Will have to sell my JUNO now. Wish I bought more with the proceeds of KITE.

The good: took advantage of yesterday’s dive on government shutdown fears to sell some Jan 26 puts - AAPL FB, NTNX, UBNT. I wanted to sell more, but I wanted to avoid companies that report earnings before Jan 26.

The bad: sold Jan 26 covered calls against Jun BA calls. I went 10% OOM and the stock got halfway there today. The only plus is my calls are far enough ITM that I won’t lose any time premium if forced to sell the Jun calls.

Just checked sCap… no more red, wow!

Did you go YOLO on small cap?

what’s the latest here? If i were to diversify some, what do you guys suggest i look into?

Very safe & effortless, any S&P index fund.

Safe & growth, any one or more of F10 (FB, AMZN, NFLX, GOOG, AAPL, NVDA, TSLA, BABA, BIDU, TCEHY).

Stocks mentioned in this thread are high risk, for aggressive investors only.

I like aggressive. I will split my options money into two groups, F10 + aggressive ones. so it’s fine.

I don’t see any charts that point to a good entry now. Most are far enough past a breakout that I wouldn’t put more money to work now. I’d wait for consolidation then the next leg higher to start. I’m just riding existing positions as long as they stay above the 10-day.

Have been selling into strength ![]()

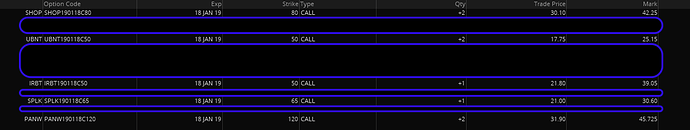

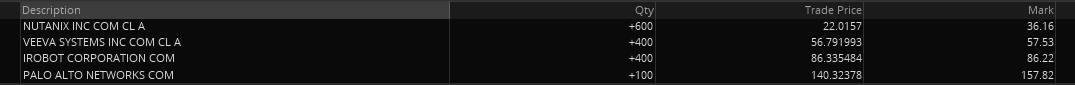

Out of shares for UBNT, SHOP and SPLK. Only holding LEAPS calls.

Essentially, reduce exposure ![]()

You can’t earn 10x by reducing exposure. The idea of buying small caps is to hold and get a 10x return on one.

On trades, I reduce exposure by selling OOM calls every 2 weeks. I can sell several times before expiration.

You can’t earn 10x by reducing exposure. The idea of buying small caps is to hold and get a 10x return on one.

Citron Research forces me to trade.

Haha, doesn’t it force you to buy at a discount once they release more “research”? I bought more UBNT and SHOP when they tanked on the “research”.

Haha, doesn’t it force you to buy at a discount once they release more “research”? I bought more UBNT and SHOP when they tanked on the “research”.

I’m hoping Andrew would strike again ![]()

Haha, doesn’t it force you to buy at a discount once they release more “research”? I bought more UBNT and SHOP when they tanked on the “research”.

Yes, Andrew gave an opportunity to but at low. Last year, I just bought some, forget it. It is 50% now .

Similarly, BA rocks with 65% even after recent dip yesterday.

I initiated calls for IRBT, BA (i already had some), and FB today.

My bigges hit last year was FB, COST (after amazon wholefoods deal), and BA.

Worst, SQ. I will buy some SQ again, but waiting for wash sale to wear off.

Broke below the long term up trend and is now testing it, good or bad?

400 shares & 2 LEAPS calls at stake ![]()

The VEEV chart doesn’t excite me in the short-term. I’m not trading it though. I’m holding it. They are still growing fast and adding new products. I think adding once it breaks above the channel is good. Then there should be some resistance at the ATH, but then it’s a clear run.

I think trading and holding for a 10x gain are very different investing styles.