7 days later…

Changes…

Open: NET (time for @manch to sell)

Close: CFLT, LILM

Don’t worry. He won’t hold for long.

26 days later…

Sep 18, 2023

Open: -

Close: -

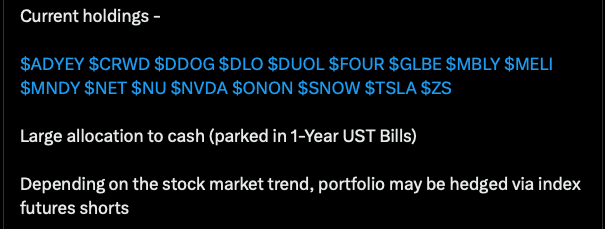

Puru is in a defensive mood. Reduce position size and park proceeds in 1yr T-Bills.

So many inverse indicators in the market.

Cramer’s inverse indicator.

Cathie Wood’s inverse indicator.

Puru’s inverse indicator… did he buy into Tom Lee’s year end rally? Feel half-hearted since he allocated large % to TBills.

Break below Oct, 2022’s low? So bearish. I’m in the camp of Oct, 2022 is the start of a multi-year bull market. Testing it is possible but not break below.

Puru is increasingly bearish. Position is till net bullish. He is not sure he can jump out before the crescendo, so he cuts his exposure gradually.

Puru went completely defensive. Sold off all growth stocks. Focus on dividend stocks, discount retailers and T-bills.

Stocks: DG DLTR BTI IMBBY MO PM SJM VZ

Puru is losing his mind.

Global liquidity is rising. Crypto being the most risky is ripping. Don’t think this is the time to go bearish on high beta names.

Puru is fearful of the darkness after the sight of the ghost (sharp decline from Nov 2022). He is convinced that another bear market would begin after the first rate cut. Consensus is Fed would cut rate in Q1 24.

Any other big name Twitter people shorting the market? Seems suicidal to me.

Global liquidity is rising. Why fight it?

I am not betting one way or the other. But, attributing Feb 2020 recession to interest rate inversion is a bald lie.