Did the pandemic kill homeownership?

Ownership has become such a financial stretch for so many folks it’s also a strong “bet” that price appreciation, aka profits, is needed to close the deal.

Ooo, the discipline. Respect.

Ownership has become such a financial stretch for so many folks it’s also a strong “bet” that price appreciation, aka profits, is needed to close the deal.

We’re an aging society. Birth rates are down, even as young adults buy more homes. And immigration, even the legal kind, is a hard sell. The result is meager population growth, if at all.

So, there will be fewer people to replace the dying Baby Boomers, cutting long-term demand for housing.

Houses demand is proportional to number of families not population growth.

Aging? Longer lifespan ![]()

Birth rates are down? Sure? Lesser but richer families ![]()

Fewer people to replace the dying baby boomers? Millennials population is bigger than the baby boomer population.

Real estate? Price up rent down?

People are rushing to buy property rather than rent. In addition to secular forces, cost driven inflation is pushing cost of new construction and replacement cost up => surging house prices regardless of mortgage rates and imminent recession.

…

(Bloomberg) -- A record share of Americans anticipate that rents will go up over the next 12 months, according to Fannie Mae data going back to 2010.

Homeowner tenure flattened near its peak in 2021 after steadily rising for nearly a decade

Est. reading time: 8 minutes

Fannie Mae says home prices will climb 11.2% this year, followed by a more modest 4.2% jump in 2023.

.

Record Share of Americans Say Rents Will Keep Rising This Year - BNN

Some zip codes, rent ![]()

One renewal, offer existing tenants 16% increase in rent, if don’t want to renew then put on the market for 33% increase ![]() which is 5% lower than current market rent. So I am being kind

which is 5% lower than current market rent. So I am being kind ![]()

Too kind. So generous.

.

Too kind. So generous.

I am eating 2/3 ![]() of the property tax increase. Cashflow drops significantly.

of the property tax increase. Cashflow drops significantly.

Marvy Finger recently sold half his portfolio of Sunbelt apartments for $2 billion, saying the Covid-crazed rental market has peaked. The buyers, pointing to a 20-year low vacancy rate, disagree.

Finger is ridiculing Greystar after selling to him. Good etiquette, old man. Anyhoo not interested in apartments.

With half as many homes to buy, competition has driven prices up 35%. Buyers are twice as likely to pay above list price, and homes sell twice as fast.

Est. reading time: 7 minutes

paper wealth

Household net worth in the fourth quarter eclipsed $150 trillion for the first time, rising at a healthy 8.2% pace from the previous quarter.

Talking about rental surge in Singapore, renewals are done at 60% to 300% higher. Same as here, larger square footage are easier to rent and enjoy larger percentage gain.

Anecdotally we see house prices and rentals sky ![]() everywhere. Hope those bloggers eg @manch and @jil didn’t sell their RE last year to buy nose bleeding high growth stocks. Asset diversification is a must.

everywhere. Hope those bloggers eg @manch and @jil didn’t sell their RE last year to buy nose bleeding high growth stocks. Asset diversification is a must.

Hope those bloggers eg @manch and @jil didn’t sell their RE last year to buy nose bleeding high growth stocks. Asset diversification is a must.

I still have my REs safe & fully paid off. I am maintaining no further RE. Presently, I simplified and invest in index ETFs QQQ/TQQQ combinations all in one bucket, no other stocks, no other assets.

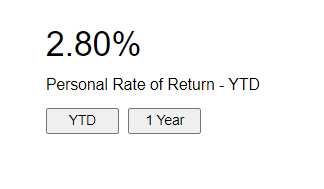

As you know, my algo that prompted me well ahead, sold all kept under money market cash for a longer time since Dec 2021. At times, I made small trades (QQQ/TQQQ) accumulated 2.80% YTD my considerable big account (way smaller than hanera and wqj !).

Nowadays, I do not blog/read even reddit as I see most of them novice, nothing to learn.

I do not plan to reply any questions or come back again. Good Luck to you all.

Nowadays, I do not blog/read even reddit as I see most of them novice, nothing to learn.

I do not plan to reply any questions or come back again. Good Luck to you all.

Leaving us again. ![]()

Probably tired of seeing all my spam links ![]()