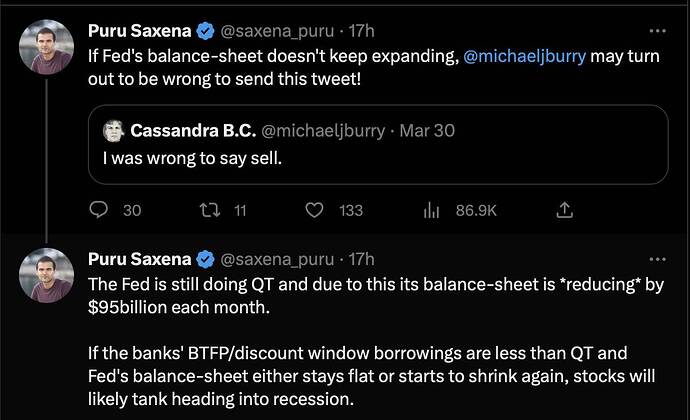

If… then… if… then…

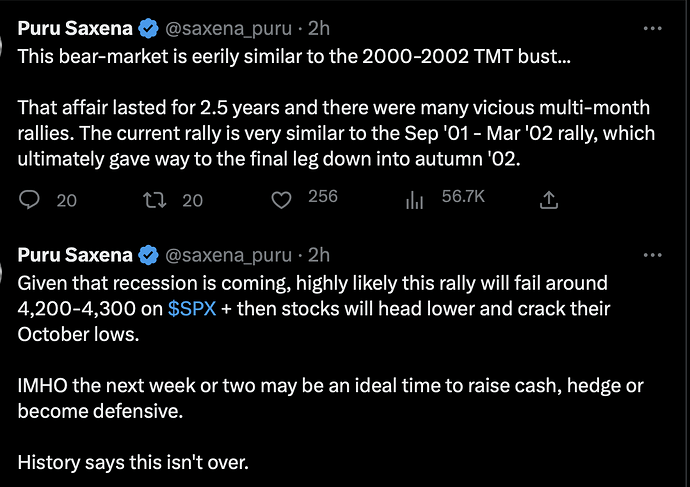

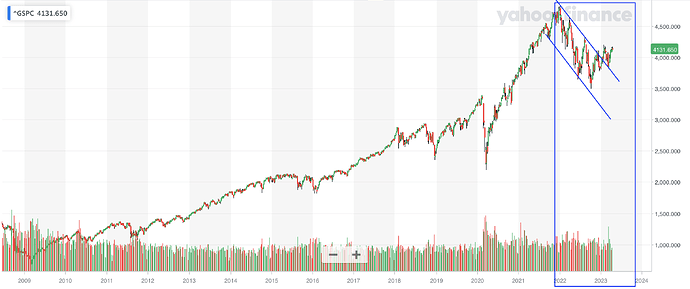

IMO, Market is bullish only 30-45 days, but bearish until 2024. The economy will tank with FED rate hikes as we see lot of mass lay offs started. The recession is imminent and economy will not go bullish until we face a recession before 2024.

.

Guess economy means stock market. Something is not right.

Booming economy with rate hikes > stock market goes bearish

Recession with pause rate > stock market goes bearish

So only rate pivot can turn stock market into a sustainable (longer than 1 yr) bull market?

Btw, current bull market started in Oct 2022, so is in 5th month, soon in 6th month.

Thanks for pointing it. OMG, you are right, I am more bearish now, seeing end of 5th month bull run. This means we are about to topple down, esp after seeing the crazy run of stocks last two days.

Recession is for economy, two cons.qtrs negative GDP. Stock market always pre-empts economy.

During 2019-2020, Stocks started coming down Dec End, 2019 and hit bottom Mar 23, 2020. The whole issue was “Covid-2019” and we - retailers - did not face the pressure of covid at that time when Stocks went down, perplexed. But later, Mass lay offs started resulting 14.1% unemployment. When FED supported, market went up V-Shape recovery, but all of us faced the real pressure of covid-2019 thereafter 2 years.

Big Players in stock market analyze the pros and cons of future and pre-empts events/economy!

Many times I indicated, market actions are decided already and with the internet speed, switches are UP or Down easily on daily basis.

Since market pre-empts (absorbs future based on analysis), there will be a skew between actual event and the market reaction and it can be from 1 day to 180 days skew.

For example: Next 2-3 days, there is a dip (short cycle or long cycle, I do not know), but market peaked yesterday. I have almost 30+ formula/logic and most of them showing bearish next 2-3 days. I was keeping cash mode until Thursday and took some token SQQQ/SPXUs Friday until I see safe point to get in.

If you have noticed, market starts going down one week before FED rate hikes, either they get rumor or leaked messages, market plans ahead in the game.

Stockmarket (with forecasts/future analysis) is skewed with reality (future events or issue).

Booming economy with rate hikes > stock market goes bearish (based on futures - borrowing cost increases).

Recession with pause rate > stock market goes bearish(based on futures - actual economic slowdown, company overall revenue/income reduces).

The recession has been predicted for two years. Never in my lifetime has a recession been predicted for that long and not happened. The boy has cried wolf for too long. Personally I think the drive to live and enjoy life after Covid19 will negate this bull shit recession

Not 2 years but 5 years. Since 2018. It seems like next recession will never occur because Fed has learnt the trick to avoid recession (print baby print).

We had a recession the first 2 quarters of 2022. They just decided it wasn’t a recession.

There was a brief recession by year 2020, very small one. Even that time, yield curve inverted.

Past 5 months, we had a small bull run and will end soon. Based on my algorithmic forecast, the top range is around 3300-3400. It may or may not reach that level, but it can not exceed.

Thereafter, spx must go down to 2800-2900 which will make the recession end.

This must happen without which no bull run for 10 years! This is in sync with what yield curve is hinting now.

With current high rates, if FED holds another 5-6 months, cost of borrowing kills all economic demands.

Now itself I started seeing nice deals on real estate, but further increase the pressure in next 6 months.

I actually would welcome a recession. I have plenty of projects on hold waiting for lower construction costs. But I am not holding my breath. I am doing several projects on my farm. At least lumber prices are 1/3 of the peak. But labor is $40/hr for unskilled. $80-150 for skilled journeymen

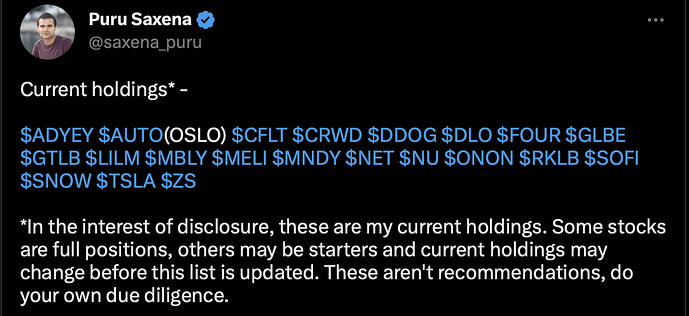

TSLA lolz

![]()

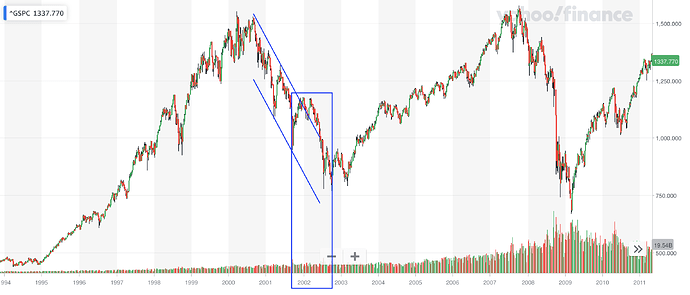

Sep 2021 to Mar 2022…

Current has higher high higher low, goes above and successfully re-tested upper downtrend channel line. Not similar ![]()

In some of my accounts, I am moving to TLT which can go 15%-20% upside from here (based on Jan 2020 to Mar-2020 SPX-TLT move).

This is the first time I try with TLT, never know what it is going to give me!

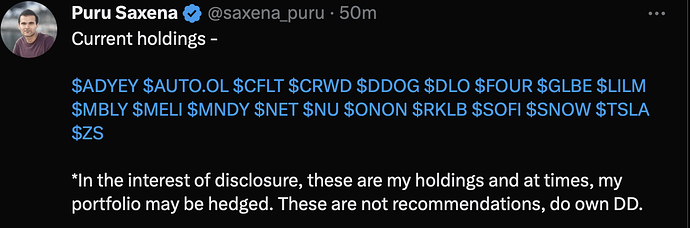

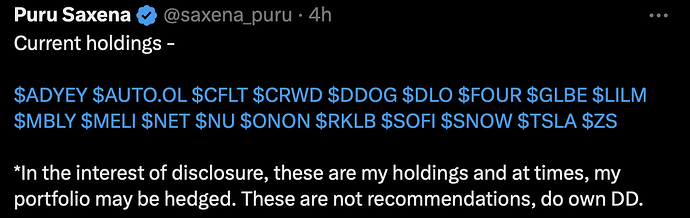

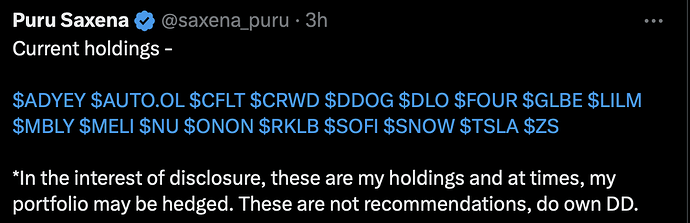

Puru still owns TSLA?

SMH…

Dude just throws random stuff on the wall and sees what sticks.

The best choice now is TLT, just sharing seeking alpha posts, read and understand why it is.

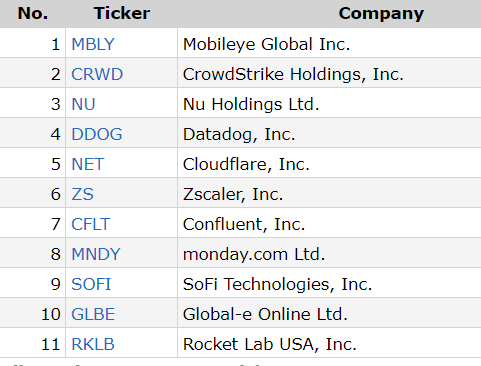

Here is the challenge, these are the companies(from Puru’s Holdings) not making any profit as of now (compare with AAPL) and how they will survive next five years in recession?

Will the survive or Bankrupt like SVB suddenly one day?

Who needs to ensure that these companies won’t file bankruptcy in next 5 years?

.

Frankly, I don’t understand why he wants to take so much risks in high growth stocks. He is from a pure finance background with no working experience in tech and operational companies. His assessment is purely from a financial and macro perspective.

My total investment in CRWD DDOG NET SNOW is less than $100k… a fraction of my stock portfolio (comprises mostly of S&P and AAPL).