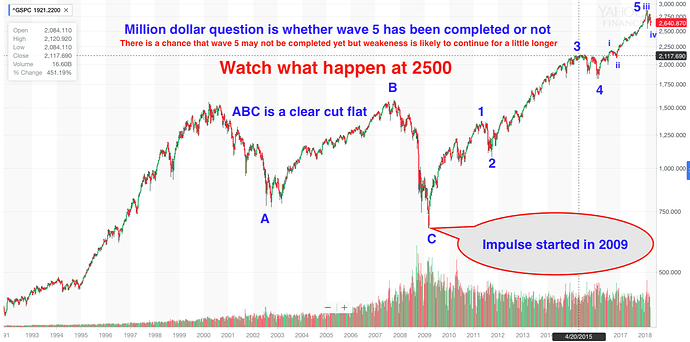

As far as EWT is considered, the impulse started in 2009 and in 10th year. Below is not my forecast. Just interpreting… Even if wave 5 is not completed, I have no idea how high and how long would wave 5 takes to be completed.

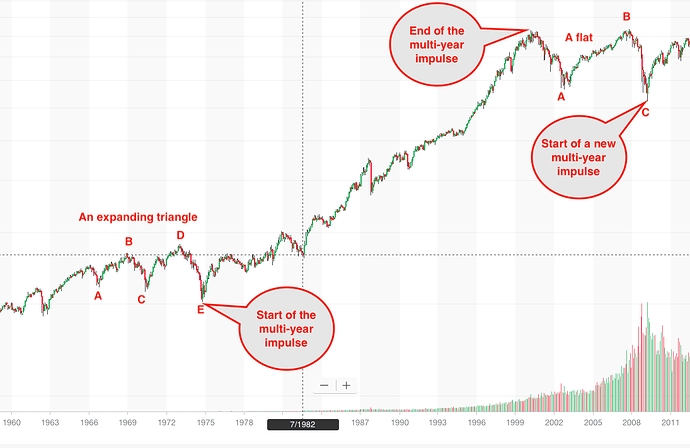

Nothing came close to 1987 and yet the 1982-2000 bull market continued apace afterward. Someone quitting the stock market in 1987 made a huge mistake.

First, when you say “Nothing came close to 1987 and yet the 1982-2000” and we are quitting means that we are not selling at down bottom, but at peak side. This is strategically better for us unless stock goes up which I am not confident next one or two years.

Second, everything is hindsight. When I am able to predict ahead in Jan through Mar, and hindsight I find the truth, I am more confident on my original decision/analysis.

Third, I have often seen a down turn or economic correction after FED completes a rate hike cycle. FED started more than an year and continue to proceed now. Chances of future (or current we will know hindsight) correction is more than chances of stock going up !

Fourth, “quitting the stock market in 1987 made a huge mistake”, true we are not quitting staying away or waiting on side lines.

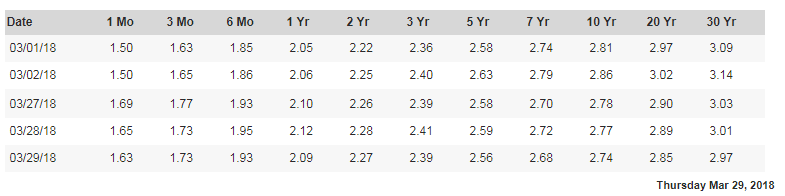

Why is the rate hike inevitable. The 10 year bond yield is dropping? Inflation is low and labor has little pricing power.

At the Fremont delivery center right now. It’s a zoo. There must be over a 100 people here (lots of families). End of quarter rush for Tesla

Hope you get the one you want.

Why is the rate hike inevitable.

The 10 year bond yield is dropping?

Inflation is low and labor has little pricing power.

Jerome Powellsays current economy has full scale employment (96% is employed) and likely over heat with inflation. We see those on roads full of cars, real estate - crazy bids, stock market spikes continuously…etc.

If you listen to is testimony, he says “Rate Hike” is one of the tools FED uses to control economy. They deliberately do it to avoid automatic explosion.

Yield curve flattening, but takes time appx 15 to 18 months to get negative (we never know).

You should use EWT to back date the 82-00 bull run so we have an Apple to apple comparison. Did EWT say that bull market started in 82 and ended in 2000?

Even in a bear market if you DCA you still come out ahead. I don’t like any kind of market timing. To me that’s just hubris. Even in a market that went nowhere, like from 2000 to 2009 there were still huge winners like google, amazon, Netflix and Facebook. You just need to do your homework to find good companies, like any other time even in bull market.

Whatever happened to the 20% underemployed. When a Trump and Bernie ran they said that there was 15-20% underemployed. Now all of a sudden we are at full employment less 4%. I don’t think the economy is overheated. They are millions of people on the sidelines especially boomers who will stay on SS unless a really good job appears.even I would go back to work if someone would pay me what I am worth. There is no wage inflation for a reason. Even if the Fed can’t quantity it.

Inflation is not coming and short term rates should not be raised.

The BA economy may be overheating but not in Trump country… Millions of unemployed men over 50 that have been discarded and ignored

You should use EWT to back date the 82-00 bull run so we have an Apple to apple comparison. Did EWT say that bull market started in 82 and ended in 2000?

I’m a very lazy person, just to entertain your question since you are a nice guy… EWT doesn’t count like the traditional way, very complicated to explain to you, suffice to say, the impulse started from 2009 is of a different degree from that one started from 1974.

Whatever happened to the 20% underemployed. When a Trump and Bernie ran they said that there was 15-20% underemployed. Now all of a sudden we are at full employment less 4%. I don’t think the economy is overheated. They are millions of people on the sidelines especially boomers who will stay on SS unless a really good job appears.even I would go back to work if someone would pay me what I am worth. There is no wage inflation for a reason. Even if the Fed can’t quantity it.

Inflation is not coming and short term rates should not be raised.

The BA economy may be overheating but not in Trump country.

There are few things to consider.

They consider unemployment based on six months EDD alone. Any one not employed beyond 6 months are not accounted. Any non-citizens (nopn-green cards) like H1B unemployed are not considered.

Obama period, they counted 12 months EDD and then final years reduced to 6 months. At that time, it was big unemployment as they considered longer period.

Cities always pick up faster than rural or country side. What Trump focusing is mainly his vote bank areas, still poor or unemployment exists. Even if not, he will focus his vote bank.

Powell says impact of tax cut will likely accelerate inflation etc

Above all, we are just helpless watchers and act based on what they say/do.

Here is his full 2 hour testimony to congress. He seems to be very confident, strong and assuring than Janet !

Yield curve flattening, but takes time appx 15 to 18 months to get negative (we never know)

Think is time to monitor this flattening… has started again ![]()

Statistics don’t tell the picture…Those of us over 50 have been ignored and ridiculed…We could be utilized at twice the rate we are now…That puts a cap on wage inflation. The internet and Walmart cap goods inflation and fuel efficiency cap energy inflation…I only see inflation in education construction and healthcare…

Even in a bear market if you DCA you still come out ahead. I don’t like any kind of market timing. To me that’s just hubris. Even in a market that went nowhere, like from 2000 to 2009 there were still huge winners like google, amazon, Netflix and Facebook. You just need to do your homework to find good companies, like any other time even in bull market.

Off track from the original discussion. We’re talking about interpreting the market, and not about investment strategy. Btw, I am a firm believer in DCA approach ![]()

I only see inflation in education construction and healthcare…

That’s about right ![]() Any education counters you’ve, own or monitoring?

Any education counters you’ve, own or monitoring?

the impulse started from 2009 is of a different degree from that one started from 1974.

How so?

The roads are full, bumper to bumper daily, as if 2000 and 2008 times, same way real estate (SF-SJC) bids are crazy surpassing year 2006-2007 period. Esp, these are happening when FED introduces rate hikes.

When stocks are suddenly crashing means that we can infer hedge funds, big banks, mutual funds and other big players are selling the stocks, keep it safe to get in DIP time.

They have massive compute force with lot of data processing before they take decision. We are very small or tiny compared to market makers like hedge funds, big banks, mutual funds. They decide and execute, we just follow.

They decide and execute, we just follow.

To follow, you need to monitor some kind of signals emitted by them. You’re using price behavior obviously, but can you explain your system clearly if you’re willing to share ![]() Sharing is caring

Sharing is caring ![]()

Lets hope it is not a government caused recession like the last time

Why does it matter? Doesn’t every recession benefit you?