For those who want reassurance of how to invest… listening to it now, so far is quite basic.

So investing is only for boring people like himself.

.

Is a well documented saying that investing is boring.

Look at BRK, all boring stocks. However recently WB decided to add some hot stocks like NU, guess he is …

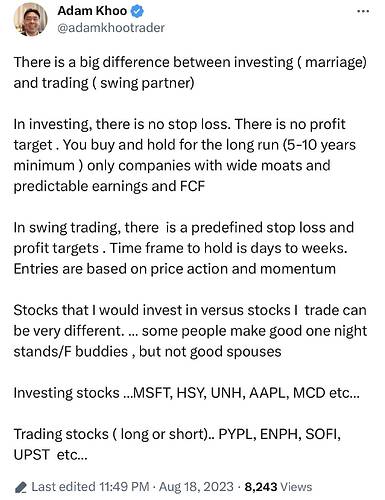

Adam thinks timeframe for investing is 5-10 years, IMHO, should be 20-40+ years. Not many stocks can outperform S&P for this timeframe. Recently some include QQQ and MSCI.

"Anybody who doesn’t change their mind a lot is dramatically underestimating the complexity of the world

Bezos is a couple of wives away from loosing everything. Change can be catastrophic…

Cheaper to keep her.

Uh, I was a loyal to GE shareholder for many years. Look how that turned out.

When I was working, there was “the Big 8” accounting firms with Arthur Anderson being the biggest and oldest. Look how that turned out.

When you are young take risks and embrace change. But the quickest way to get rich is to concentrate on something you know and bet the farm. When you get old invest conservatively until you bought the farm.

What do you think I’m doing?

After all, I am 66 now. Can still enjoy it. But, can’t make it back if things go wrong. ![]()

.

Did you continually assess that GE and these accounting firms are a hold for 5-10 years on a continuous basis?

5-10 years doesn’t mean you invest in say, 2000 and think is a hold that it will still be a hold if you invest in 2008. That is in 2008, you have to think is a hold till 2018 ![]()

For accounting firms, the writing is on the wall … fundamental changes. The problem with many sayings, it assume readers understand the assumptions made and the context of applicability.

.

Oddly I have never bet the farm.

I bought a barren land (for a song) that turn out to be a gold mine ![]()

Of course I assessed my GE hold. But, guess what? By the time you, the retail investor, is aware of any issues, the market has already priced the issues in.

People who believe they can outguess the market, are fooling themselves.

I had no investment in AA. I think you missed the point. This wasn’t about accounting. It was about the integrity of audit firms.

AA went out of business after more than 100 years because they tried to change with times. They tried to be certified auditors as well as business consultants. They certified Enron’s books, among a few others while also consulting. And went from the world’s largest and oldest auditors to out of business in short order.

I can almost guarantee by the way, that they also acted as the auditors for GE at some time.

.

Generally cited by investors but is not true. Usually symptoms appear fairly early. However you have to fully engage in the company and have many ways to monitor, or you can miss them. For most retail investors, they either didn’t do DD or just did once and didn’t bother to continually monitor and re-assess.

…

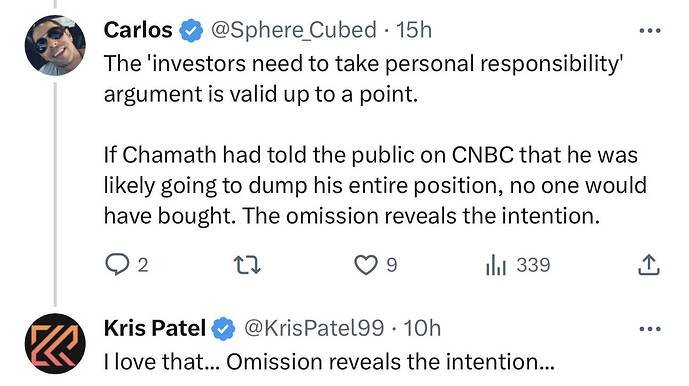

https://twitter.com/KrisPatel99/status/1695231737188503669

Who at fault? Carpet bagger or personal responsibility of investors or both at fault?

Interesting view.

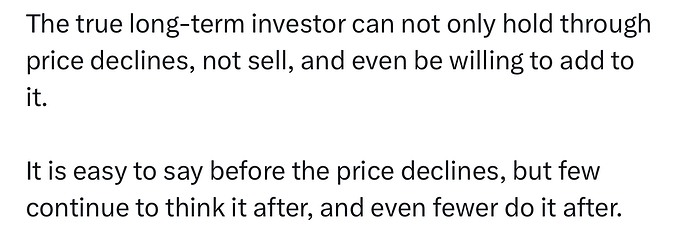

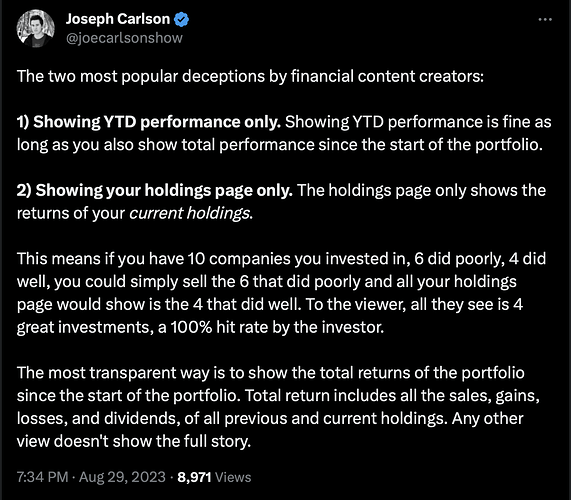

Buy is easy.

Hold is hard ![]()

Only 1-2 times, author is anxious. AAPL did many (lost counts) 50%+ declines from previous ATH since I purchased in 1997. However, I do agree with most of his suggestions. To hold, one need to have deep understanding of the company… leadership calibre, business model, business strategy, product-market fit, supply chain competitiveness, …

What percent of companies actually recover from a 50%+ decline? My guess is not many considering how much turnover there is in the Fortune 500 every 10 years. Everyone is going to think their stock will defy the odds and most will be wrong.

.

Is why the need to have deep understanding of the company. Decline could be temporary or an irrecoverable deterioration of the fundamentals. Ofc is easy to say. Most important element: LUCK. Btw, author suggests holding a few ![]() and only need one to succeed.

and only need one to succeed.

Are sharp decline of DIS, PYPL and INTC temporary or an irrecoverable deterioration of fundamentals?

AMZN, META, GOOG and TSLA. Are they recovering or merely just a re-bounce before the next long decline?

Exactly. Who knows which will recover with a high degree of certainty?