Saw a chinese blurp saying google is buying a stake in JD. Bullish.

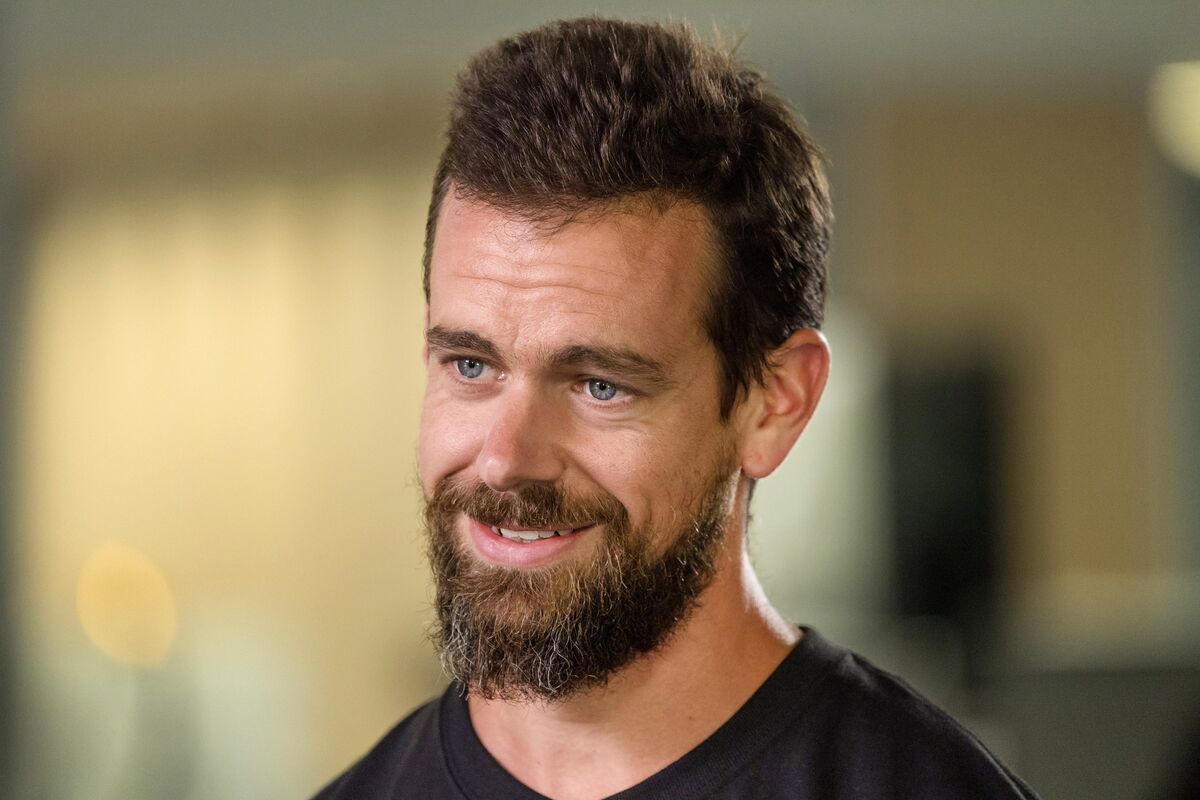

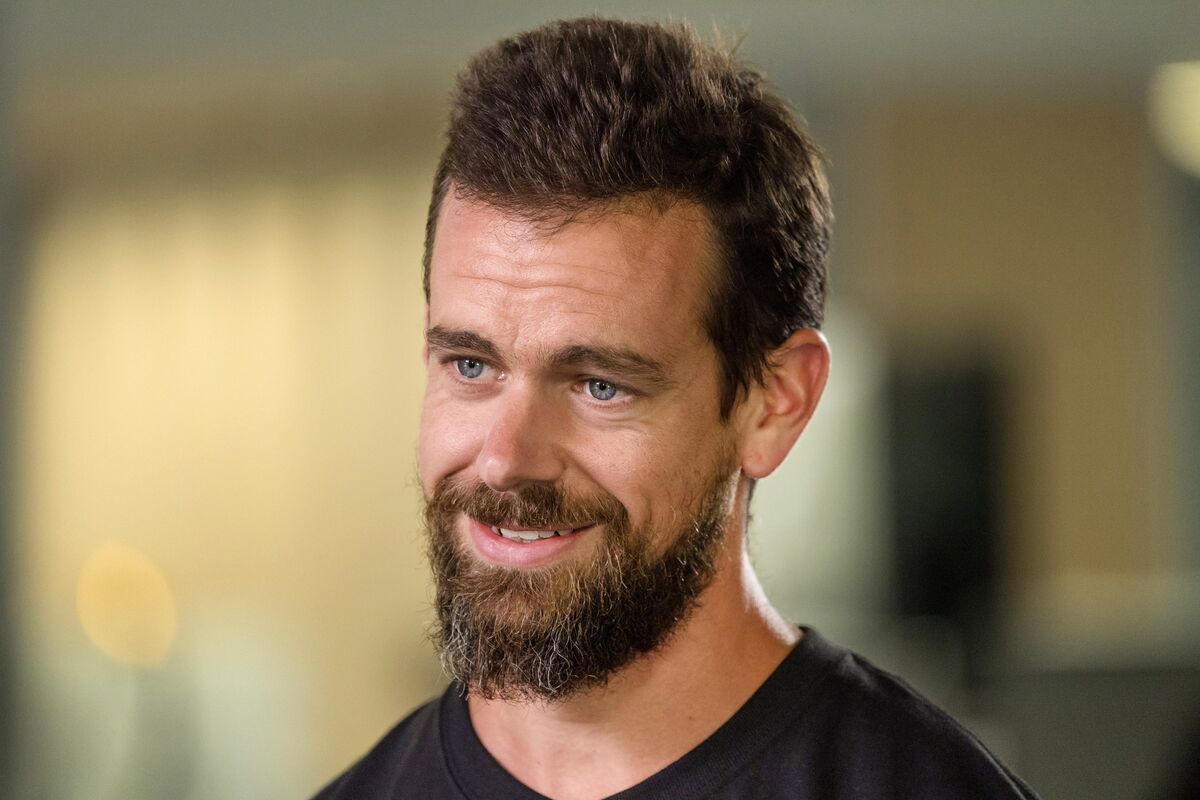

Jack Dorsey's Twitter, Square Are Both on the Verge of Doubling This Year

In 2018, it pays to be on Jack Dorsey’s side.

Saw a chinese blurp saying google is buying a stake in JD. Bullish.

1% stake?

Less than 1%. This is just “earnest money” for google, to show that they are a committed partner. The other yet to be announced details of the alliance should be more interesting.

Google has zero presence in China. This deal should help JD’s international push into SE Asia. That’s the next battleground among amazon, alibaba and JD.

So no need to invest into JD. Because I already own google.

Btw, NTNX and TWTR tripled within a span of 9-12 months.

The rest of the 10x about 1 double.

Tim…berrrrr.

Are you reaching out to Tim Cook? He can’t help you.

It’s a good day to buy some far out calls. I’d look at Jan 19 expiration.

Sound like you think is only a one-day event.

nflx?? I bought some for funn… and now I think I should have bought more…

explain why?

It’s good to do when there’s a big down day that’s a knee jerk reaction, but it doesn’t change the fundamentals of the economy. The trend is still up. Buying way out in January gives plenty of time for the turbulence to pass. Plus, you get to own through the fall which is typically the strongest season for stocks.

I did it a week or two ago with TWLO and VEEV. They were down 4-5%. Now I can sell OOM calls against them if I want to generate yield. That’s another perk of the strategy.

I did this with COST last year, and occasionally do with SQ when it has 3-5% daily drops.

I did this with COST last year, and occasionally do with SQ when it has 3-5% daily drops.

I did it with WFC when the huge scandal first broke. I waited 3 days then bought far out calls. I should have done that with FB over the Cambridge Analytics fiasco. I just bought the stock, but that’s one I’ll keep holding.

I did it for fb as well after cambridge analytica

Need to read up on options!

I wouldnot do it for wfc, those are the kind of things that could go veery bad

In 2018, it pays to be on Jack Dorsey’s side.