If I infer, today the spike in MU and NVEC is related to blocking QCOM-AVGO deal as AVGO is competitor to MU and NVEC.

Let me know whether my inference is right or wrong…

If I infer, today the spike in MU and NVEC is related to blocking QCOM-AVGO deal as AVGO is competitor to MU and NVEC.

Let me know whether my inference is right or wrong…

How do Broadcom (AVGO) and Micron compete? I think their products are very different. Broadcom is mostly communications chips. Micron is DRAM, flash, and SSD.

I think the merger rejection would be bearish. It means there will be more semi conductor companies competing for business.

More business for memory ![]()

JIl,

Micron shares rally as analyst nearly doubles price target

Some traders are late to news ![]()

https://www.nasdaq.com/symbol/mu/competitors

AVGO+QCOM is a big challenge to many companies. Merger rejection blocks AVGO’s easy penetration and gives advantageous position to MU, Intel and NVEC.

I may be right or wrong-I do not know exactly.

I wouldn’t trust that competitor list. It’s just naming semiconductor companies regardless of the type of semiconductor. Some of them are even complementary. You can’t sell processors without memory, and those are made by different companies. I only consider them competitors if you can replace one company’s products with another’s. AMD and Intel are competitors for PC processors.

“But the memory industry is a very different beast nowadays. Market leader Samsung (NASDAQOTH:SSNLF) has reduced its memory-chip production capacity by 20% and nobody is building new factories for making more DRAM or NAND chips. The market is controlled by a triumvirate of disciplined giants – Samsung, Micron, and SK Hynix – where none of the rulers have shown any signs of wanting to flood the market with cheap chips again”

There’s the actual competitors. Intel is complementary. The more processors they sell the more opportunity for Micron to sell DRAM and SSD.

The issue is DRAM, SSD, and Flash are commodities. You can generally switch between brands without changing your design. You can’t switch from a Broadcom communications IC without changing your design. Design wins are huge when switching is difficult. The business is locked in until the next design cycle, and gross margins are usually higher.

When switching is easy, then you have to worry about industry capacity and how it compares to demand. It’s easy to qualify all memory suppliers for a product then pit them against each other on a quarterly basis to determine what percent of your business they get. Right now, industry capacity is low so risk is low. It takes a long time to add capacity, so Micron should be good for awhile.

It will be tough to add capacity because Moore’s law is dying. It’s a bitch to scale down nowadays. Witness the previous process king, Intel, still hasn’t got its shit together on 10nm. It has been delayed for 3 years and counting. Without the Moore’s law tailwind, it’s very hard and increasingly costly to grow capacity.

That’s why the industry has narrowed down to just 3 players. All 3 are very disciplined in managing their fab buildout. They have to. A new fab costs 10B+. They just wink at each other and milk the cash cow instead of going on a price war.

Few more headwinds,

. PC sale is increasing

. Cloud deployment is strong => datacenter => More memory!

Gross margin keeps increasing!

Actually “Moore’s law dying” is a rich investment theme. So far we had two deductions:

DRAM and NAND suppliers’ stock will be a lot higher than before. They are no longer just “commodity” suppliers. We are seeing that in Micron. How about WDC?

Equipment suppliers will do very well. A piece of equipment may sell for 100s of millions. I have Lam Research and ASML in my portfolio. Lam specializes in DRAM and NAND equipments. ASML is the only supplier of EUV equipment.

I am waiting for my muse to tell me what are the other conclusions…

LRCX, I owned for 9 months, but came out as the dividend payment is small. Now, I missed the low price point.

Finally, manch is able to talk about his specialization and nobody is able to challenge him. So proud of you, manch  What is the point of buying stocks in the same space?

What is the point of buying stocks in the same space?

Looks like my theory of wdc as part of dc and ai related matters is playing out. Should look into it again.

Thoughts on wdc? I guess it doesnt fit 10x concept.

I like buying different players in the same sector. Covers my bets. I am bullish on the whole sector. I don’t necessarily know which company will do best.

NAND has more players than DRAM. I think there are 7 major players? So pricing not as stable as DRAM. Micron is ramping up its 3D NAND. So I have something in NAND too. I need to think more about WDC. It’s not an obvious buy like micron.

M.u. Like f.u.

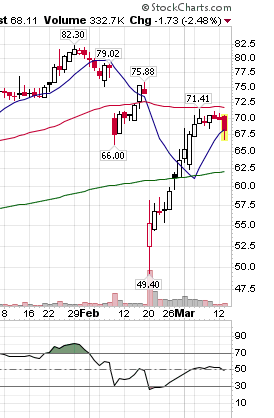

Spoke too early.

Party over?

BTFD

Daily party does not work !

The two strong stocks continue to stay strong. Added SHOP.

Recovery of UBNT stalls.