He has 10 accounts? What is the point of that? Also, what kind of tool is he? He says he doesn’t talk about his Bitcoin holdings. He literally just mentioned them which is talking about them. Does he sell some sort of subscription service?

.

He meant he won’t share his trading of Bitcoin coins. He did talk about price direction of bitcoin and share his trading of crypto miner stocks, proxy crypto ETHE and GBTC.

No. Won’t be surprised he starts doing so once he got enough followers… a path that many Xers use.

The whole thing seems fishy. I suspect he only talks about positive trades. 10 accounts so then he can show whichever account has the best gains. I don’t get the value of following these clowns.

.

For me,

Treat as talk show ![]() I find it more entertaining than watching TV shows and movies.

I find it more entertaining than watching TV shows and movies.

I have seen people set up multiple account to trade for their clients. Clients put money into those accounts and give the person permission to execute trades.

Otherwise nobody needs 10 accounts for their own money.

If those other “private” accounts are indeed client money, this guy doesn’t have 10M net worth. He may be managing other people’s 10M.

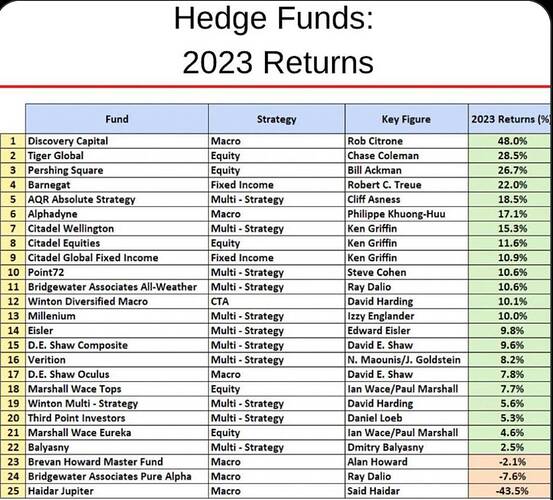

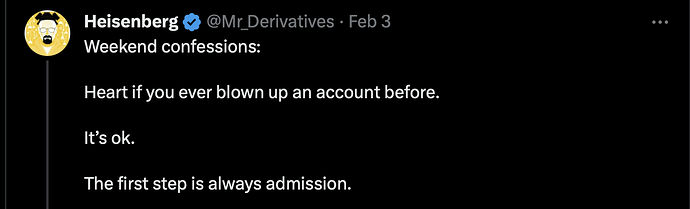

Hedge funds ![]() All underperformed QQQ.

All underperformed QQQ.

Exactly. Since you don’t have billions, you should self manage or just invest in only broad based indices such as QQQ.

Most argue it’s more difficult to beat the market with billions. They can’t move money as quickly. Also, their moves can move the market (especially options markets). They have to stick to mostly options on the largest ETFs, or they’d move options pricing.

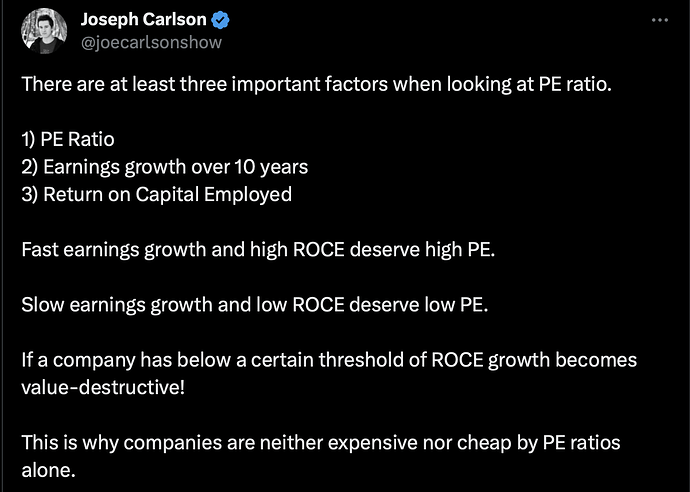

The index structure of prioritizing winners and holding them long-term is the winning strategy.

The error that individual investors so frequently make is doing the exact opposite of the index:

-

They prioritize low-quality “cheap” companies…

-

They sell winners because they have become too expensive, selling out of winners leads to a portfolio full of losers.

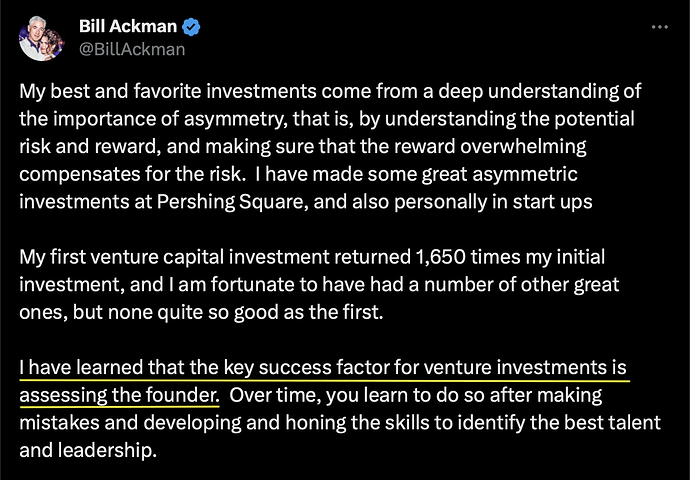

https://twitter.com/BillAckman/status/1746369013368709232

Which growth stocks (market cap less than $100B) have a promising leadership?

I think the key is execution. That is revealed over time.

The issue is projecting earnings froth over 10 years. There will almost certainly be a recession over a 10 year window. Who actually models that? Then there’s the issue of addressable market and if it’s actually large enough go to support the earnings growth forecast. That’s where companies like Beyond Meat fail to justify their valuation and crash. The company will also need to out execute competitors in the space.

The key is identifying the big secular trends that’ll lift most companies in a sector. E-commerce and cyber security should have strong secular trends for a while. If a company is in those sectors and not performing well, then the company has to be run by total idiots. Within the sectors, there will be massive winners that out perform the others.

…

Not all companies are pure play. A company can has three divisions eg E-commerce, Fintech and entertainment. E-commerce may be doing well but the performance is dragged down by the other twos. Pure play tend to be volatile.

Paul of Everything Money use the super duper fundamental analysis reasoning to short NVDA. Now down a few million dollars. Has he used TA, he won’t short.

Reasonable but for average Joe, is better to ignore macro conditions and continue to DCA to your high conviction stocks. This is what WB said and is what I did. I don’t even bother to hedge via put or earn extra passive income by selling covered calls.

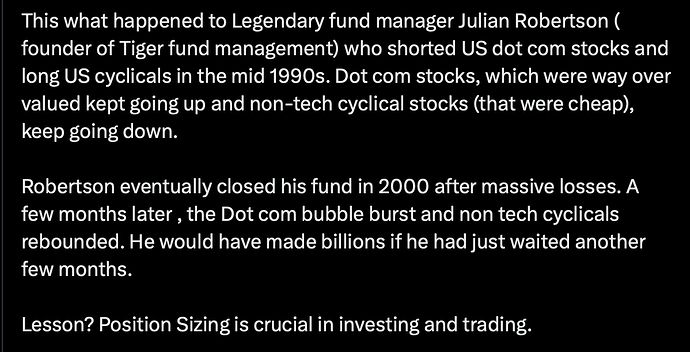

IMHO, Kris is an opportunistic trader. From the few posts he made, I get the sense that he doesn’t hold any stocks for longer than 1 year.

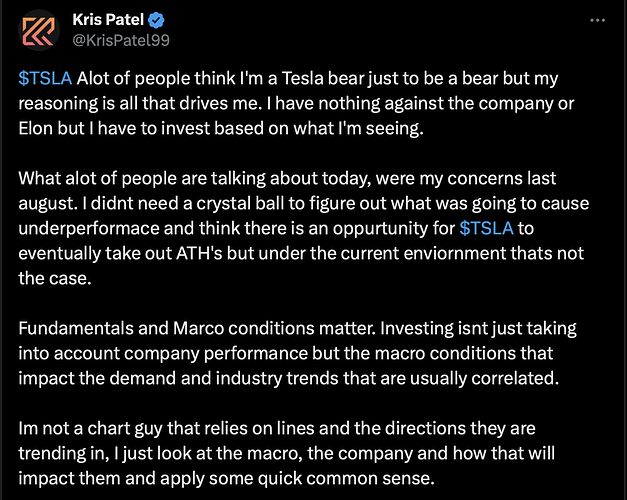

Danny talking to his fellow and ex-fellow countrymen eg @manch ![]() Stop the envy and look for better opportunities.

Stop the envy and look for better opportunities.

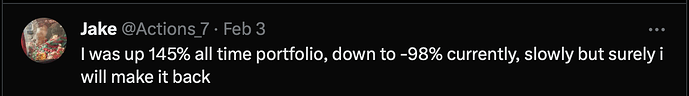

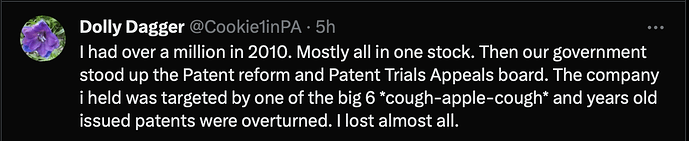

Admissions of traders who blew up their accounts:

https://twitter.com/Mr_Derivatives/status/1753829008939401718

Your sincerely during Dotcom bust ![]() Luckily own an AAPL phoenix.

Luckily own an AAPL phoenix.

A phoenix rises from the ashes.