This year, Puru performs badly.

Puru Ytd: -30.5%

QQQ: -20.7%

S&P: -13.3%

AAPL: -8.5%

That’s much weaker than I expected. Didn’t Puru make a lot of noise how he perfectly sold at the top? What happened?

He lost a lot of money in hedging. And a few times, his hedged position miss the big move… growth stocks shot up, his short ARKK also shot up, so make nothing. In a nutshell, his hedging doesn’t work in a choppy market. It works spectacularly during the Mar 20 dive, chop up and down, doesn’t work.

Market is complicated and unpredictable. You make $, thought you found the right key, use the same strategy, lost big. That applies to those who make $ ytd… doesn’t mean would make $$$ in the next bull run. If you can make good return (> 11% CAGR) for 20-40 years, your strategy is good.

He has zero idea how to be an active trader then. You don’t do options in a range-bound or choppy market. The odds are against you. You want the 200-50-10 day moving averages aligned in ascending or descending order. I also don’t get why he was hedging if he went to mostly cash as claimed. There shouldn’t have been material positions that required hedging. He should have just DCA back into positions over time.

.

He is a long term investor like Cathie Woods. Identical in growth investing concepts and philosophy. The only difference is he learnt from somewhere that long term investors also need to hedge whereas Cathie didn’t hedge. Ofc, different choice of stocks.

He went fully cash after he lost a lot in hedging. If I have read correctly, he is fully invested now.

Confirmed. Fully invested.

Market is sending the message is time for rock n roll. But why are there so much bearish sentiments in social media and by WS commentators?

Market goes up and down on its own, Media provides running commentary with attractive or sensational story for markets action.

Did you ask him what his trend following indicators are?

Sentiment lags. It won’t change until the market is measurably higher. That’s why most people sell at the bottom and buy near the top.

.

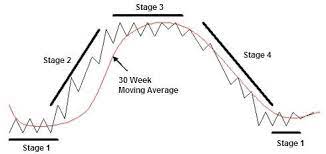

Just a simple one. Twitter is hard to search. IIRC is 70-day EMA on daily chart. Don’t recall he explained why this is good. The popular way for stage analysis is to use 40-week EMA on a weekly chart, still not in stage 2 (bull run)… Mark Minervini uses stage analysis. Refer to chart below. IMHO, stage analysis is too safe, take long time to confirm stage 2. Can take risk (as in put in 25-50% planned $) now since MACD has crossed above signal.

.

Look like he has adopted the Stage Analysis standard.

The popular stage analysis uses 40-week EMA as follows:

Buys when price breakouts 40-week EMA, sell when breakdowns 40-week EMA. Simplest TA rule.

Puru is blabbering like media on => Powell’s dovish comments might have ended the cyclical bear-market.

Listen after 4 mins (exactly 4.40mins to 4;60mins) of this video what powell is telling is “Another unusually large rate hike is appropriate and depends on data”

This is hawkish.

Market is always market, cheating retailers, making unexpected twists. Never trust Media, news or anything else except your own guidance, guess, knowledge…et al.

Educate yourself to survive in this field.

The prior statements were September then 2-3 more hikes after that. September is now dependent on data which is dovish compared to previous. They aren’t as committed to hikes after September either. That’s dovish compared to prior statements. It’s about changes in the forecast. There’s a reason mortgage rates have dropped from the highs over 6%. The yield on 10 and 20-year bonds peaked on 06/14.

It is not wrong riding the bull wave, but be cautious on speculators statements.

People say dovish when market goes up and bearish when market goes down. This is just media translation.

Yield peaked 6/14 and now yield came down by demand on long term treasury bonds increased. Here is the issue. With such yield down the 10Y-3M is 0.25%.Presently market accounting 0.5% (based on sentiments), but soon will change to 0.75% (very likely).

If FED raises 0.50% itself, inversion likely happen. Knowing all these, market is pulling up and up drop again sometime at peak as this is long gap between two FED meeting (July 27th - Sep 23rd).

BTW: This is my inference and guess work, any thing can change any time. Jotted only for discussion purpose.

Is he investing based on FA or TA?

WB somehow able to do so ![]()

This year, actively managed funds such as Puru can’t beat broad market indices e.g. S&P and Nasdaq, nor slow growth cash rich stocks e.g. AAPL and COST.

From Sep 1, 2016, CAGR of portfolio = 33.27%, only slightly better than CAGR of AAPL of 31.4%. So much active management for a small gain which is likely to erode as time passed.

Sound good but…

Miracle can happen ![]()

US negotiated ending of Ukraine-Russia war.

China gave up locking down. Outcome uncertain: Demand by Chinese shoot through the roof but China is also the world manufacturer. If you own AAPL, TSLA and RE, laugh to the bank.