This does a good job explaining the SHOP business model.

Twilio CEO: We Are In The Business Of Growing Business

Cloud-based stocks have fallen out of favor with investors who turned away from “turbocharged growth stories with nosebleed valuations,” Cramer said on Wednesday’s “Mad Money.”

This isn’t uncommon and occurs multiple times a year, which gives investors an opportunity to buy one of Cramer’s “cloud kings,” Twilio.

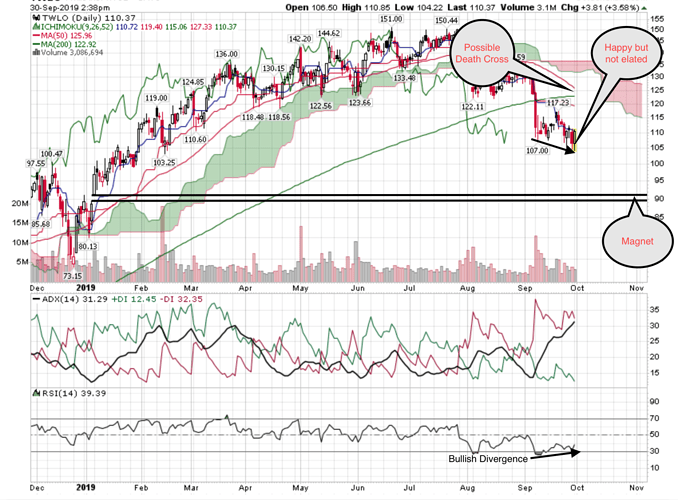

Owned 200 TWLOs ![]()

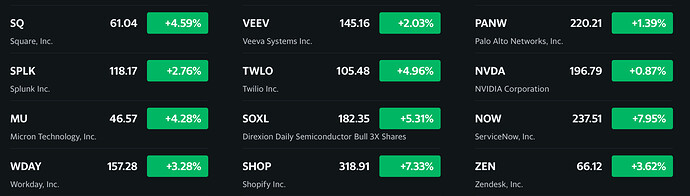

Portfolio of five edges up a few % since 10 days ago.

With most of our favorite indicators and moving averages aligned to the downside and a lower Point and Figure target, I would look for TWLO to work lower into October. If support develops in the low $90s we might want to look at the long side again.

From TA (not FA), lowest could be anywhere from $90-$105, hence a gamble to buy 200 now. Now waiting to see how it behaves next week. As for the potential death cross, is not always lead to more decline, often is a bottom.

Expect TWLO to re-bounce to $118-120. Then not sure whether should unload (if think is a DCB) or hold (if think is resumption of rally). Can’t decide now, wait and see. Hopefully is clearer by then.

QE forever

Asset inflation reboot!

Usually stocks would bounce on that. They are down even more. I thought I’d need to sell all of my puts.

All I understand that market (mainly HFTs,Quants based funds/banks) behaves opposite direction when many are fully bought the stocks.

In my opinion (IMO), market reacts based on some of their own financial statistics, but not necessarily for the news (except fundamentals like company results or strike).

But, news/media assigns news depending on market reaction. IMO, News/Media are not even 60% correct as they just follow market producing sensational/attractive topic for that.

For example, my inference is tomorrow market will be up and news/media will assign Powell Balance sheet as reason.

In short: Market goes UP or DOWN on its own, but media assigns some reasons to it.

Looking back, noted AAPL appreciated 30x from 2003 to 2008, and appreciated 20x from 2009 bottom to current ATH.

SHOP appreciated 20x from 2016 to 2019 (ATH).

So 10x over 10 years is not sufficiently stretched

People who are serious about software should make their own hardware

True one: They produced proof too.

Before he became famous for the big short in the 2000s, Michael Burry discussed stock trades on online message boards. Burry’s posts were thoughtful, well-reasoned and showed deep research.

The sub-Reddit WallStreetBets, with the tagline “Like 4chan found a Bloomberg terminal,” is rarely any of those things.

The forum’s 600,000 members dub satirical options-trade commentary over scenes from TV shows like “It’s Always Sunny in Philadelphia” and rant about a loss that caused a member to get their “face ripped off.” Toss in a smidge of casual racism and a whiff of locker-room misogyny, and WallStreetBets is a window into the back rooms of a seedy stock-market casino with no Burry to be found.

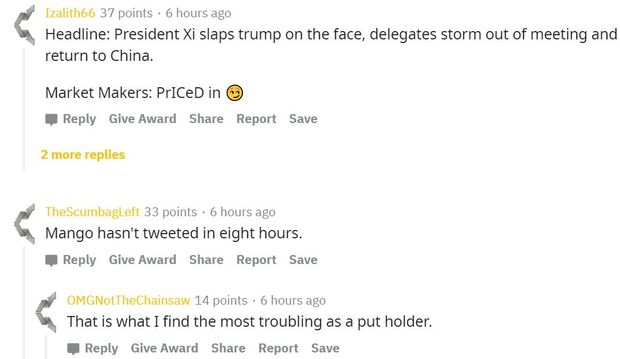

A post on the sub-Reddit WallStreetBets refers to the president as “Mango.” Members await a Trump tweet in the expectation it will send stocks down.

The chat does have Eddie Choi, however. Choi said WallStreetBets taught him how to trade options – contracts that offer the right to buy or sell a security by a specific date. Choi became a rock star on the forum last month after sharing details of his own big short – playing Roku Inc. options.

“I’m naturally a risk-loving person,” Choi said in an interview. “When I see these people making a lot and losing a lot of money, it caught my attention.”

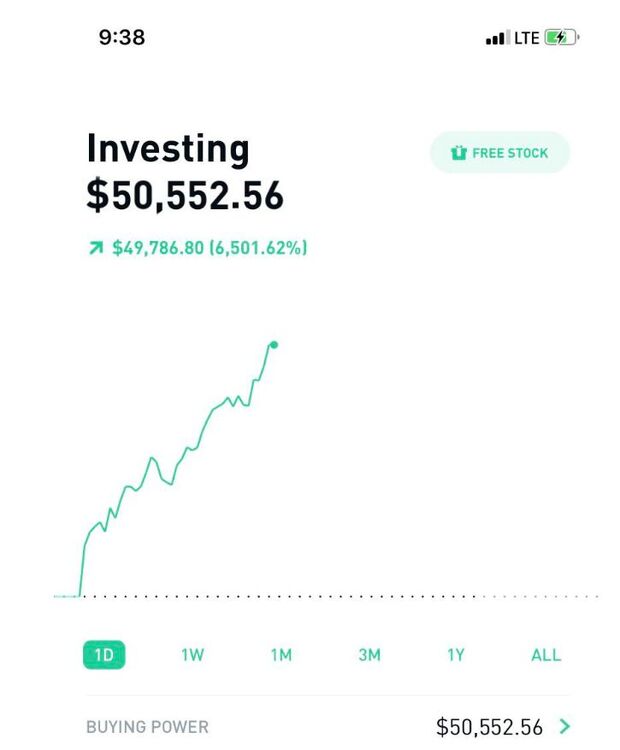

When the stock of Roku, a streaming-service provider whose shares tend to fluctuate, cratered 19% on Sept. 20, Choi’s initial $766 investment in Roku puts – a bet that the stock would decline – ballooned to $50,553 overnight, a 6,500% gain. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Bloomberg confirmed Choi’s account via screen shots of his Robinhood Financial trading history.

Eddie Choi’s $766 bet against Roku Inc. netted him $49,787 on Sept. 20.

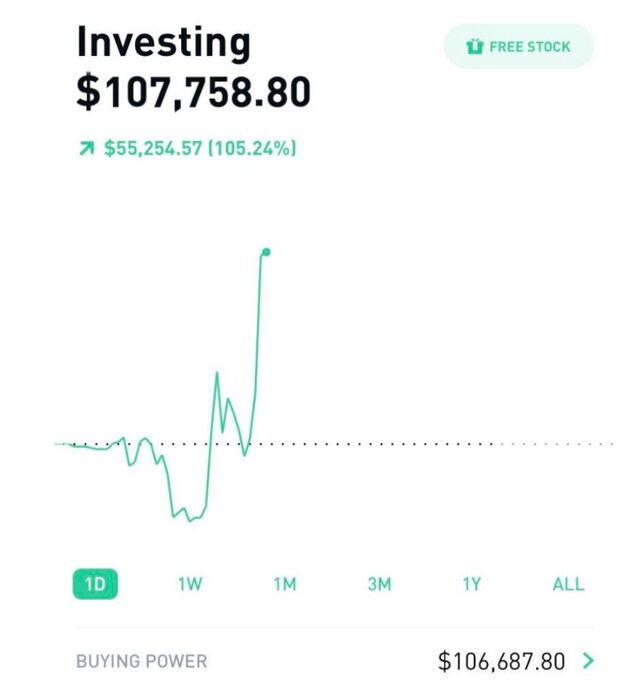

A few days later, lightning struck again. Choi doubled his Roku winnings by buying more puts, this time on the S&P 500 exchange-traded fund. When the SPY fell to $295.87 on Sept. 24 – the first time it closed below $297 in more than two weeks – his $297 puts that were set to expire on Sept. 25 went ka-ching.

Choi doubled his winnings on Sept. 24 with a bet against SPY, an ETF that tracks the S&P 500.

Choi credited luck – and WallStreetBets.

“I use it to develop my watch list,” Choi said. “Of course, there are threads where people are just trolling, but you can find good entry points.”

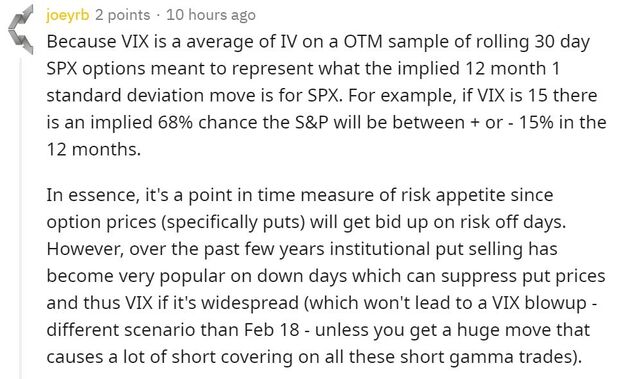

Take, for example, a posting from joeyrb that offered an explanation of why the VIX Index hasn’t spiked during the trade war:

On WallStreetBets, joeyrb evidently did his homework on VIX options.

In the movie, “The Big Short,” Michael Burry was played by actor Christian Bale. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community.

“I don’t really want to stop trading options and reading WallStreetBets because it’s entertaining and funny,” Choi said. “But I didn’t want to be infamous on the forum for losing all my gains.”

Short-term OTM is crazy risky. That’s usually throw away money.

How does it connect to my post? One or two hits of such gains is quite common in option trading. Consistency over many years is what is hard. When AAPL is roaring from 2003 to 2008, many option traders become famous! I knew two of them turning a few thousands to tens of million dollars. One went bankrupt, the other switch to investing to RE.

Is Choi an UNWI yet?

Sell sell sell

LOL: You should allocate $766 next time !!!

Reverse psychology? 100% sell if come from a relatively unknown author.

Look like I need to remind myself of this. Many such possibilities but didn’t trigger because wasn’t on my mind.

Buy on rumor, sell on news. Classic wall st bs.

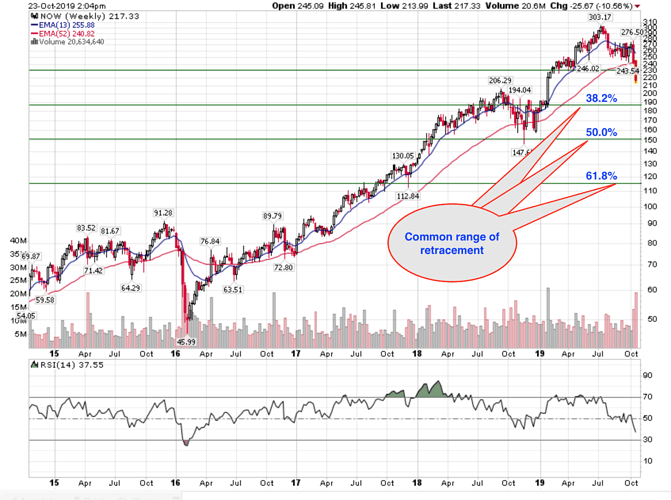

So disappointed with NOW. GTC long calls not triggered because it didn’t decline sufficiently near $200 when market open.

Edit:

AH