Legacy autos have too much inertia with unions and crap. But even GM and Ford are turning around. GM’s self driving tech is much better than supposedly tech co Tesla.

What about banks? Did bank CEOs read too? They are f… slow to adapt. FinTech companies are eating their lunch.

Tomorrow is my birthday. That chart makes me feel like reallocating some liquid reserves.

Lol. SOFI revenue TTM was $1.6M. JPM was $129B. JPM is 80x bigger. WFC was $74B. MS was $50B. GS was $47B. Exactly who is eating whose lunch here? $1.6B of revenue wouldn’t even move the needle for the big banks. Don’t fall for the trap of the hype.

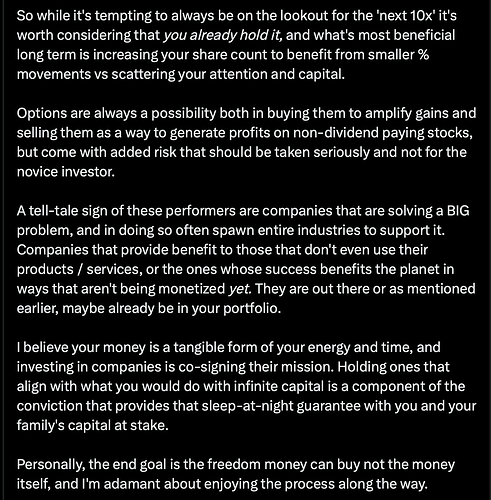

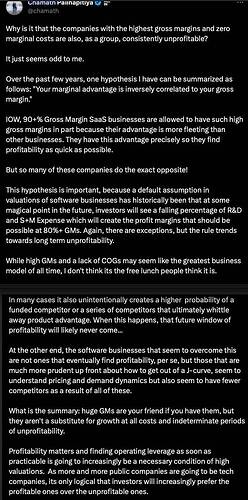

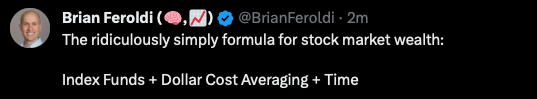

More and more investors/ traders realize is better to focus on a few, ideally one, stocks.

Can start with more (stay diversified) when started investing, but once you got a winner, YOLO. Sell the rest and pump into this winner. Btw, TSLA and NVDA are not the only choices. There are tons of choices now… do your DD… make sure is where you are willing to spend your evenings and weekends to research on that stock. What others find interesting, you may find it boring, so don’t follow other people’s choices.

There is a lot of survivorship bias in this statement. Winners write books and give talks boasting their success. Losers who bet everything on one horse but lost just disappeared. We don’t hear from them ever again. That gives people the impression “bet everything on one” is a sound strategy.

I don’t disagree with focusing on “a few”. The follow up question is how few is a few? But to bet everything on “one” is not very wise I suppose.

.

Note the nuance ![]() no winner no can do.

no winner no can do.

…

Ideally one. Nuance ![]()

Few as in you can reasonably follow closely ![]() Number depends on you. Most say 3-5 . You may be capable of more

Number depends on you. Most say 3-5 . You may be capable of more ![]()

Speaking of nuances, there is a difference between “not trimming your winners” vs “selling everything else and YOLO into that one winner”. Which one are you suggesting people do? And what did you yourself do?

.

I have to repeat myself so many times. SMH. During dotcom bust, I sold everything and dumped into AAPL.

If you have many winners, then focus on those winners. Don’t be 4by2. Be flexible. You want me to draw intestines too?

What would happen if you dumped everything into a loser like Yahoo? It wasn’t apparent at the time yahoo would be a loser. Or that Apple would have a brighter future.

It means have to admit not good in stock picking. Stick to broad based index. Then, is obvious to me Yahoo! is not good. I have Yahoo! during dotcom era. You have forgotten many other conditions are said in the post… those have to be adhered to. Please don’t keep needing me to draw intestines and do all the connections.

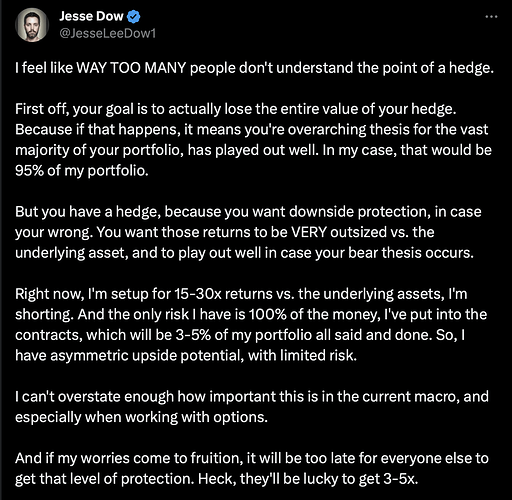

This guy makes 6x his investment Ytd using above approach. The call is very OTM leaps calls, extremely risky but can turn into 10x within 2-3 months.

Jesse is presumptuous. Hedging is essentially trading and requires good timing. You have to recognize the danger of a sharp and disastrous downturn is high before you hedge. Improper timing could lead to losing 5% of the portfolio every time you hedge… can’t sustain too many times 5% drawdowns. IMHO, hedging is appropriate only for astute traders. Is not a good idea for LT investor.

![]()

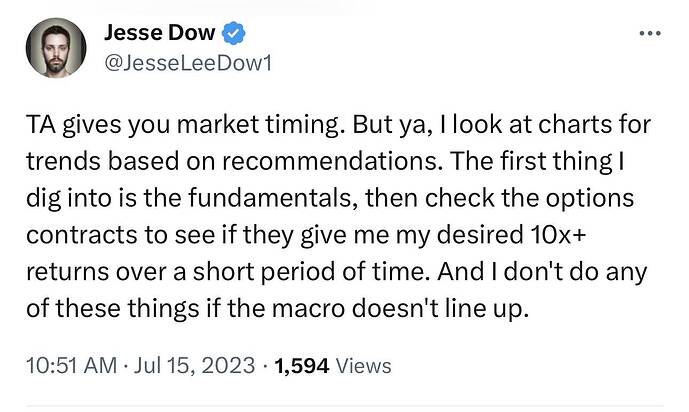

Jesse uses TA and proves to be correct. Does it mean TA trumps FA?

NO.

TA is bearish.

FA, with high interest rate, people can’t afford solar panels so business is bad for solar companies.

However, uber bulls like Vitaly and MeetKevin insist that ENPH is a great buy…

TA and FA trump uber bulls (cultists). This applies to the stock starting with T too.