![]()

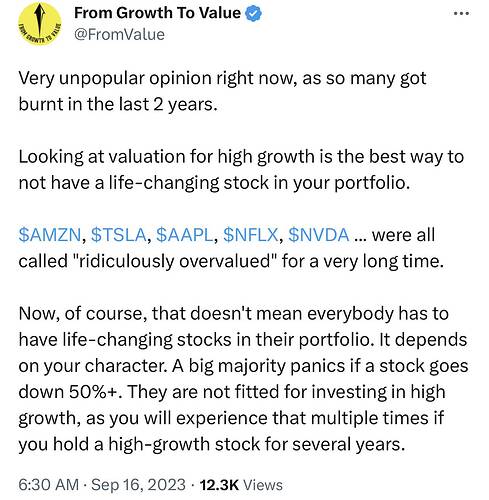

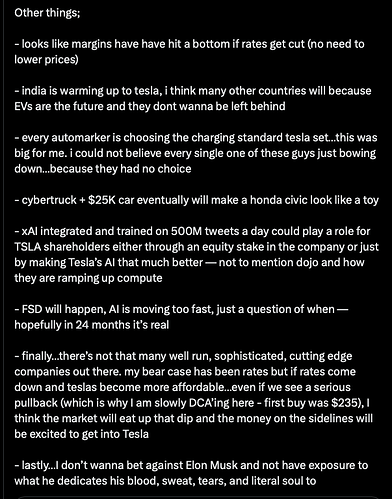

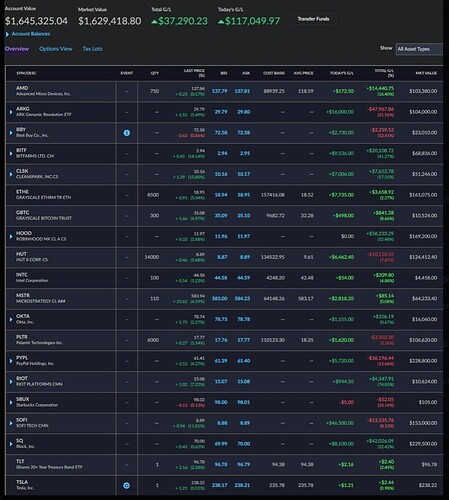

View of an Ex-US champion in trading…

I have PLTR CRWD NVDA SHOP COIN in growth portfolio.

Highest holding: NVDA… very green

2nd highest: SHOP… about breakeven

3rd highest: SQ (not traded by Oliver)… red ![]()

4th highest: COIN… red ![]()

Don’t have much in PLTR and CRWD, both are pretty green.

@manch’s favorite, NET and SNOW, are not mentioned?

Whadup with gold and silver today? Dollar and interest rates are basically flat. I don’t see any major news stories.

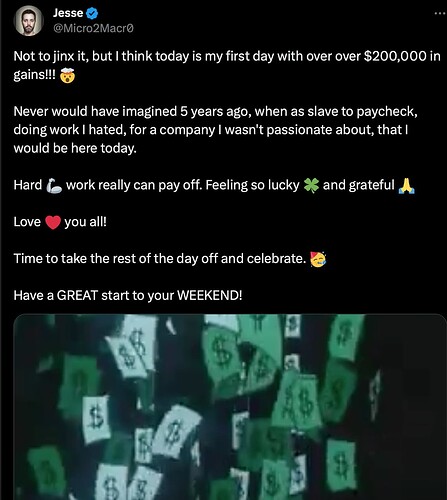

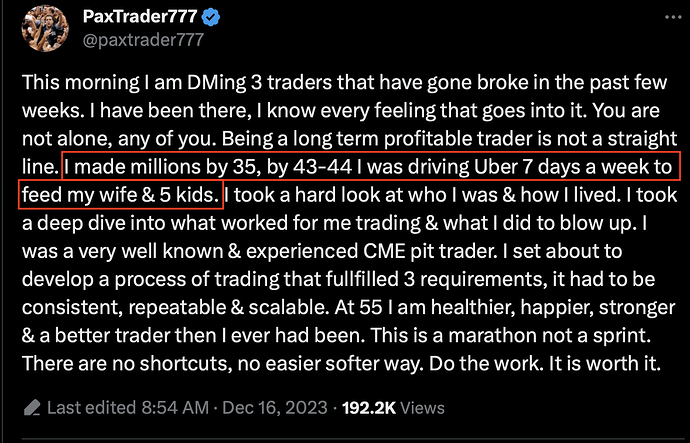

While SFers are discussing which colleges should their children go… a high school dropout has been making banks… he is ~ a $10 millionaire at ~40s. He trades crypto and high risk calls (very OTM calls)… manages to catch the bull market from Oct 2022… so his success story is still young… nevertheless did very well.

Btw, is not difficult to make this type of money trading calls in a day… is just as easy to lose them in a day ![]()

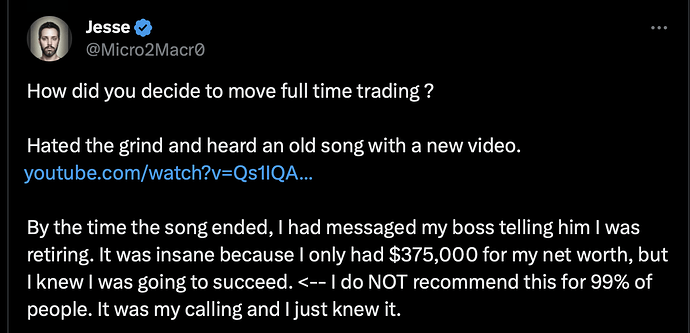

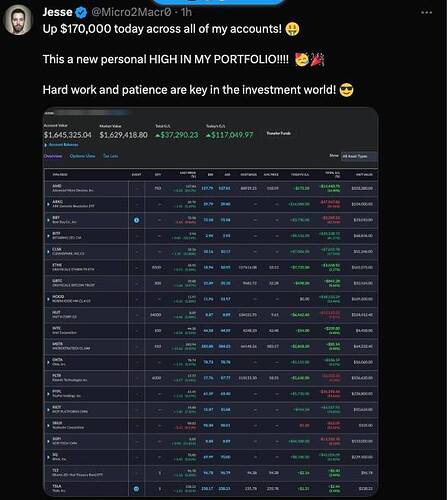

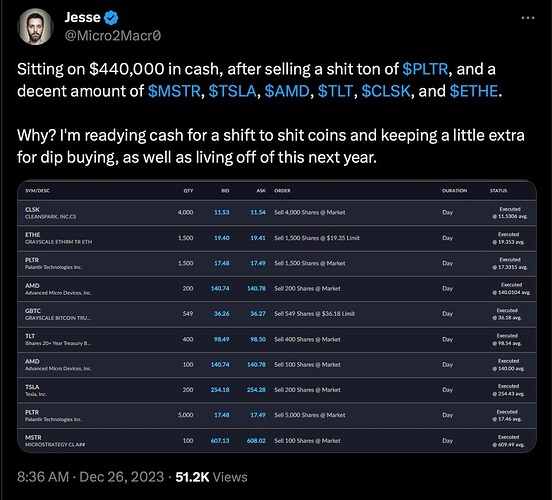

Jesse, the high school dropout, brags again…

Big deal, Jesse. Any Tom, Dick, and Harry can achieve that…

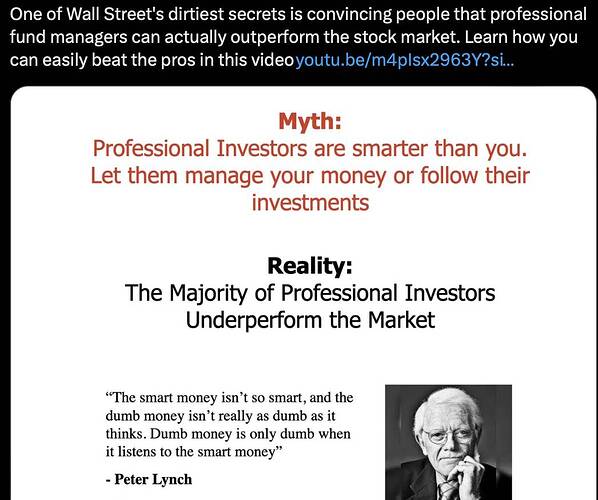

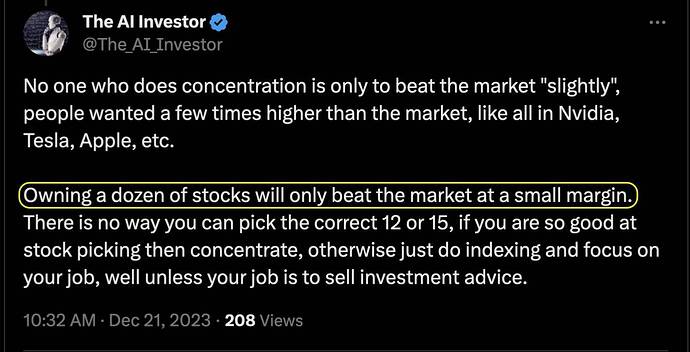

Sound like what I did. From 30+ stocks (about even allocation) to AAPL (at one time AAPL = 99%+ of stock portfolio), S&P index fund/etf and a growth stock portfolio. However, I notice these two Xers keep trimming their winners to buy laggards which is different from what I did… I sell losers and plough proceeds into the winner (AAPL).

Exactly! S&P or a few stocks.

https://twitter.com/Brian_Stoffel_/status/1737803019368956073

Performance of AAPL, NVDA, TSLA and S&P. ANT outperforms Brian’s portfolio by a wide margin over a 5-year period… 5 years ago, AAPL, NVDA and TSLA are well known to be outstanding companies.

How many high school dropouts make it to 10 million net worth?

Vs

How many graduates from elite colleges make it to 10 million net worth?

.

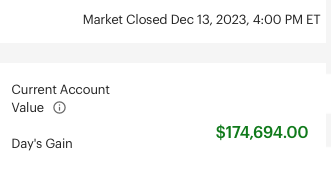

Are you over $10M NW yet?

Disclosure: When I’m at 40, not sure even have $1M NW. That’s with academic: MBA, BEng, top in K-12.

I realize graduates are brainwashed to be intelligent donkeys. Wake up!

Is this question:

relevant to my question?

Your question is whether one individual has 10M net worth.

My question is statistically, which group has a higher probability of achieving 10M net worth.

.

Yes. Your statement/question has two parts:

a. NW $10M

b. Graduated from elite college

So if you are from elite college and have $10+ NW, anecdotally you are one of them. If you’re not from elite college and don’t have $10+ NW, anecdotally what is implied in your statement is also true.

Heard of proof by induction?

.

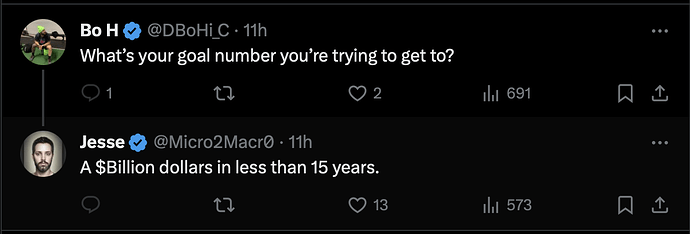

Jesse is aiming to be a billionaire in 15 years. Whereas a certain Master in CS of older age is still struggling to get to $10M NW.

Interesting goal. Not sure why being a billionaire is important for this high school dropout. Or 10M for that matter. Some sort of past drama? Need to prove to some people he’s not worthless? I don’t think he will be happy even if he got to a billion dollars. But most likely he will go broke for taking excessive risks.

Now I know Singapore high schools don’t teach mathematical induction. Or at least its students didn’t learn it right.

.

No worries. I know you’re fossilized, unimaginative and always live in the past.

Hmm… reverse psychology?

Is that jealousy or a curse?

Just reasoning with probability. Another math concept Singapore schools didn’t teach apparently.

.

Just reasoning with probability. Another math concept Singapore schools didn’t teach apparently.

You’re so smart ![]()

Need to prove to some people he’s not worthless?

![]()