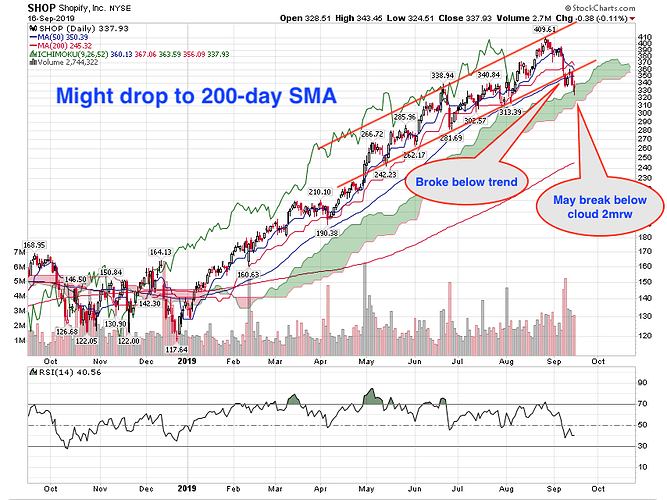

This might be the week I finally but more SHOP via selling puts.

If Square stock is able to build on its reversal next week, bulls would love to see shares reclaim the 100-week moving average. On the downside, a decline to $50 would be an attractive risk/reward spot for a bounce.

Bot 300.

SHOP is down on a secondary offering. It represents a 2% increase in shares. In other words, it’s a tiny amount dilution creating a buying opportunity. It’s no surprise they have to raise cash to build their fulfillment network. That’s a crazy profitable business.

Dropping fast AH. 5%. Monitoring.

https://seekingalpha.com/article/4291261-shopify-reality-check

This article provides a valuation spreadsheet and based on very optimistic estimates, Shopify should be valued at about 25% of its current valuation (as of September 1st, 2019).

![]()

He’s evaluating revenue growth by dollars growth not percent growth. That’s moronic. By his measure a giant company growing 1% is better growth than a small company growing 60%. He doesn’t even know when to use percentage valves dollar value.

I’ll sell a put tomorrow.

Another article, https://seekingalpha.com/article/4291677-square-laggard-payment-space , predicts $50 target. So front-run ![]()

I don’t see any reason to bottom-fish on Square and see the stock as a sell into 15% plus rallies going forward as the trend is down. If the company can’t put up $1.13 billion or better for revenue in its Q3 report, we may have a date with the $50.00 support level in Q4.

7 Momentum Stocks to Buy On the Dip

SHOP, OKTA, TTD, PINS, SPLK, CHGG, ADBE

Bot 300 SPLKs ![]()

It’s down much less than it was AH. I should have just grabbed shares then.

Looking at the technical indicators, we think that the stock is a “sell.”

Investors’ sentiments is SHOP vs AMZN is like AAPL vs MSFT after iPod is released ![]() Is the fulfillment centre the iPhone? ATM, seems to be in the path of another 10x

Is the fulfillment centre the iPhone? ATM, seems to be in the path of another 10x ![]()

Looking good…

I don’t think people realize third party fulfillment is the cash cow of amazon retail. It’s far more profitable per unit sold than amazon’s own retail business. The plus for merchants is Shopify won’t turn around and compete against them selling the same product the way amazon will. It’s a golden age for small online businesses because customer acquisition costs have never been lower. Facebook has made getting new customers super cheap and effective compared to other method.

Thought Facebook or Instagram came up with a product similar to Shopify?

New Buys By Best Mutual Funds: Payment Processing, Defense, Retail Stocks Lead Charge

The latest report shows top money managers have been investing in Microsoft (MSFT), Paysign (PAYS), Paycom Software (PAYC), Veeva Systems (VEEV), ServiceNow (NOW), Twitter (TWTR), and Starbucks (SBUX).

Nineteen IBD 50 stocks were spotted on the new buys by the best mutual funds list. These top growth stocks include PayPal, Paycom, Atlassian (TEAM), Copart (CPRT), Veeva and Universal Display (OLED).

Facebook won’t fulfill orders for retailers. That order fulfillment is what will make revenue and profits explode even more than the existing business.

On Monday, Shopify said it offered 1.9 million class A subordinate voting shares at a price of $317.50 each

Why pay $328 if you can get for $317.50?

I’m not sure how you get access to buy at the lower price.

Short put

In any case, I shorted put (L21 $280). If drop to 200-SMA, long call (L21 $280)

Meanwhile monitor the price behavior and what blogosphere/ analysts have to say.

TWLO has been topping out over $120 since March and its break below $120 began the decline phase. Further weakness to the $80 area is possible.

Mr Market feels TWLO is not low enough, engage Bruce to write an article to push TWLO to $80 ![]() AH, price drops…

AH, price drops…

Would FB effort to integrate messaging (WhatsApp Messenger Instagram) threaten TWLO cloud comms platform?

TWLO is business to consumer messaging. When door dash texts you that delivery is close, that’s on TWLO platform. It’s not personal messaging. Texting and online messaging is becoming bigger for customer service. That’s TWLO.