Longest bear for 75 years. No wonder it felt so bad and people still in disbelief we finally came out of it.

I saw someone comparing the current period with 1995 when Netscape IPO’ed. The narrative back then was that the web browser was going to change the world. Now the narrative is AI is going to change the world.

The strong narrative will drive a ton of FOMO just like what Netscape did back in 1995. We will see insane valuations getting even more insane. From Netscape in 1995 to Pets.com IPO in 2000 there were 5 years of absolute insaneness. Maybe we will see something similar?

Oh we also have VR making a come back. And don’t forget crypto. Even tho it’s in the toilet right now maybe its narrative will change and suddenly people think it has something to do with AI?

Because everything has something to do with AI in a mindless gold rush.

.

Who is the clown? You can say that for Solar, EV, crypto, cloud computing, etc. If we characterize 1995 as Web 1.0, Web 2.0 is ![]() . AI has been around for many decades, about 10 years, much talk about AI… characterize it as AI 1.0, now we are in AI 2.0. Btw, solar 1.0 is also shit, I still own a solar stock acquired during 1.0, because of that I refuse to buy solar 2.0 stock, ENPH! Just for info, cloud computing 1.0 is not called cloud computing, forgot the name…

. AI has been around for many decades, about 10 years, much talk about AI… characterize it as AI 1.0, now we are in AI 2.0. Btw, solar 1.0 is also shit, I still own a solar stock acquired during 1.0, because of that I refuse to buy solar 2.0 stock, ENPH! Just for info, cloud computing 1.0 is not called cloud computing, forgot the name…

It is a matter of degree. Ask someone not as online as us here. Maybe ask your wife. Does she know about Web2.0? Now ask ordinary people whether they heard of chatGPT.

For a narrative to get extra strong it needs to have extra wide acceptance.

Presumptions ![]()

Do the experiment and report back. Has your wife heard of Solar 1.0? I didn’t even know such a term exists until you brought it up.

She knows because I told her ![]() Solar? I cooked it up for illustration. I knew about solar when I was an undergrad. One of my friend’s 4th year project has something to do with solar. Mine is to do with digital music (Creative stole my idea

Solar? I cooked it up for illustration. I knew about solar when I was an undergrad. One of my friend’s 4th year project has something to do with solar. Mine is to do with digital music (Creative stole my idea ![]() ).

).

Anyway we are due a big bubble the size of dot com. I am betting AI is going to give us one. It also fits the secular bull market timeline. The burst of the AI bubble 5 years later is going to end the secular bull and push us into a secular bear.

BTW the right way to count the start of secular bull is when it exceeded the last peak. So the current secular bull market started in 2013, not 2009. We are 10 years in.

.

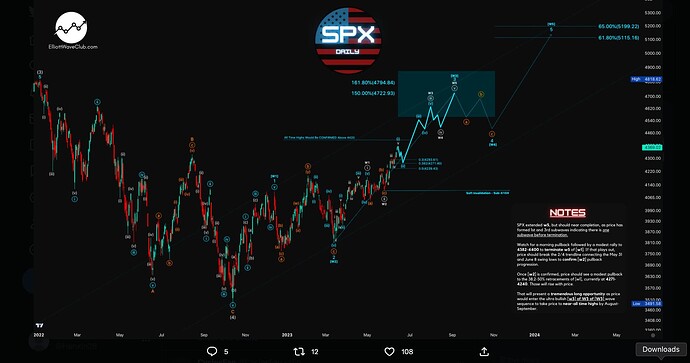

This is not the EWT way. The start of the bullish impulse is Oct 12, 2022.

As investors, we want to buy in 2009, not 2013.

Face Ripper uses EWT?

Knox uses EWT and he’s a pretty big bear.

Face Ripper’s preferred count = Knox’s alternative count

Knox’s preferred count = Face Ripper’s alternative count

The Black Swan is coming. Once evaluated, next would be bombing of TSM factories. Global economy would dive into Depression and stock market would enter a secular bear market. Need close monitoring… need to sell all stocks and buy… bitcoin? There is a reason why some whales are bearish… they won’t talk about the black swan in public, watch their action, not their talks. BRK/B has unloaded TSM, watch their holdings in AAPL and CM’s holdings in BABA.

You are even more bullish than face ripper.

Are you the ass ripper?

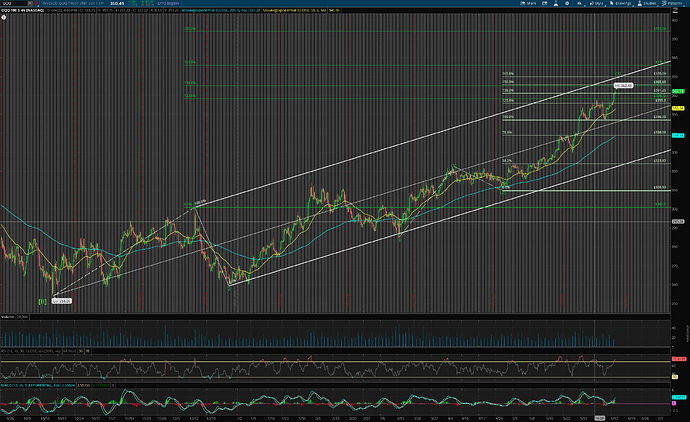

No idea of his view of QQQ. Didn’t follow him that closely. Only look at his post whenever it pops up in my twitter feed. Cycle degree impulse means many significant correction of Primary degree (multi-month) ![]()

.

I think the random Elliottician is more bullish than Face Ripper. His/ her peak target is ~5200 before another bear market strikes.

Two correction ~4800 and ~5200. Other pull backs are consolidation kind.

Consolidation: less than 10% decline from ATH

Correction: more than 10% but less than 20% decline

Bear market: More than 20% decline

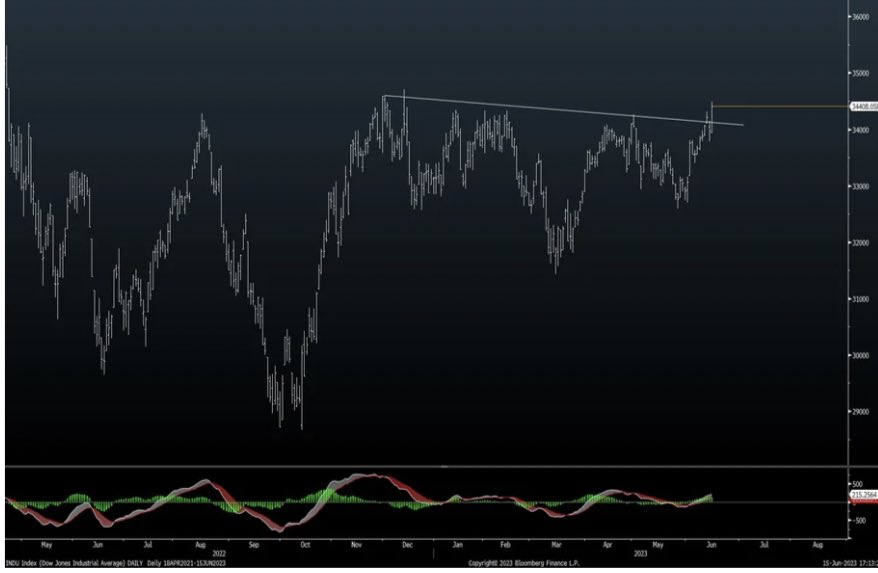

Face Ripper’s head TA guy:

The DJIA’s pattern “resembles a reverse Head and Shoulders pattern and is quite bullish technically speaking … I do feel that a rally back to new all-time highs is likely for ‘the Dow’ this year.”