy, trade, switch based on market conditions.

Anyone has considerable amount of investment, say 10M or more and less than 100M, other than insiders such as Pelosi Husband or similar, it is not easy decision to trade as and when market changes. Anyone above this amount, still harder to trade, harder to manage. Most of them spot some dip and DCA, and look for long term investment.

You see how many time Jim Cramer or Cathie Wood or Warren Buffet falters.

They will expect economic confirmation than market changes.

Second, market will run upside as long as every one is skeptical. When all are comfortable in putting their money, it will show the real face ! That is fun with stocks !