50% rule haven’t failed for 50 years ![]()

Don’t short the market. Look like an extended third wave.

Using hourly chart, preferred count of QQQ, is more bullish than what I see in daily chart.

I check a few EW rules, the preferred way should be to count the uptrend from mid Jun to be wave (1)(2)(3) of an impulse. Somehow, many Elliotticians in fin twit count as zigzag (a)(b)(c). I suspect they are not using purely EWT.

Please includes a note stating that the comment applies to broad based index like S&P (SPY) and Nasdaq100 (QQQ) only. For strong fundamentals (means you need to do DD) stocks, need monitoring (sorry, need to spend time and effort).

Wondering why so many Elliotticians are still counting the bottom from mid Jun as zigzag abc. The convention is to count the pattern as in impulse (currently in wave iii) once the length from wave ii (not wave b) is longer than 1.618xwave i (not wave a). See chart of VOO (Vanguard version of S&P) below.

That’s why the indexed annuities and life insurance policies are awful. You don’t get the dividends. Some even cap your annual gains. My mom almost bought an indexed annuity with a cap of 6%. That’s INSANE.

The log scale is sneaky. It makes the results appear closer than they actually are.

What if run did not go further? I am still suspecting this is going like 2008-2009, compare it.

You are thinking this is bullish wave, they are thinking still bear run is not over. I have also mentioned this run is a kind of cheating bull run (I said enjoy bull run, but never trust this run).

Watch closely the 10Y-3M yield (as of today 0.17%), When FED raises anywhere 0.50 to 1% rate hike, it may very likely invert, then you know B-C happens.

Posted only for discussion purpose. All these are guess work, everything can go wrong.

Should follow convention. Not think and then label.

Did you notice 50-day SMA is above 200-day SMA?

What if this is the peak and market turning down?

This will happen when sma50 > sma200.

Not expert of EW. EW is not properly defined.

One person can say wave1 and another can say wave3 etc, totally confusing .

Same thing happens here, your assumption and others assumptions did not get along.

But seeing pre-market, looks like reversal on the way.

It may be B-C now ( I am not EW expert).

.

Don’t use assumptions, use rules.

There are price points to change from one count to another. For QQQ, below 300. For S&P, below 4000.

Using VOO 2h price chart, added pitchfork and retracement from $396.69. If declines below red line, switch count. Price is far above that red line and is traveling nicely within the pitchfork so have to assume is still in wave iii. Break below lower channel of pitchfork is wave iv. Break further below red line then change count.

Finally, making money and interpreting EW picture are two different activities ![]()

Like many, I just follow S&P only for reference for market purposes.

Reg pitchfork, it is just a drawing, market always winding way like waves.

Anyway, with all thumb rules, EW rules ( very open not really a standard as there is no clear cut defined way), it is hard to measure day to day market moves.

.

Some refer to them as guidelines ![]() One of the issue is what price to use… say, daily chart, use closing price? day hi and day lo? volume weighted price? include PM and AH? I notice many Elliotticians use closing price just like other TA. I prefer to use day hi and day lo, and include PM and AH prices.

One of the issue is what price to use… say, daily chart, use closing price? day hi and day lo? volume weighted price? include PM and AH? I notice many Elliotticians use closing price just like other TA. I prefer to use day hi and day lo, and include PM and AH prices.

Also gap up and down can confuse the picture big time because many waves disappear. So may have three-waves impulse (strict EW rule is impulse must have five waves).

2h price chart of QQQ as per yesterday (didn’t update today, just imaged).

QQQ is in minor degree wave (4) of intermediate degree wave iii. Short writing, wave iii.(4).

If below red line, then back to drawing board. Notice wave (4) break below the pitch fork.

EW is really confusing and there is no clarity like TA,

Long back when you introduced EW, read it, but unable to program it with out clarity.

The rules are very vague and can be interpreted anyway by the investor.

Master WU also follows EW and again same vague interpretation.

Completely came out of it. Above all, stock market is always behaves crazily and media gives only running commentary, hard to master that art.

Simple go along with fed as they are funding the whole country by printing or revoking the money flow.

That is why, I never believe media, but spend time with FED conferences!

.

That is why the simple stage analysis is becoming very popular.

For trading, simple S/R lines are easier to use.

Liquidity ![]() drives the market. So need to know what Fed is doing.

drives the market. So need to know what Fed is doing.

I have thought about programming it too. Too complicated to do so. I think you have read the general guidelines and not the detailed EW rules.

I read almost few chapters and finally came to know it won’t work for programmatically.

AIV was kicked out of S&P to make way for TSLA. Thought I would make more $$$ because of the 2.4% weightage of TSLA in S&P. Wrong. Ended up make less $$$.

Inclusion of S&P reduces volatility and increases stability as multiple index funds and 1000s of S&P based funds buys & sells TSLA when market fluctuates. Similarly, TSLA can not go up faster without pulling the S&P up.

Few days before some one quoted TSLA may reach $800 (you shared that post), that will only happen when index also dips to that level equally.

Here is the biggest challenge for Buffet (conundrum) ! By being part of top S&P fund, he has to choose a company to invest which grows faster than S&P for slight changes of S&P.

Simply, he is sitting in S&P car and wants to go faster than his car!

He waits for big correction, last S&P 20%, to grab AAPL, or go for S&P 118th position OXY (this can grow faster for a small change in S&P) with Biden embargo to Russian oil. Now, he is ready to buy 50% stake!

Watching the paint dry.

Today. Break below low channel of pitchfork, so is in wave iv. If below red line, switch to zigzag i.e. i-ii-iii becomes abc.

3 days ago.

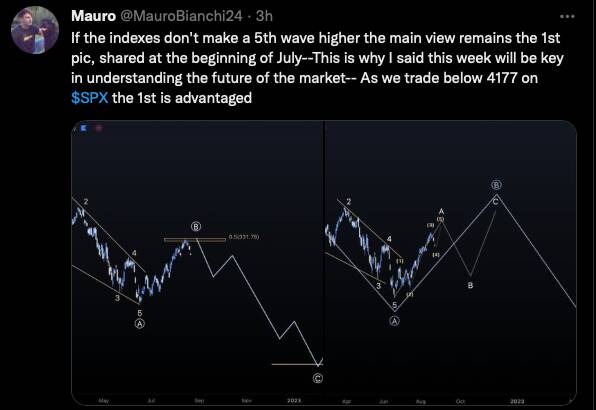

Mauro has a valid alternate count (right). It means in a larger degree, likely Cycle degree, wave IV.