Nothing smart. Just basic high school math.

If you have a unique skill you likely feel compelled to apply it whether you’re Jesse or Taylor Swift. And if you’re really good you’ll likely make a lot of money doing it. Nothing wrong with that. No need to cast aspersions.

I actually don’t know anyone who trades their own money all the way to a billion dollars.

There are plenty of billionaires in finance, but these people got rich from founding firms that leveraged other people’s money. They got rich from the 2 and 20 pay structure, not from beating the market.

People like Buffett own whole businesses. There are hundreds of thousands of people in Buffett’s payroll.

Or that Hainan Chicken guy who became billionaire from trading Tesla options. Well he was a 100M-aire from a tech company he founded. Getting to a billion dollars was just a 10x event for him.

I don’t even see where it mentioned this HS dropout guy has 10M. Maybe I missed it?

My feeling is that the stock market is mostly a game of psychology. It will tease out and magnify the worst instincts in people. If you don’t come in with a level head and try to get rich in a hurry, bad things tend to happen. Not always of course. Maybe he will get lucky? But then why even bother following his “strategy” when the said strategy is “be lucky”.

Personally I would rather spend $20m than make $1billion.

.

With $1B, you can spend $20M every year from the interest.

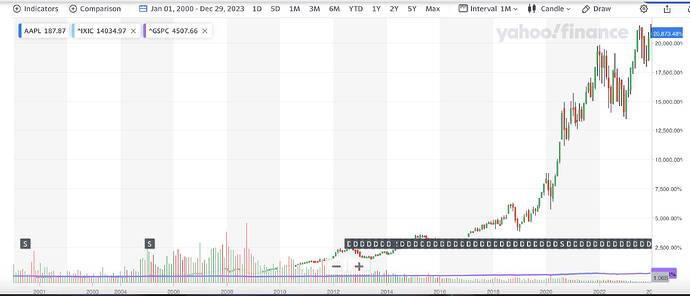

No need to study any fundamentals or follow any macro-economics and geo-politics. Buy n hold (hopefully forever) a right stock.

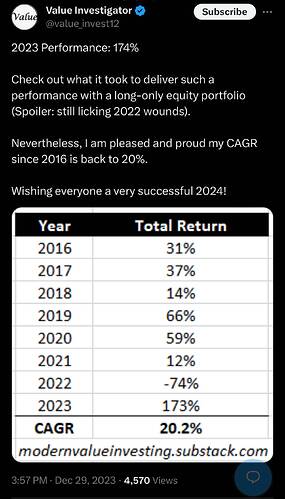

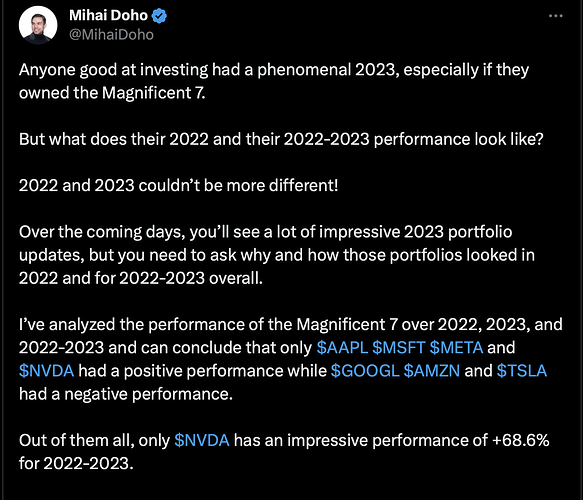

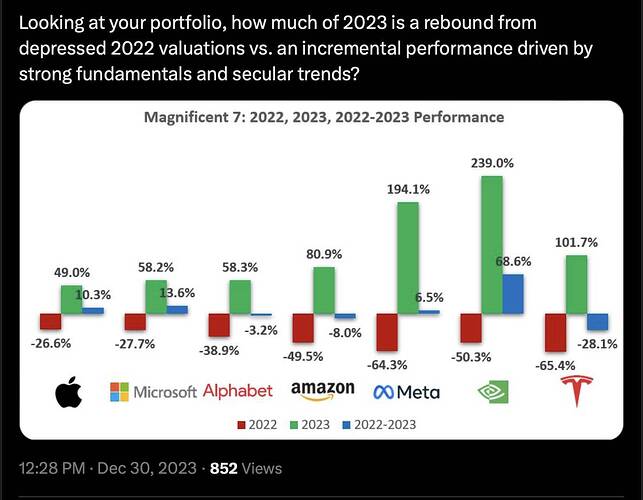

Gain in 2023 (1 yr gain)

Gain in 2022-2023 (2 yrs gain)

Gain in 2018-2023 (5 yrs gain)

Did you underperform the index during dot com? If you sold all your individual stocks in 2000, including AAPL, and put everything into S&P, would you have been better off today or worse off?

So Chicken is giving people bad advice?

You could have sucked for a while but you can keep learning and improving yourself. I am sure Chicken himself sucked in the past, and may actually suck in some future year.

Not good to be a cocky SOB.

.

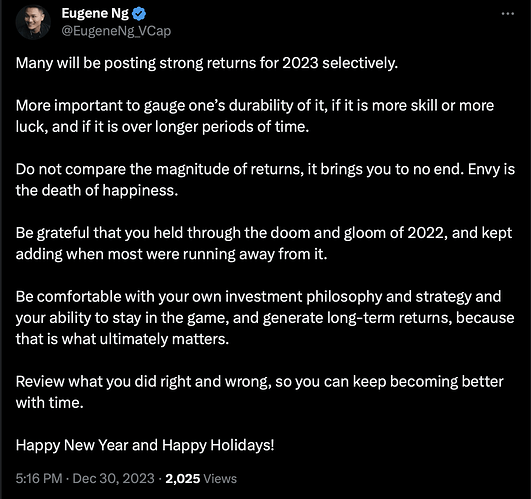

Didn’t know you still retain this type of humility after living in USA for so long.

Textbook advice. Heard it all the time.

Not a financial advice.

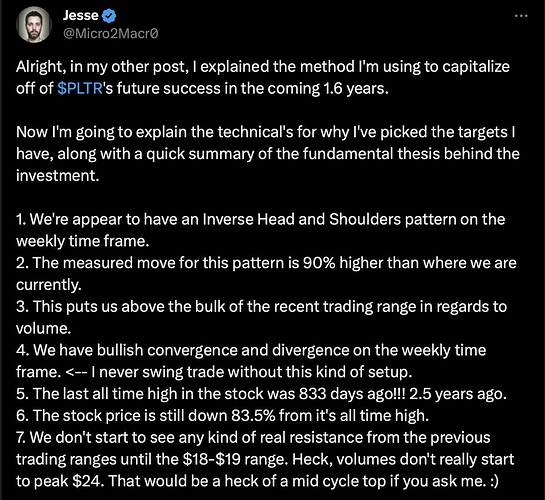

How to make few hundred percentage return per year?

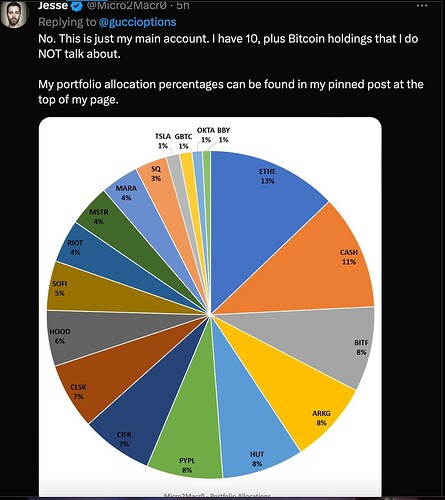

Jesse shares his secret recipe…

What I gather is miners lead bitcoin i.e. rise first and peak first.

Time for traders to brag. In 2023, Jesse makes 600% (may be higher), Kris makes nearly 400%, me nearly 200% (growth stock portfolio only). Btw, all of us employ options opportunistically.

Look at your two-year return.

Gain > 68.6%, you’re an outstanding trader ![]()

In-between, average ![]()

Loss > -28.1%, you suck ![]()

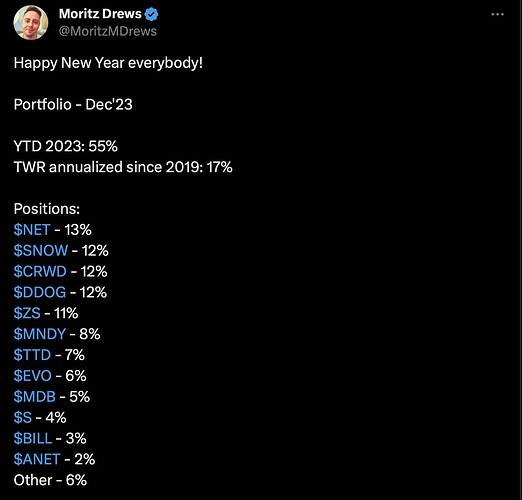

Adam Khoo thinks he did well in 2023 (45% gain) and since 2019 (19% CAGR) but…

2023 gain for QQQ = 51.3%, AAPL = 48.2% and…

I love listening to influencers, not just their stock picks and rationale for picking, but also their background and how to they become stock investors/traders and influencers. His top 7 stocks are:

NVDA, MSFT, AMZN, AMD, AAPL, SNOW and CRWD