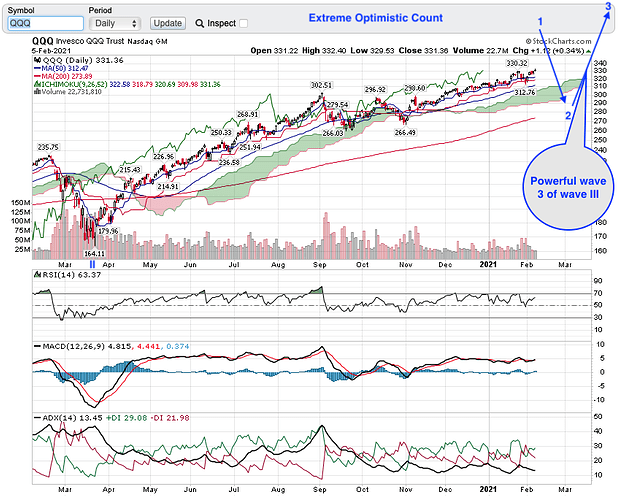

Throwing $800 to train my brain to be able to short ![]() Green already.

Green already.

Is $331.38 completion of (I).V or (I).V.1?

Make your own judgement.

Note: Chart is dated Jan 23. Doesn’t matter, won’t affect interpretation of the EW picture.

I see you didn’t read past posts and just jump in. The chart is cut n paste from a past post.

Remember, I don’t have an almanac, purely guessing just like @jil My interpretation of EW could be 100% wrong. So far, the chart indicates a completion of a five wave impulse (assuming your have some basis of EWT, otherwise, is like telling you a story when you don’t understand alphabet) which could be marked the completion of… in layman’s terms (rather than EWT terms), a bull market from 2009 or a bull rally from Mar 2020. Obviously, if it is the former, is a bear market (index drops more than 20%), the decline would be to very low level, scarily low and over a few years (ofc with bull traps and technical re-bounds along the way). If it is latter, a correction (drop 10-20%), not that bad but could last few months. I know all these seem weird when the economy is supposed to be opening soon and hence things are getting better… haha… stock market roars when things are bad so turn bearish when mainstreet is good is not abnormal behavior.

Yes, I didn’t read the past posts but I have been generally following the EWT that you are @Jil have been talking about. Thanks for the layman’s explanation.

Cool understanding ! Now you see how market behaves after exceeding expected results !!

$381.49 should be iii and last Friday completed v. Refer to the chart below,

So back to the same question, is $388.47 (Last Friday’s HoD) completion of wave (I).V.5.v or wave 1?

Wave 1 is the bullish impulse from $215.52 (Mar 2020), so wave 2 would retrace that impulse.

Wave (I) is the bullish impulse from Mar (roughly, didn’t precisely check) 2009, so wave (II) would retrace that impulse.

Ready for the start of a ferocious drop next week?

Initially can assume is Primary degree wave 2 so long is above $215.52. Going below $215.52, then is SuperCycle degree wave (II).

Did your algo flash deep RED finally? I have bought SQQQs, didn’t buy put yet, may be on Monday. Btw, don’t be so urgent to long TQQQ ![]() It will be awhile before we know is Primary degree wave 2 or SuperCycle degree wave (II).

It will be awhile before we know is Primary degree wave 2 or SuperCycle degree wave (II).

Asking secrets !..Not yet…so far…

My own feeling,not inference from data, bull run ahead next week…(may be wrong, skeptical)

BTW: There may be failures in the past, Market may change suddenly, without me noticing it! Do not take any action based these updates.

So far, wave 5 doesn’t have the feel of a wave five. Normally, appreciation accelerates… now it feels like a wave one ![]() Anyhoo, no harm hedging with SQQQs. In fact, I have closed many positions, with high cash position. Better safe than sorry. Ofc, it could turn out to be just a wave (1) i.e. decline not lower than $380 (1-2 days decline), and rally resumes.

Anyhoo, no harm hedging with SQQQs. In fact, I have closed many positions, with high cash position. Better safe than sorry. Ofc, it could turn out to be just a wave (1) i.e. decline not lower than $380 (1-2 days decline), and rally resumes.

I am also seeing similar one day drops often next few weeks than big drops (even though we never know). The simple waver changes are made by market makers to make profits,

Even if there is big drop, it is going to be like $350 (unlikely now) and not going down deeply like 20% or 30%.

IMO, as long as FED and Treasury are supporting recovery, we do not need to think about any recession.

BTW: Everything here is a guess work which may go wrong.

I never understood why Zillow stock has done so well until I saw this video

![]()

I am not thinking about recession. I am thinking about stock market tumbles ![]() Actually, many beat down stocks because of Covid might be the BEST bet for multi-year HUGE gain. I itching to buy Jim Cramer’s recommendation to buy BA… he has been saying for weeks. Once people get vaccinated, they would travel like mad like no 2mrw. Staying home for so long feel like imprisoned at home for many extroverts.

Actually, many beat down stocks because of Covid might be the BEST bet for multi-year HUGE gain. I itching to buy Jim Cramer’s recommendation to buy BA… he has been saying for weeks. Once people get vaccinated, they would travel like mad like no 2mrw. Staying home for so long feel like imprisoned at home for many extroverts.

I thought you liked staying at home. I love covid19. My wife is afraid to travel. I would be happy to never fly again. A miserable experience . Dehumanizing boring and usually catch a cold every time

For optimists, can select to believe in the extreme optimistic count. Buy TQQQ (25% of your stock portfolio as suggested by @Zeapelido) when QQQ hit 200-day SMA to ride the powerful Primary degree wave 3 of Cycle degree wave III… very high price target!

Should I be pessimistic or optimistic?

Is the glass half empty or half full?

Market cycles, small UPs and Downs are always common. It is the way market works. No one can control market cycles and it is too difficult to find out top and bottom often, many times I missed only to know after the fact !

If we know clearly, we can take benefit out of it which is a rare chance.

Anything corrected by Covid will come back soon. Yes, BA is too good for long term and JC is right, but you should not be disturbed by in between waves. In fact, BA came to $90 level, stayed few days, we should have bought at that time !

What about oil stocks? More travel more oil needed

It is like year 2008 real estate, whatever went down, recovers ! Right from airlines, entertainment, we will recover when normalcy is coming back.

However, stocks are set to go high ahead in future. BA, AAL,LUV,DAL,SAVE, LVS, MGM, AMC,CUK,XOM…everything will revive, but we do not know when they will start picking up.

I just bought CUK, dividend payer, and adding it since $11.08, AMC starting from $2, but went up now. BA and XOM are in monitoring list.