Good. Citron has a history of issuing bearish comments to push price down and then turnaround to buy the stock e.g. TSLA or the stock would shortly rebound e.g. UBNT (new ATHs recently). So, should wait patiently to buy at very good price.

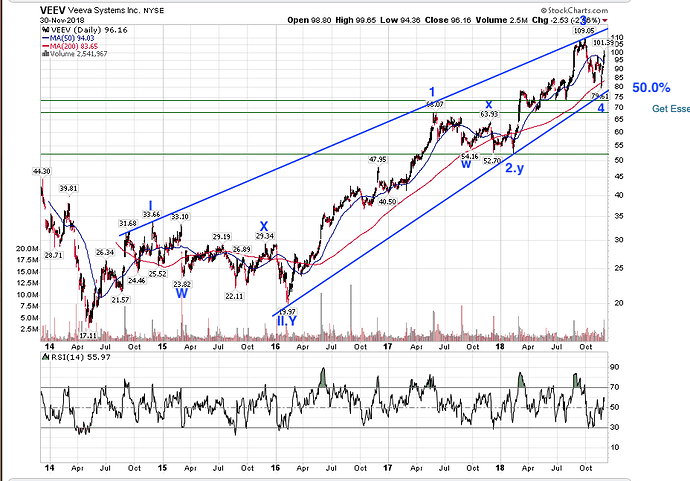

We must thank Citron ! I am waiting for such opportunity, let me know when and what price ! ! Pre-scan VEEV looks fundamentally good , zero debt, Good cash reserve, profit margin, but big P/E.

$85 a good price or $80 a good price?

$85 a good price or $80 a good price?

Since I have 400 shares, not buying anymore. Might long calls if it hits $80 ![]() for a trade.

for a trade.

Top Analysts: Five ‘Strong Buy’ Stocks for 2019

TJX - None

SPLK - Have 500 shares

PANW - Have 300 shares

MRVL - None

VRTX - None

Both pass wqj’s criteria.

Surprisingly tech stocks are mixed, not all red in a day like this.

SPLK and PANW are GREEN ![]()

SQ and NTNX are green too.

Maybe we’ll start to get some differentiation instead of days that are all red or all green.

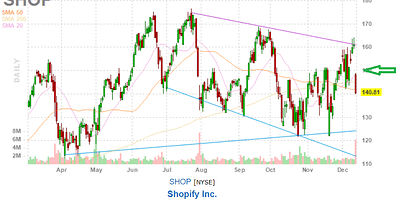

Chance to buy SHOP cheap after a drop on secondary offering.

https://finance.yahoo.com/news/shopify-prices-offering-class-subordinate-141100156.html

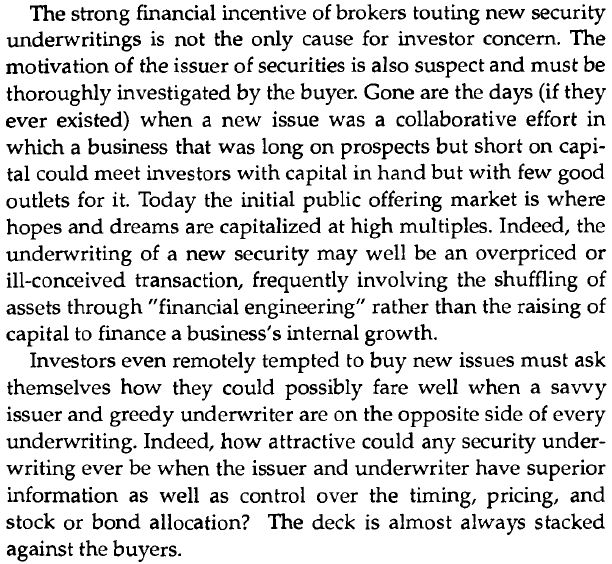

Just taking this an opportunity how companies/under writers are trying to spoil retail investors.

“Shopify expects to use the net proceeds from the Offering to strengthen its balance sheet, providing flexibility to fund its growth strategies. Pending their use, Shopify intends to invest the net proceeds from the Offering in short-term, investment-grade, interest-bearing instruments or hold them as cash.”

SHOP always dilute the share holdings with secondary offer, means they seek free money (no interest) from public to run the show. They get free money (secondary offer) and wants to invest in securities. There is no growth on fundamentals by issuing this offer, no clear plan.

Secondary offer is opposite of buyback.

Vested parties (funds) pulled up SHOP to peak and then announced a secondary offer

Many institutions (under writers) support secondary offering for the commission they get out of it.

Not a good approach from SHOP or it does not give a sound plan for investors to get the stocks.

Prefer a company, like FB, which is approved buybacks and stay with them at low price.

FAANGs are better than SHOP, COST is also better (dipped after good results) to consider.

They are growing very fast. They make software to help businesses manage their online presence and e-commerce capabilities. If you think online shopping is the future, then they are the software enabling it. They even offer integration for Amazon’s FBA program. They offer a single portal to manage ad campaigns on all platforms and integrate operations across different selling platforms (Amazon, ebay, own website, etc).

It’s not much different than a fast growing startup getting another round of VC funding. Who considers that a negative? FB did 14 private rounds before going public. SHOP did 6 private rounds and this will be the second public one. Would you rather have bought FB at funding round 8 or 14?

It’s not much different than a fast growing startup getting another round of VC funding. Who considers that a negative? FB did 14 private rounds before going public. SHOP did 6 private rounds and this will be the second public one. Would you rather have bought FB at funding round 8 or 14?

There is a major difference between private funding (VC) and public funding. VC funding is aggressive, they will sue or throw the CFO, CEO out of job when they are not performing. Public funding is dumping on retail investors. On any case, whoever funds, they will not get good returns, but VCs are shred, no funding unless great returns, while retail investors are ignorant.

IMO, what SHOP is doing is not good for retail investors. The stock will touch appx 110 to 120 range further.

They are exactly doing the same this like cannabis stocks or dot.com era work, get some funding with company name, play with it.

At bullish times, it may work as everyone keeps on buying, but not now.

See what is going with Ten cent Music (TME) and in future UBER & LYFT. All will go down like SNAP.

Why Banks underwrite? It is for commission. If they are unable to get subscription, they need to provide funding, get into loss.

That is why, all bank stocks are tanking now even though economy is good and company results are good.

Now, buy one and only strong stocks with high real profits/sales.

What percent of VC funded companies fail and never have an exit? VC firms aren’t clairvoyant, and they are wrong far more often than they are right.

You’re comparing a company that will break $1B in revenue this year with a 50%+ growth rate to dotcom companies that didn’t even have revenue. SHOP is break even on operating cash flow.

SNAP has crashed because daily active users is declining. That’s going to dramatically limit future revenue potential.

What percent of VC funded companies fail and never have an exit? VC firms aren’t clairvoyant, and they are wrong far more often than they are right.

VC are wealthy, they go deep in detail before approval, they may reject many startups which we may not know. The chances of getting VC approval will be very low as they expect extra-ordinary returns in short run.

They may make mistakes, esp companies like UBER, Lyft etc when they are well known.

Retail investors , like you and me, are week and ignorant of many details esp for IPOs, Secondary offers.

You’re comparing a company that will break $1B in revenue this year with a 50%+ growth rate to dotcom companies that didn’t even have revenue. SHOP is break even on operating cash flow.

This part, frankly, I did not deep dive. It is up to the investors to look. But the scope “Shopify expects to use the net proceeds from the Offering to strengthen its balance sheet, providing flexibility to fund its growth strategies.” is not correct. They do not have any clear growth plan.

SNAP has crashed because daily active users is declining. That’s going to dramatically limit future revenue potential.

SNAP is an example, I am not comparing SNAP as one on one with LYFT, UBER and SHOP.

You didn’t deep drive any of it. You just applied some broad statements based on your opinions.

You didn’t deep drive any of it. You just applied some broad statements based on your opinions.

Correct.Deep dive means complete valuation, takes 4 hours of dedicated time. I deep dive only on the stock I try to invest, but not others.

It does not mean that I am wrong, but the caution is for the investors who is going to put that money into it.

What SHOP is doing now is affecting the investor, diluting the holding (opposite of buyback) and there is no clear growth plan for the secondary offer - This is like SHOP JunkBond.

Horrible, down and down, I am down 12% on STNE (over all 3% down), warren buffet is down 35%. WB lost $100 million loss by now. No reason, price is going down daily.

If I guess, this time recession may be with financial sector by Yield curve inversion.

See all banks BAC, FITB, RF, SIVB, DFS, USB,JPM, MS, GS and WFC are down and down, not even recovered.

STNE belongs to financial/credit lending sector.

All RED except TSLA !

WDAY and NOW Ytd gain is over 50%, did Jil short them?