that’s the plan. RE income = retirement income

Retired still need to manage rentals? Too much work. Buy a growth + dividend stock like AAPL and enjoy cruising, may be not cruising, staycation ![]()

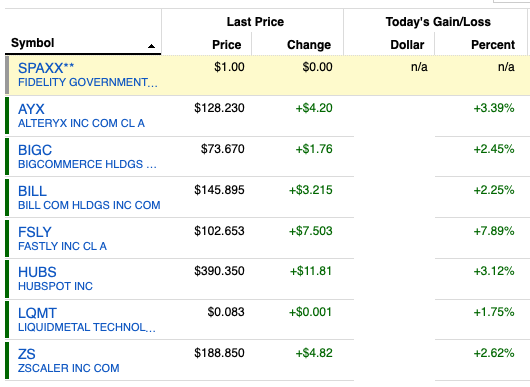

Many greens in a sea of reds,

AYX

BILL

COUP

DOCU

DT

FSLY

MRNA

SNPS

SQ

TEAM

TWLO

ZS

Dot com days? In a year he will collect more than 1B.

Make Tim Cook and Sundar Pichai look very underpaid.

They are not underpaid. They are managing existing business with well defined structure… The SNOW CEO brought company through IPO.

Told you retail investors especially RHers are powerful enough to influence direction of stocks. Keep your old books till these guys are decimated or left. They have sheer numbers.

I think it’s more their liquidity and speed. Big funds move money slowly in and out. A huge percent of money is now index investing, so it’s not actively traded. Then mutual funds always try to beat their target index. They will have guidelines and limits about their allocation percentage. That means far less of the market is actually liquid than people realize. It means it doesn’t take a lot of money to make a stock run. It’s the whole supply and demand dynamic, and the supply that’s available is much smaller than then number of outstanding shares.

Did hedge funds study what day traders do back in the dot com days? You are our in house dot-com historian.

Some young RHers are making many reckless bets. For example:

They buy SPY 0.15 cents 3 day expiry call 500 calls, next day they sell that with for 0.35 cents or lose entire amount

But, Robinhood pass the order to backend HFT firms.

They have to provide 500 option means they need secure 50000 stocks and convert into 500 options. Or they need to borrow 500 options.

Hundreds or thousands of such bets are common with RHers.

RHers money is way less, but the backend HFT issues are complex.

Single day people used to post 700000 gains using such wild options, next day losing entire amount too.

So long is tech, UP.

CRM is not a 10x stock but as @manch pointed out highly likely to become $1T eventually. After patiently waited for a long long long time, can’t remember how long, for it touches 200-day SMA, it still didn’t so I bot a round lot just in case it runs… waiting to buy 2nd round lot if it touches 200-day SMA.

Hah, yeah i bought feb calls and wrote put options (already closed) when it dipped few days ago. It might dip again but when it does, I’ll double or triple my call size. I like the accumulation action right now but it did fill that gap from Aug so I like the upside from here.

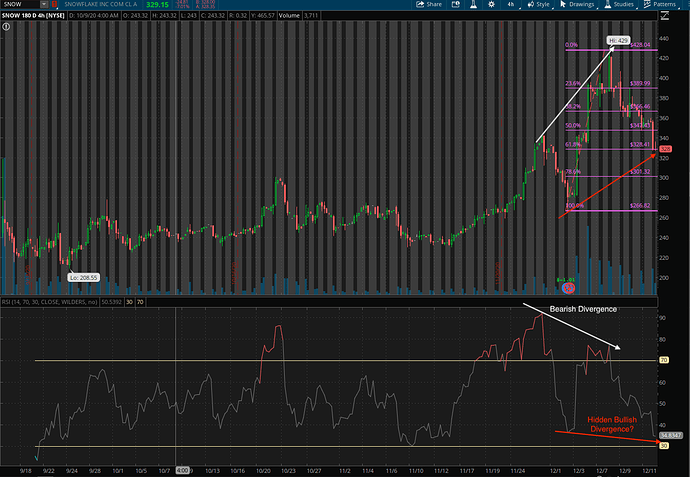

Didn’t fill gap is risky because could be breakaway gap DOWN. I am waiting for a bullish divergence… still didn’t occur. However, I notice MACD crossed above signal line in daily chart, this type of cross over when MACD is -ve usually lead to a multi-month long rally. Just an early signal, need to be confirmed by other indicators, best by a bullish divergence.

Its a Redwood city based.

While TSLA (hence @wuqijun) stole the limelight, I noted two stocks perform better than TSLA since Jan 28, 2017, Auspicious day for starting the F10 index. SHOP and TWLO. Kudos to the outstanding stock picker, @marcus335. Btw, I follow him into ESTC, FSLY and BILL - all doing very well. Hopefully he can score twice ![]() Surprisingly, @manch is also VERY good at stock picking, AMD rallied nearly 6x. All these stocks appreciated more than AAPL since Jan 28, 2017. Thought I can brag about the performance of my trading portfolio since Jan 28, 2017, about ~5.5x, less than SHOP TWLO TSLA AMD. I will continue to work harder

Surprisingly, @manch is also VERY good at stock picking, AMD rallied nearly 6x. All these stocks appreciated more than AAPL since Jan 28, 2017. Thought I can brag about the performance of my trading portfolio since Jan 28, 2017, about ~5.5x, less than SHOP TWLO TSLA AMD. I will continue to work harder ![]() Anyhoo, my goal was to beat AAPL which I did, now I have a stretched goal : To get return higher than @marcus335 @wuqijun and @manch.

Anyhoo, my goal was to beat AAPL which I did, now I have a stretched goal : To get return higher than @marcus335 @wuqijun and @manch.

I need to start “diversifying” again. You guys all seem to have a lot of good suggestions, but I don’t know where to start. I used to follow companies I actually used (Amazon, Google, Apple, Netflix, etc…) but I need to broaden.

Is there any summary of current best picks like Marcus originally created?

How about put some money into companies making stuff that your wife uses? I own a little bit of lululemon after seeing so many women in my gym wear them.

so you mean SHOES