https://lplresearch.com/2018/03/07/where-does-this-bull-market-rank/

They counted wrong. This bull is only 5 years old.

他是在班门弄斧

He is playing the axe in front of you

I’m being interrogated ![]()

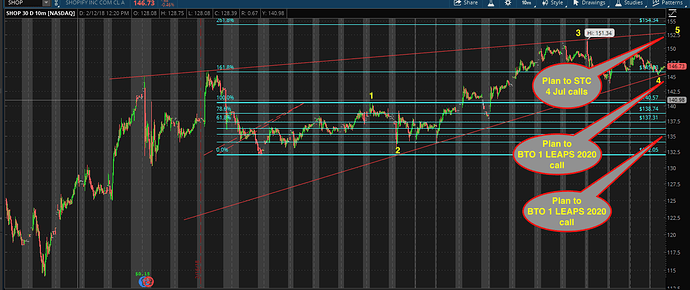

Recalled I foolishly sold 100 shares and 1 LEAPS 2019 call? End up with only 1 LEAPS 2019 call. In desperation, I FOMO bought 4 Jul calls to maintain the required delta. My plan is to STC those 4 Jul calls around $152-$155, hold on to LEAPS 2019 call… if retraces, BTO 2 LEAPS 2020 calls ![]()

Plan is super critical. If you’re trading options, then consolidation is the enemy. It eats up your time until expiration while going nowhere. It makes more sense to wait for a breakout to initiate a position.

If you plan on holding long-term, then consolidation or dips are where you want to add more to your position.

You’re trading with a longer-term focus, then I’d keep the LEAPS and sell short-term OOM calls against them. That way you can make some profits during the consolidation while holding the LEAPS for more upside.

I don’t set sell targets for options trades. It goes back to the market can stay irrational longer than you can stay solvent. I just use the 10-day as a stop.

Make sense.

I don’t use stop ![]()

Any new ticker any of you guys watching?

CORT, DLTR, MYGN these are my new picks after the dips. I have added TEVA when it dipped $17.91

DLTR looks interesting. Out of principle, i stay out of bio/medical/pharma stuff. got burned once.

Momentum saps.

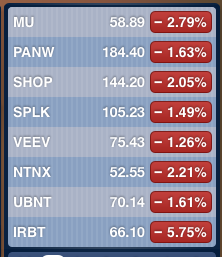

Breakdown below 10-day SMA for most.

BTFD or run for the hills?

Wait for some more time , like 2-5 days, watch how it goes after Rate hike !

One green ![]()

SHOP up on news about shopping on Instagram and frictionless checkout with Google pay.

STC 4 Jul calls… please not being foolish again ![]() So far, every time I sell, it goes up some more

So far, every time I sell, it goes up some more ![]()

Holding 1 super duper LEAPS call $80 ![]()

All the talks about tariff and trade war, impending Fed meeting on rate hikes, etc is getting me nervous.

My mantra is Sell the rip, rather than BTFD.

Basically, getting rid of non-LEAPS calls, and holding LEAPS calls + underlying for now.

Effectively, cutting delta of most position to 33% to 75% ![]()

Bull markets climb a wall of worries. SPY is consolidating between the 50 and 100-day. There’s pretty good considering the recent run. Once it goes back above the 50-day, it’ll be time to get more aggressive with options. The key is which stocks will lead once it goes back above the 50-day. Tech and consumer discretionary are the sectors closest to breakout.

For years, people said financials would benefit once rates started to increase. We’ve had rate increases and the forecast is more wait increases, and banks haven’t taken off yet. I think the correct statement is when the yield curve steepens, it’s great for banks. Usually when rates are increasing, the yield curve gets steeper. The yield curve is staying flat this time, so the rate increases aren’t helping financials. It’s just another case of a misinforming headline not explaining what really happens.

IMHO, for the next 5 years if it is still bull, tech stocks are the best choice. For options, go for mega cap because liquidity is high, can buy 10-100 calls without affecting price. Liquidity of options of 10x stocks is too low. So I prefer to just hold LEAPS calls and stocks, shift some $ to ride the bull market if it is rallying again. In Chess, is called pause and wait for development.

Btw, 10x account is at ATH again ![]()

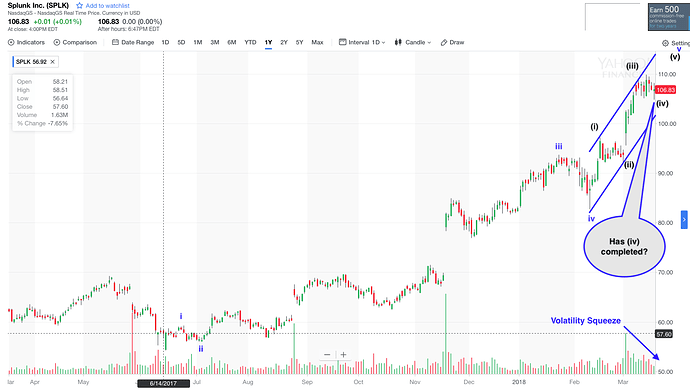

Waiting to STC SPLK May calls around $115. SPLK calls and MU calls are the only two counters left that I have short-term calls. The other six counters, LEAPS calls and underlying.

I like how noone talks about SQ: )