![]()

Interview of King of Valuation, Aswath Damodaran, by a gen-z.

What make a great investor?

Most important… wait for it… LUCK ![]()

![]()

![]()

2nd… have a core philosophy ![]()

Btw, I don’t have a core philosophy, I believe in 鸡犬升天 i.e. follow outstanding leaders.

.

So I am doing the right thing? I like to laze around. Instead of doing DD, I invest in companies with

and can’t be bother with analyzing financial performance or understanding the macro environment.

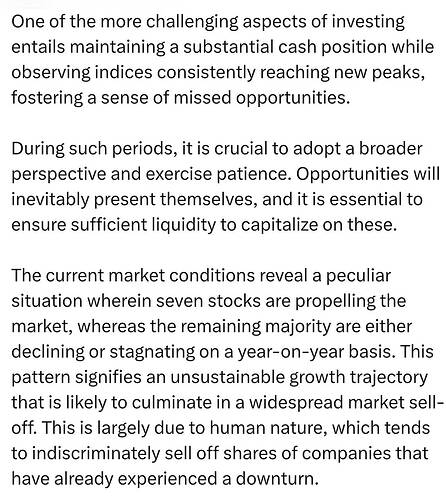

How old is that? It says begin to raise interest rates. We’re way past beginning.

Everyone is talking about a new bull market but we’re basically at the top of a trading range we’ve been stuck in for about 18 months and are now losing steam again. Doesn’t seem bull marketish.

However, if the dollar keeps weakening that should provide some tailwinds for US earnings as more than 40% of S&P earnings come from abroad.

Worldwide. Many governments are still increasing rates. For US, Fed plans to hike 1-2 more this year.

![]()

What are the 7 stocks. And have they topped out?

Right, but they started a LONG time ago now. He makes it sound like we just had our first rate increases.

.

AAPL, NVDA and MSFT have made new ATH in 2023.

I own 5. Not Tesla or Google. Apple has been the best of the bunch… of course timing is everything… probably ripe for a pull back

That’s just the 7 biggest cap tech names.

![]()

FANGMANT less NFLX. JC is boring. What happened to his cow kings and whatever.

Anyway, it shows current environment is unhealthy… the huge behemoths continue to win and win… is FTC sleeping? Thought the beauty of the US system is mom and pop startups can have a shot to be a behemoth.

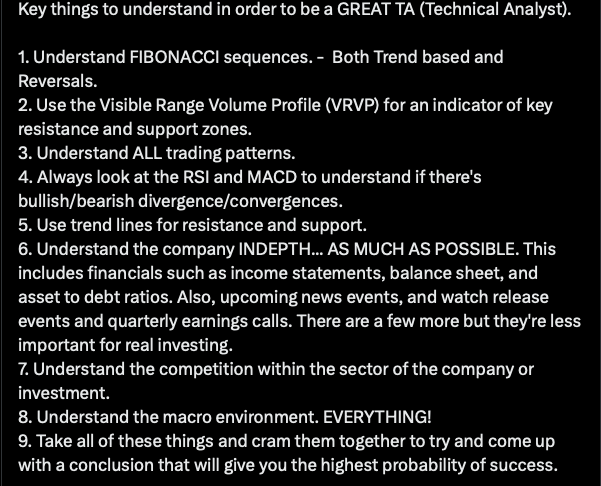

Saw a theory saying every big co CEO has read Christensen’s innovator dilemma book. They all know the danger of disruption and how to disrupt themselves. So all the big techs are not as prone to startup disruption now.

Bain, McKinsey, and BCG all have practices focused on R&D spend. Everyone is looking at R&D spend as a percent of revenue. They do it at a product level, and there’s guidance based on product age, revenue growth rate, and market maturity. The goal is to ramp down spend on the old products or mature markets, then spend more on the next generation of potential hits. The companies that survive beyond a single hit product are really good about doing it.

.

…every big co CEO has read Christensen’s innovator dilemma book…

How come legacy auto companies are being disrupted? Did he mean Big Tech Co CEOs?