Death rate lags case rate by 3+ weeks

The positivity rate is absolutely blowing up in the north central states. I generated my own plots and have the y-axis cutoff at 40%, and the curves are blowing past it!

Just look at the graphs. Before at ~30k daily cases we had 60k hospitalized. Now we have 4x more daily cases and the same hospitalized. I’ve only seen age data through August, but the median age of people testing positive has been dropping consistently. The elderly are isolating, and the younger people are getting on with their lives. That’s how we have 4x more positives, but the same number of hospitalizations. Deaths will be lower as a percent of total cases, since its younger people who are far less likely to die.

Weather is getting colder and people are moving indoor. The coming thanksgiving holidays will have crazy number of superspreader events all over the country.

That makes sense. It spreads much easier indoors, and people spend more time indoors when outside temps are very high or very low.

Time to go on vacation in Australia

Trying to wrap my head around market direction with covid potentially raging much higher than now in a few weeks.

- Nationwide lockdown unlikely with Trump until mid January.

- State level lockdown very likely for blue states

- No stimulus until Jan or Feb

- Election uncertainty until mid Dec

- Many small businesses make up huge part of the revenue toward end of the year…not good.

It does not sound good but market doesn’t seem to care.

2 week quarantine when you enter the country, and mandatory masks. and their lockdowns are real hard lockdowns. Think you can manage it?

I am looking forward to the ski season. Don’t plan on flying for a long time. Could drive to Mexico. My friend in Cabo says things are ok there.

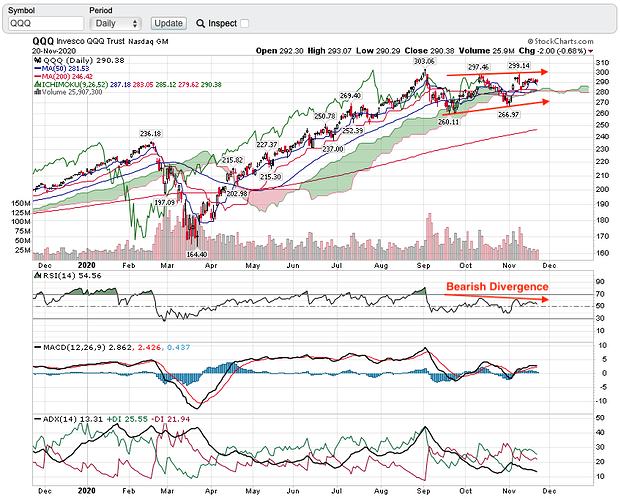

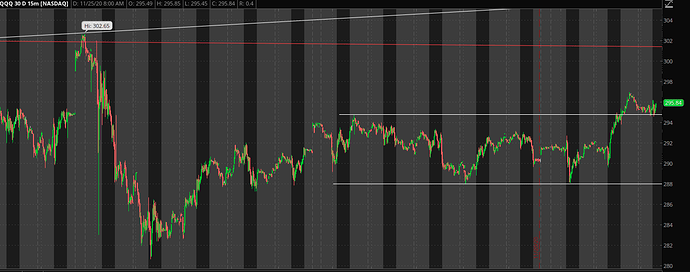

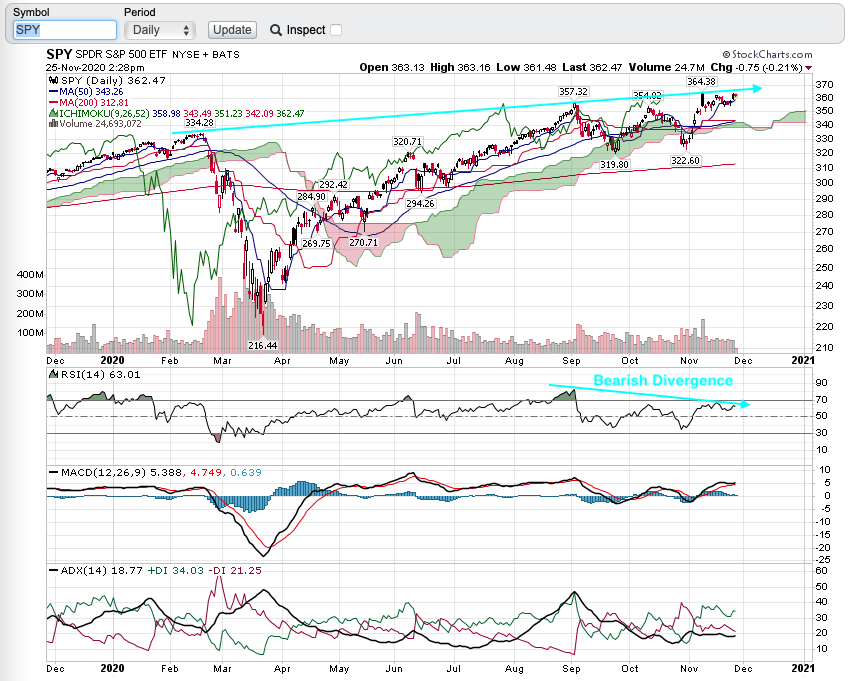

From daily chart, QQQ is resolving the bearish divergence. Not sure whether it has completed or not. If not resolve, can drop as low as 255 ![]() (if lower trend channel line doesn’t hold). Anyhoo, I didn’t close my TQQQ/ QQQ trading position, merely cut down to 30% of previous position.

(if lower trend channel line doesn’t hold). Anyhoo, I didn’t close my TQQQ/ QQQ trading position, merely cut down to 30% of previous position.

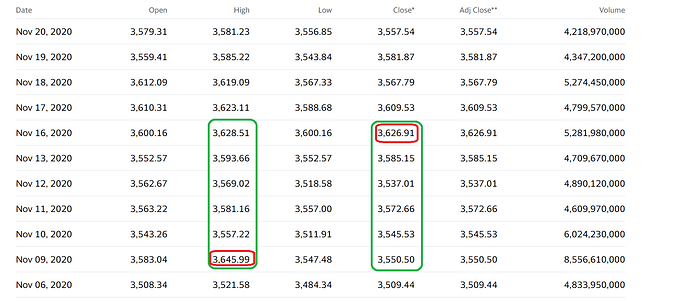

QQQ peaked on Nov 09 ![]() same day as GSPC at 3645.99 (how come you said is 3627 on Nov 16?).

same day as GSPC at 3645.99 (how come you said is 3627 on Nov 16?).

You are looking at peak (high) price in a day, while my calculations are based on daily close price.

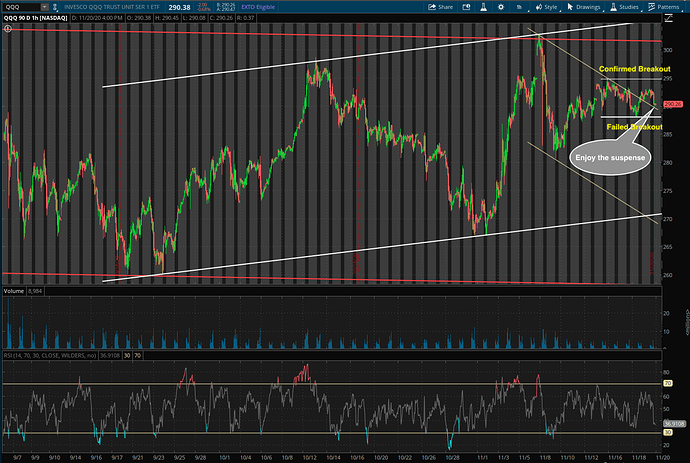

Still indeterminate ![]() Btw, upper downtrend channel was tested (resistance turned support) twice

Btw, upper downtrend channel was tested (resistance turned support) twice ![]()

Bot 3 QQQ weekly calls ($295) for a quick multi-day trade ![]() Just lunch money.

Just lunch money.

However, Hussman’s recent returns have been less-than-stellar. His Strategic Growth Fund has returned just 2.4% over the last year, putting it in the 47th percentile relative to peers, according to Bloomberg data. And it’s actually declined 1.4% on a three-year basis, putting it in the 23rd percentile.

In a bull market, return of a well diversified investor always fall behind. He will perform better in a bear market. Is debatable he can perform better than a growth investor for a cycle of bull and bear market.

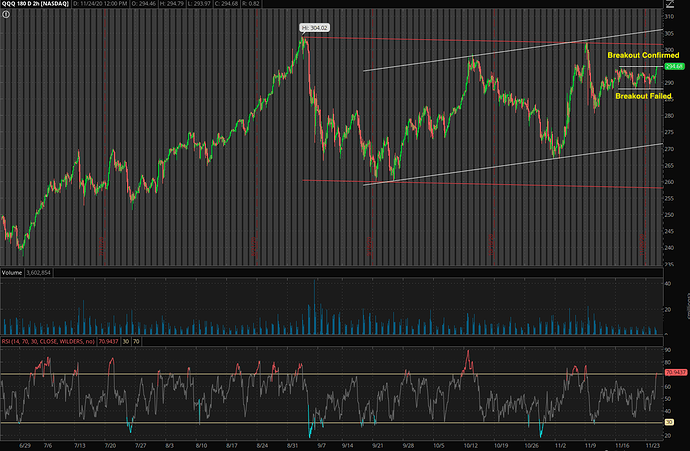

Since 5 days ago when breakout is suspected still yet to be resolved. Still holding 600 TQQQs ![]() betting on breakout.

betting on breakout.

![]()

![]()

![]()

Regrettably I closed ![]() all long QQQ calls and short put (TQQQ) yesterday when it was testing the resistance. Just happy that I hold on to 600 TQQQs

all long QQQ calls and short put (TQQQ) yesterday when it was testing the resistance. Just happy that I hold on to 600 TQQQs ![]()

I opened SPY calls today, UPRO now.

With the way market behaves, looks to be bullish for some more time until I get my next false positive signal !!