yes I see that but how do you identify wave(1). I mean in future?

You need to read up  on basics of EWT. Theory is simple straight lines, reality is plenty of zigzags, so need practice

on basics of EWT. Theory is simple straight lines, reality is plenty of zigzags, so need practice  to be good. Something like learning how to drive

to be good. Something like learning how to drive  need practice.

need practice.

great thanks! I will understand it soon

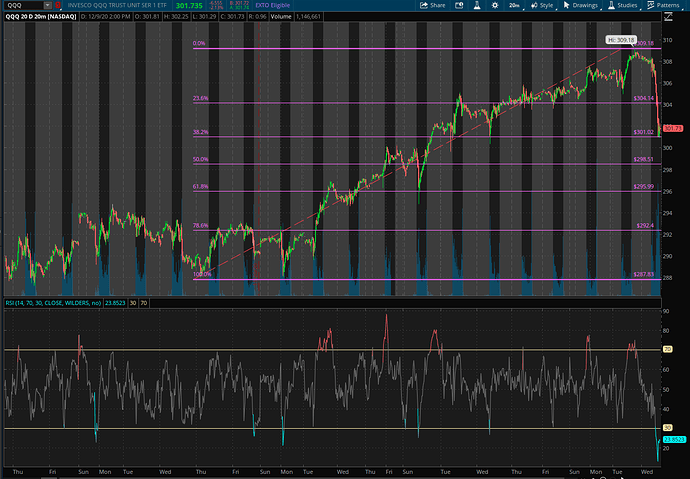

ToS/ Ameritrade platform allows you to plot fib ratios on the price chart. Take note that price has retraced 38.2% of wave (3) which is normally the completion of wave (4). Usually retracement of wave four (generic label) won’t be more than 50%, most common is 23.6%-38.2%.

So I decided to short some TQQQ puts, planning to long some QQQ calls if retrace till 50% line.

Btw, this position is green ![]()

what’s your prediction accuracy using EWT? I am trying to understand, if anyone who understands EWT can time the market?

EWT was developed for currency trading. Overtime traders try it out on stocks. From my experience, EWT works best in highly traded instruments such as QQQ, don’t work well for individual stocks. Remember EWT is about probability, so is good that you have other indicators such as RSI, stochastic, and charting techniques to increase the probability of success.

For example, wave two can retrace from 23.6% to 99% of wave one, is a very wide possibility.

Frost and Pretcher, two wonder boys have used EWT to win many trading tournaments. Frost has passed away and I think Pretcher is not that good. That is how EWT became very popular.

ok got it. thanks! for individual stocks, what would you suggest?

Highly traded stocks such as AAPL  and AMZN

and AMZN

Highly traded so no entities (@Jil favorite banks) can manipulate the price.

I meant similar to EWT, for stocks do you recommend any specific technique with higher winning accuracy?

I use EWT + charting + divergence of price vs RSI.

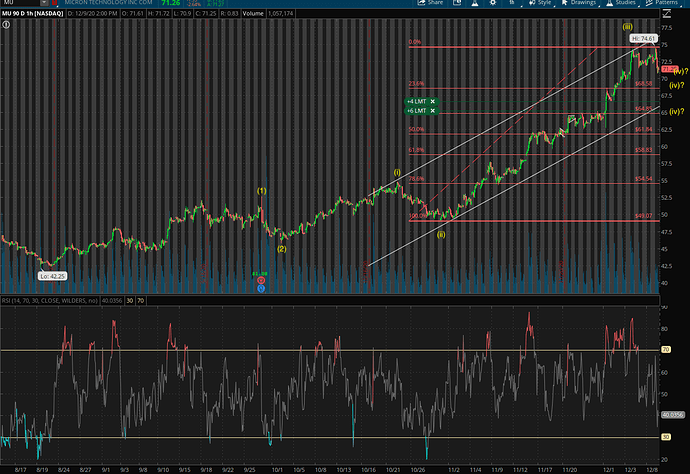

For example, MU,

Notice where I put my GTC purchase? Earlier GTCs are triggered.

I see you put 10 buy orders at fib ratio 38.2%, which I can consider wave(3)?

Guessing where wave (iv) would be completed

The numbering is in wave (3).(iv) i.e. wave (3) has yet to be completed.

I do see tomorrow up day temporarily (only tomorrow).

How did you come up with EWT 309 ceiling and 300 bottom?

No No No…clearly banks/big funds are the culprit for up/down.

I knew Monday market will be down, but yesterday makers fooled with a short down play. I thought today is up day, but I was wrong. It is a learning curve for me.

I have appx 150 spy calls setup for sale tomorrow.

However, I am amazed with your EWT pointing out that QQQ will not exceed 309 today and it will touch 300. How do you calculate with such a precision? This is very essential to know.

This is stunning for me, How?

Ok I will understand EWT and get back to you. Thank you master

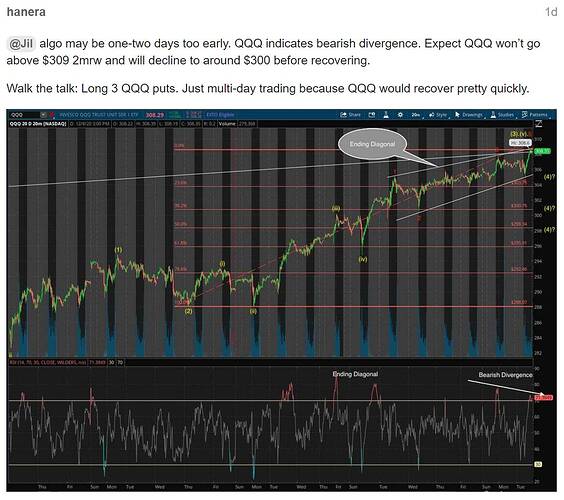

Refer to post 1 hr earlier for $309. I have deleted the channel for clarity. That is use EW + charting.

$300 refer to the next chart (and previous charts). Usually higher degree wave four (i.e. (4)) retrace to lower degree wave four (i.e. (iv). I have detailed labeling of charts in previous posts.

Just started reading Jeff Greenblatt book now. You made me amazing point which I missed Monday.

More than any stock, these theories will work for market indexes like spy or qqq.

Let me read it first and then come back here.

Your yesterday $309 and $300 showed me exactly what I am missing here.

Kudos to you and EWT, I need such precision point of turning !

Recent times, due to low volatility, I am unable to clearly point, may be EWT backfill the gap.

Question: why did not you sell yesterday TQQQ and buy SQQQ (3x short) until retracement completed ?

Still a newbie in trading ![]() You need trading instinct to do what you’re saying. Learn EWT for a long time but didn’t employ it for trading. Since you said I should so I tried. Long ago, I don’t trade, only buy n hold. Learn EWT for fun.

You need trading instinct to do what you’re saying. Learn EWT for a long time but didn’t employ it for trading. Since you said I should so I tried. Long ago, I don’t trade, only buy n hold. Learn EWT for fun.

BTW: Looks to me the slide has started today and will end up turning upside after a wave completes (Is it your fourth wave?).

On any case, tomorrow very likely positive day and we can not help thereafter for next 15-18 days, year end profit taking will kick off !

This is my inference, as no one can clearly tell what will happen in future. What kind of Fib number you expect to drop, 5.57 or 9.02 or 14.29 or 23.61?