AEHR is also a Beth+Knox pick. Interesting you came to the same conclusion as them.

I like your wide range.

What is UWC?

AEHR is also a Beth+Knox pick. Interesting you came to the same conclusion as them.

I like your wide range.

What is UWC?

It has been in my review since 2019 onwards, but after 2020 I decide to stick to index ETFs (or sector) only for my trading purpose, got rid of all stocks. I purchased it for $7 or $8 onwards, traded at $24 too (all 2020 or before).

This one AEHR stock price growth is far better than TQQQ, still it comes to my 2020 watch list.

Nowadays, I do not have any idea about such stocks.

AEHR wasn’t doing much for two years since discovery.

was trounced by PLUG during that period.

and behind PLUG since discovery too.

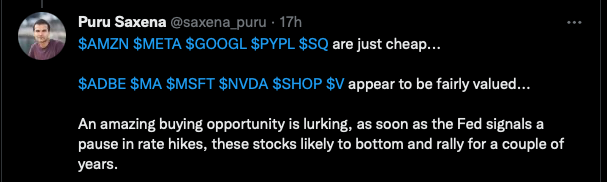

His views are based on FA solely, not good. Should provide some analysis of business prospects and risks.

This guy already struggling for his own investments !

ZI should taught Puru a lesson.

Revenue growth ![]()

P/S, P/E, or similar ![]()

Free Cashflow ![]()

Valuation = Sum of discounted ![]() cashflow

cashflow ![]() over x

over x ![]() number of years. The two variables (discounted interest rate) and cashflow… don’t assume they are identical over the x number of years… most investors use the most recent

number of years. The two variables (discounted interest rate) and cashflow… don’t assume they are identical over the x number of years… most investors use the most recent ![]() numbers

numbers

What did Puru learn from ZI and TWLO?

SMH

Fed rate jumps from 2-3% to 5%, revenue growth slow from triple digits to double digits, still expect high valuation? 2022 tells us the popular belief that fast growing dominant capital light businesses would yield highest return is not true. May be a few are, not hundreds of them. The high valuation is due to easy money, too much money no where to go, all dump into stock equities and crypto. Anyhoo, Fed has been telling us to stay in cash for nearly a year… many of us are deaf.

Well, for the deaf who don’t get the “Stay in cash and not done hiking advice”, margin call is the only way to wake them up. Better to listen to Fed using simple layman language than to use big words like recession, liquidity, inflation, CPI, …

I don’t think he realizes the danger of being cash flow negative in a bear market. Also, hyper growth companies hit a point where growth slows. When that happens, most of them have expenses that are growing much faster than revenue. People don’t think about the math on headcount growth. Whatever percent headcount grows by in the current year will cause expense growth the following year of ~60%. Growing headcount this year by 50% is ~30% expense growth the following year. That’s without even hiring anyone additional the following year. Once revenue growth slows, then it’s very easy to have expenses growing faster than revenue and have a disaster. If they were already cash flow negative, then it’s brutal.

.

I learn from Management Accounting class of MBA that capex attract future stream of capex, so control capex ruthlessly. Headcount is a capex.

A HUGE issue is budgets are always baseline plus incremental ask. Most teams are never re-prioritized and asked to give up headcount. It leads to massive bloat in some areas. Amazon does a better job than any company I’ve seen at moving headcount between departments to avoid bloat.

We are still struggling at my current employer to reduce bloat in a sister organization that has duplicative functions. Said bloat was caused by power hungry execs who’ve since been booted. But exec appetite to re-org that org is still not urgent and I wonder what the tipping point will be.

Mature companies tend to be bloated ![]() Most effective way is to change CEO, TWTR is a good example. For department/ division, change the head of D.

Most effective way is to change CEO, TWTR is a good example. For department/ division, change the head of D.

SMH.

The thought of becoming rich/FI through investing and not getting a 9-5 job is put to test by Fed. Fed wants young people to work productively and not laze around at home tweeting and blogging.

Social media ![]()

Easy money ![]()

Go get a W2 job.

![]()

![]()

Puru is smart and experienced, and he understands macro well. That doesn’t mean he would do well in the investment world. He is a prime example of why I no longer believe that much in intelligence, qualifications, knowledge and skill in success especially investment success. Success is random, or luck if you wish.

In % term? My guess is Puru lost more in % and absolute dollar term.

Performance of both is why for most (almost 100%) of us, better to just invest in S&P. Free yourself to do other stuffs, for your family, and for your other interest (if investing is your interest, put up max 5% of your NW).

Technical recession Q1 Q2, stock market didn’t bottom.

Btw, for Dotcom era, stock market bottoms after ![]() recession. Currently, is in cloud computing bust, stock market didn’t bottom during Q1 Q2 recession, so could bottom after

recession. Currently, is in cloud computing bust, stock market didn’t bottom during Q1 Q2 recession, so could bottom after ![]()

Soul searching cont’d…

…quoting my favorite investment guru…

“In regard to young companies…there is an important deviation from this rule (of profitability), such companies will at times deliberately elect to speed up growth by spending all or a very large part of profits they would otherwise have earned on even more research or even more sales promotion than they would otherwise be doing. What is important in such instances is to make absolutely certain that it is actually still further research, still further sales promotion which is being financed today so as to build for the future, that is the real cause of the non-existent profit margin. When this happens, the company with an apparently poor profit margin may be an unusually attractive investment.”

![]() Read what other people have to say.

Read what other people have to say.

![]() Exactly, can only try our best and not be so sure i.e. invest with what you can lose.

Exactly, can only try our best and not be so sure i.e. invest with what you can lose.

![]() Can’t predict the future, try our best and then

Can’t predict the future, try our best and then ![]()

![]() IMHO, SBC is too high. SBC is critical to attracting top talents but easy money gives rise to excessive SBC.

IMHO, SBC is too high. SBC is critical to attracting top talents but easy money gives rise to excessive SBC.

This is why some follow the the rule of 40:

operating margin + revenue growth > 40

If you’re accepting lower op margins, then the revenue growth needs to be higher. It’s become the standard for SaaS companies.

One thing I don’t see broadly discussed is SaaS companies had major tailwinds from their customers going on hiring binges. That has ended, so it will be more difficult to grow revenue now. It’s the net revenue retention metric with is usually in the 115-130% range for top companies. That could decline to <105% which would be a significant hit to revenue growth.