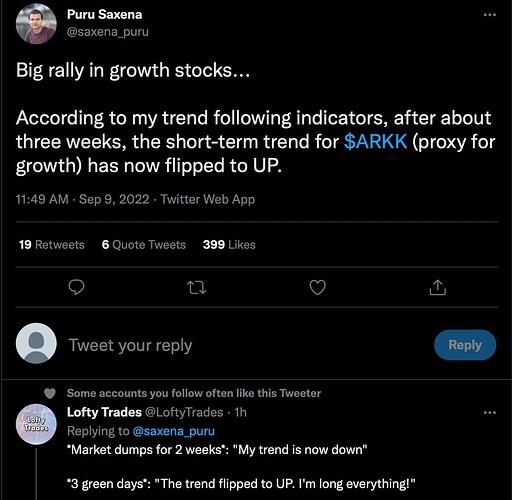

Ha ha ha ! Most of the debt ridden and loss making (last 1-3 years) stocks likely to end up delisting !

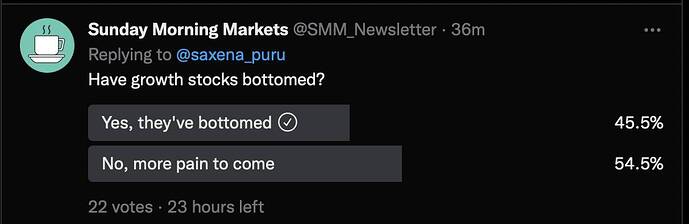

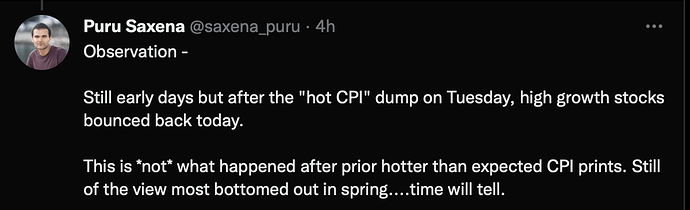

Puru, Tom and Bill are in the same page, expecting CPI prints to decline sharply.

If true, following the CPI print, stocks could jump 10-20%.

Aug CPI to be released on Sep 13.

Market is calling Fed bluff. Let’s what is the CPI print on Sep 13. Market is expecting low print. OPEC cuts oil production yet oil price tumbles.

Just my 2 cents: These are media hypes to show investors attractive news for circulation purpose. None matters.

Market is in short term bullish turn, but it is not permanent bullish turn. I do not know how long it can go bullish and when it changes.

What I have said “We can expect 30%-40% drop from here” is a guess work of long term impact for the next 15 months. IMO, This still holds good.

We are still in EW => B-C.

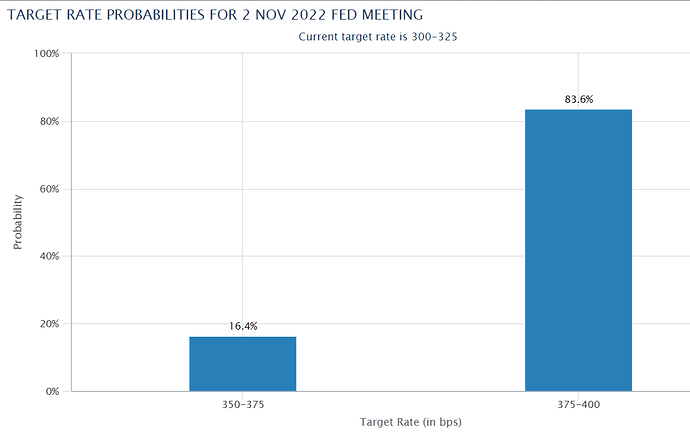

Almost certain that Jun 16 is the bottom for growth stocks unless CPI print is unexpectedly high which could lead to Fed raising rate by 1% instead of 0.75% (88% probability).

Bitcoin which is a risk-on indicator appears to put up a double bottom. So risk-on!

Agree.

Almost certain that Jun 16 is the bottom for growth stocks unless CPI print is unexpectedly high which could lead to Fed raising rate by 1% instead of 0.75% (88% probability).

Don’t think is unexpectedly high, 8.3% is within the expected range of 7.9%-8.3%. Some retail investors might have unrealistically think would be below 7.9% and traders take advantage of the sentiments.

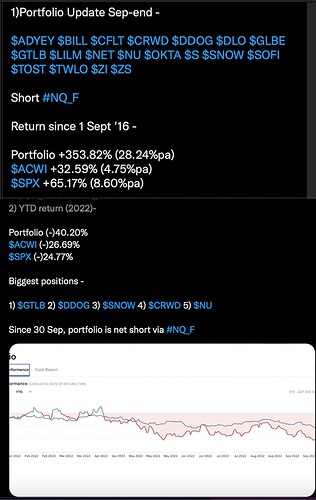

After only 6 years, his portfolio annualized return of 28% is already underperforming AAPL annualized return of 31% over 25 years. Actively managed portfolio might beat buy and hold forever portfolio short term (up to a decade), can’t beat buy n hold for 20+ years.

SMH.

Buy n hold is BS? CAGR 35% over 22 years.

Agree with the last phrase but most of the stocks in your portfolio have little track record and don’t know why they are considered as quality compounders.

Very dangerous thinking. Seem to be justifying what you are holding rather than objectively evaluate the current environment.

In dotcom bust, stock prices decline 90-99% (many went bust). Please don’t tell me fundamentals are different… is not exactly true… too lazy to put up a prose.

Don’t think CPI print matters that much to Fed. I would view any uptrend arising as bull traps. Fed is most worried about the “anchored attitude”.

.

Puru doesn’t seem to believe in established companies. Prefer newly listed companies.

His thinking may be like this => Chances are RIVN, now 28B can become 280B in 10 years, will TSLA become 7.68T in 10 years?

LOL !

He is optimistic since Mar.

Market is expecting 1.25%. 0.75% Nov, 0.5% Dec. Some are expecting 1.0% Nov.

Buy & hold works for broad-based index like S&P, and rock solid business like AAPL AMZN MSFT e.g. over a 20 year period from Oct 10, 2002 to Oct 11, 2022,

AAPL CAGR 36.3%

AMZN CAGR 27.0%

MSFT CAGR 7%

S&P CAGR 7%

Huh? Not everyone hold growth stocks. Growth stocks are unproven, so buy n hold is extremely risky.

Buy n hold (hopefully never sell) AAPL and S&P works very well. Return on effort for AAPL and S&P is near infinite compare to actively managed Puru’s portfolio, ARKK and GK.

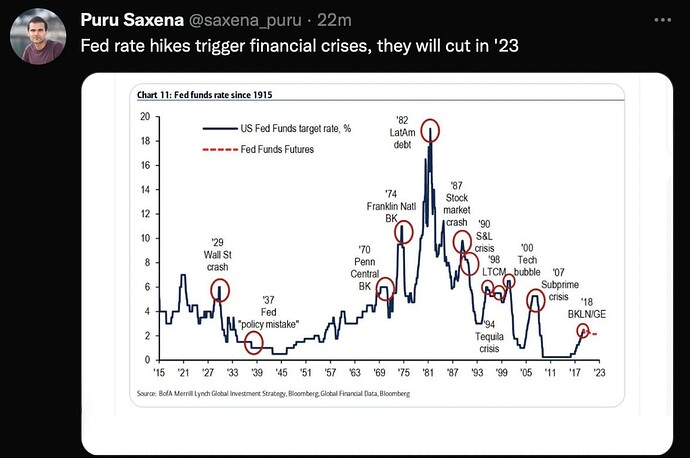

I think they’ll cut next year too, but there will be more pain before they cut.

I think they’ll cut next year too, but there will be more pain before they cut.

From JPowell speech, cut should happen in late 2023 to early 2024.

The projection is 1-2 hikes in Jan-Feb, pause, cut later in the year or early 2024.

I think it’ll be first half of FY24, because they are going to crash land this thing.

The projection is 1-2 hikes in Jan-Feb, pause, cut later in the year or early 2024.

Did JPow said about this(bold highlighted)? Any way, we get minutes tomorrow 11AM that will confirm what is their plan.

Buy & hold works for broad-based index like S&P, and rock solid business like AAPL AMZN MSFT e.g. over a 20 year period from Oct 10, 2002 to Oct 11, 2022,

How did you conclude 20 years ago Apple was a rock solid business? Amazon was very much a cash burning startup back then too.

These are great investments in hindsight. But in real time it was tough to say let’s just buy and hold for 20 years and they will give you 100x returns.

How did you conclude 20 years ago Apple was a rock solid business?

I have answered you long ago! I will repeat for you one last time, SJ said he would build Apple to be the number 1 company in the world. Long ago, you can access private blogs and forums, it was uttered in one of those, unfortunately I didn’t do a screen shot.

Zuck says recently he will dominate VR and it will be a great business. You buy that?

Barnes and Nobles once said they will crush Amazon. Why did you not believe in them?

If it’s so obvious to pick long term winners, can you give us 3 names that will 100x in the next 20 years?