Mr Loo parallels current AI boom with Dotcom boom. What are the lessons learnt from Dotcom boom and bust, how can they be applied to current AI boom (and subsequently bust).

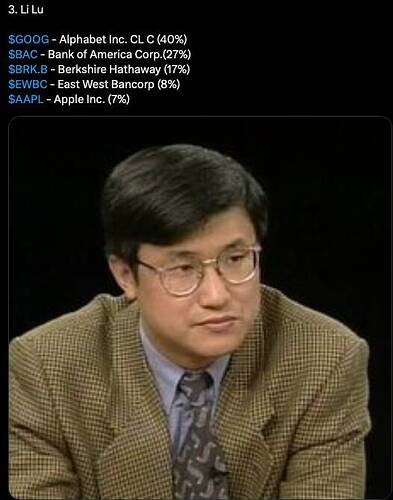

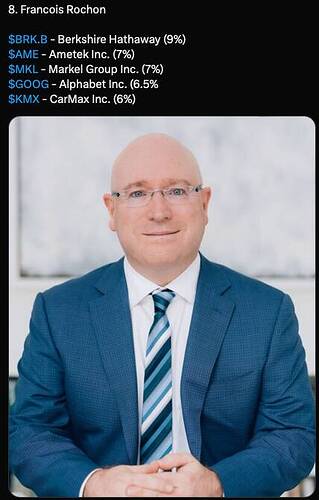

Legendary investors are hot on GOOG, none of them think highly of NVDA. So… how to identify stock like NVDA? Obviously shouldn’t use what are taught in valuation and fundamental analysis.

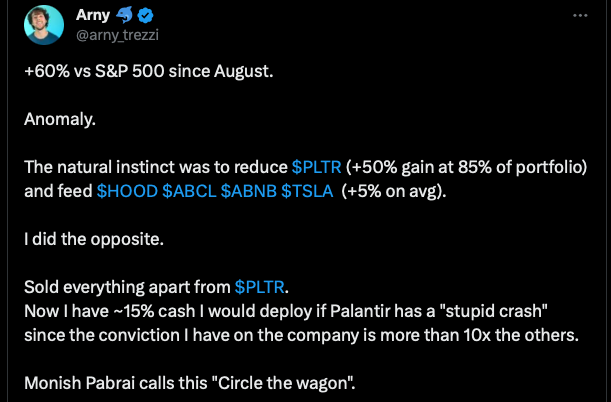

Arny did what I have done when Dotcom busted. Sold all other stocks and ploughed into AAPL. Now I know there is a sexy name for this approach, Circle the wagon.

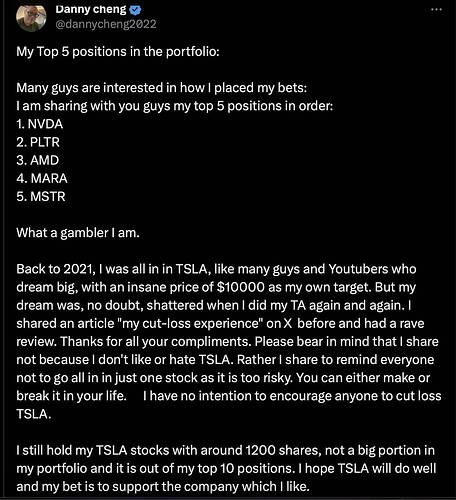

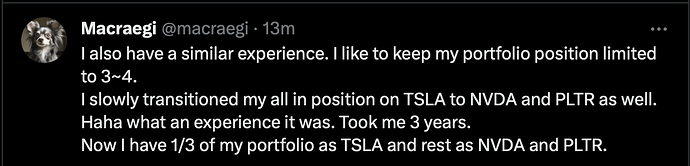

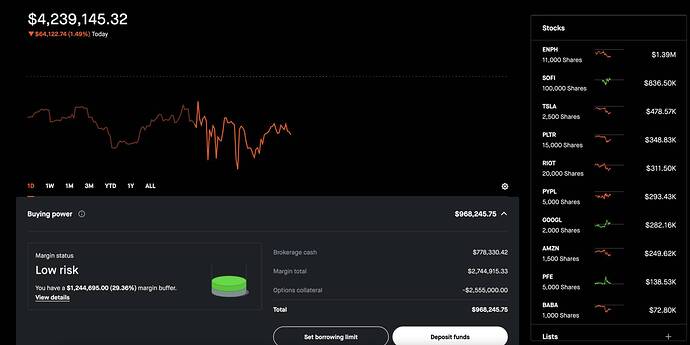

Danny went all-in TLSA in 2021 ![]() Eventually he cut-loss and his current position is…

Eventually he cut-loss and his current position is…

His TSLA holdings is worth $1200*188.71 = $226k is not considered as a big portion and out of his top 10 positions. Btw, not big enough to be in my top three position too ![]()

- NVDA

- SHOP

- COIN

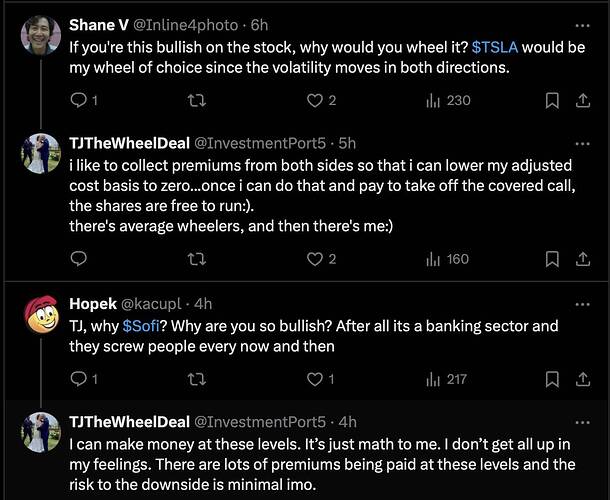

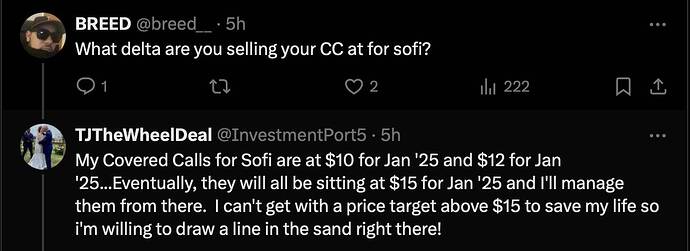

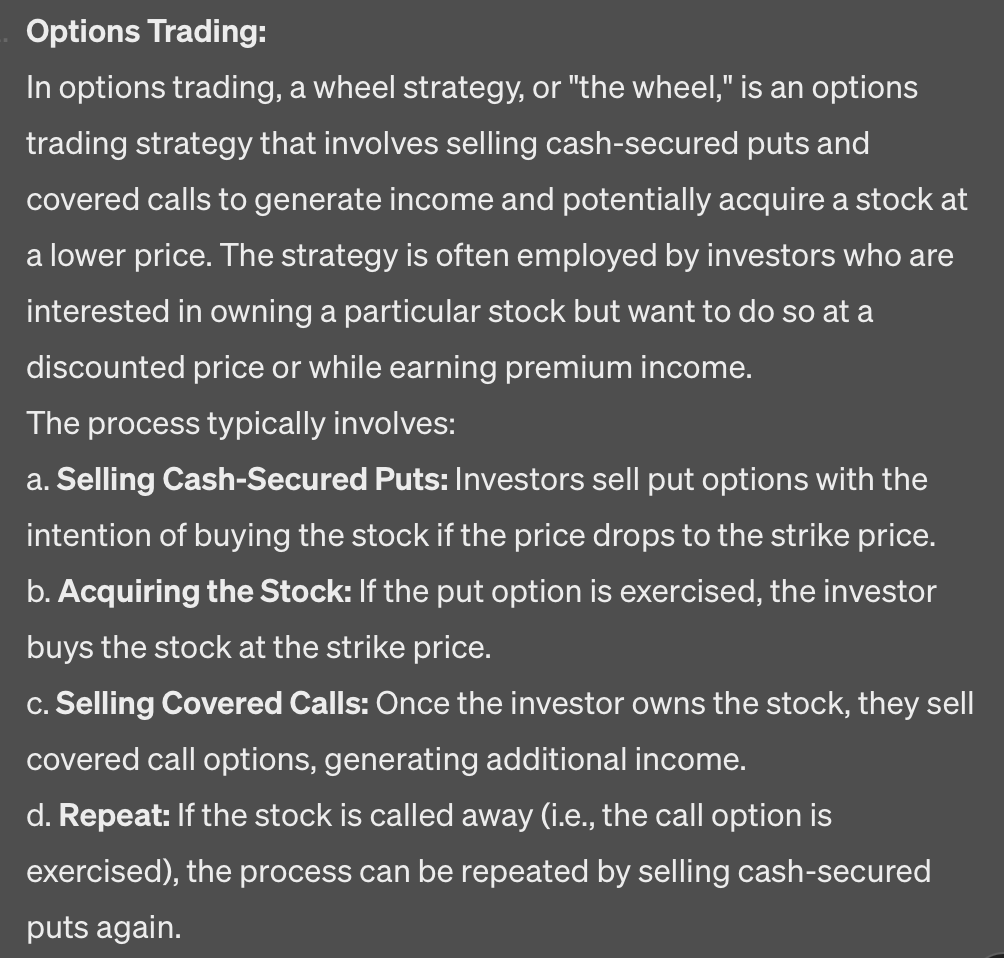

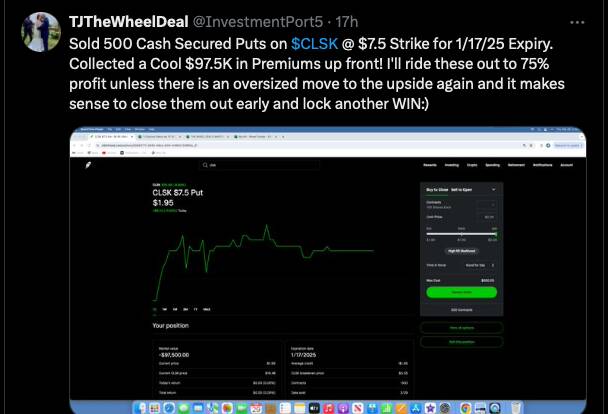

Wheeling is a popular strategy that I don’t quite get it. Guess is I don’t know how to execute ![]() well.

well.

Wheeling

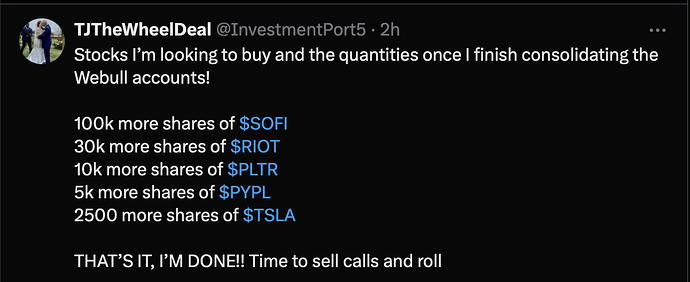

Investors and traders who make tons of $ in 2023 and 2024 so far are proudly sharing their approach and position e.g.

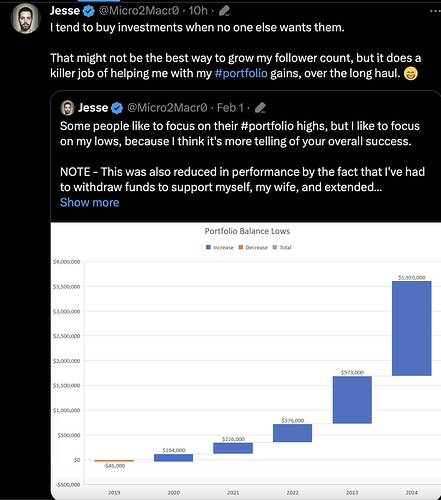

About $2.5million worth of stocks.

Have been trying to reduce the number of stocks in the growth portfolio to a 2-3 stocks from ~15. Psychologically is hard to do.

Kudos if Tevis can do it.

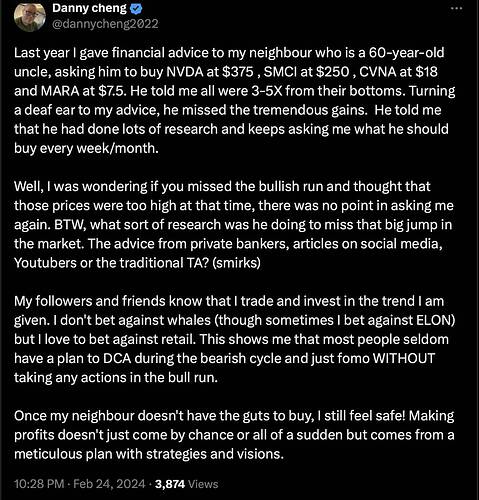

Danny doesn’t have conviction in TSLA (not that I believe in TSLA, didn’t do enough DD to make comment). He sold TSLA around 30% below ATH and currently TSLA is trading at around 47% below ATH. I hold through 60-90% price declines while all-in AAPL. Just like @Jil, can’t stomach deep retracement and can’t don’t do anything, so not suitable for buy n hold (forever) approach esp all-in.

Ofc, Xers Danny and The AI Investor are lucky successful traders that have dumped TSLA and focus on NVDA. Some souls e.g. Puru, didn’t invest in NVDA because of high valuation and chip is a cyclical business didn’t enjoy the ride.

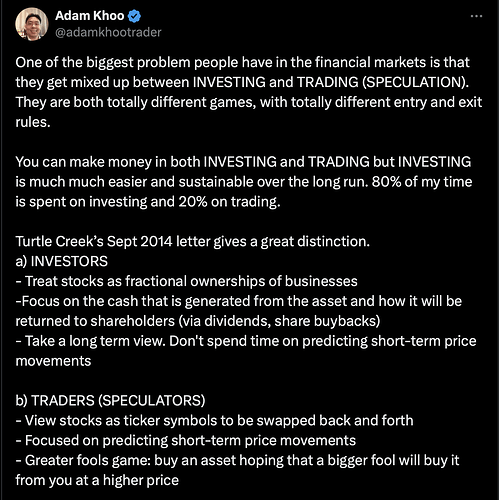

Perspective of a trader who lost a bundle during the bear market 2021-2022, now feel that he has discovered the key to trading stocks… everyone is a genius during bull market…

12% over 10 months. CLSK is volatile, can easily make that in one week. Why tie up $800k? Is the CSP secured vs cold hard cash or margin from stocks? I don’t get the wheeling strategy.

Just sharing. I didn’t do any DD so don’t know whether he is right or not.

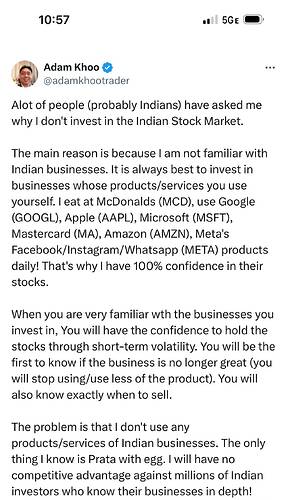

Investor’s mindset… Adam has a “proprietary” valuation methodology. Using this valuation methodology, all stocks are overvalued ![]() So sit tight, no buying, no hedging, waiting for pull back to add.

So sit tight, no buying, no hedging, waiting for pull back to add.