House-Flipping Tech Powers a Boom in Single-Family Rentals

Phoenix’s hot housing market, investors are turning to new tools that help them quickly buy, repair and rent out large portfolios of homes for rent.

Housing Crunch Turns Employers Into Landlords

It’s a new twist on the old concept of company towns. “If you call anybody, they’re all buying houses for their staff,” says Kim Jensen, a Wisconsin restaurateur.

Vail is looking for 100 units to rent for staff in South Lake Tahoe. Nothing available

How about Reno? ![]()

Too far for Heavenly employees. Most don’t have cars.

The almost all South American staff at Heavenly/Kirkwood/Northstar is really interesting. We’ve been signing our kids up for ski lessons all winter and almost every instructor has been from Argentina or Chile.

Why don’t they hire more locals? Wages too low for the local market?

They need staff only housing. Dorm style.

It’s not just a Tahoe problem. It’s a problem for all the expensive ski towns.

Same with soda springs. Argentinian staff.

Today, his gross rental income from over 100 units exceeds six figures a month, which was confirmed by Insider.

Net? Profit? Cashflow?

His first major refinance was in July 2021. He pulled out seven-figures, reinvested it before January of 2022, and “churned it into another 4 to 5 million dollars worth of assets,” he said.

![]()

His second refinance was in March 2022.

Still sitting in the bank?

I can’t believe BI did 2 articles on him in the same month! No other investors to interview or profile?

This is only from March 1, 2022

free link: https://archive.ph/Qwi2f

They are raising wages next year to $20/hr. Ski resorts been having using employees from the Southern Hemisphere forever. Rich kids on summer break definitely don’t need high salaries… so these temporary employees don’t need as much income as full time residents. Vail intends to put 4 employees into studio apartments. 400 into 100 units. Definitely not meant for long term living. Not sure what they will do with them the other 8 months a yea.

If these are rich kids, clean/fix them up? ![]()

.

Not every investors are like TSLA ![]() investors, like to brag. His gross rental income is high, but his net cashflow might be lower than your. Also, he didn’t impute his own labor in fixing up the house so the price of his house is lower than it should be. Ditto for PM.

investors, like to brag. His gross rental income is high, but his net cashflow might be lower than your. Also, he didn’t impute his own labor in fixing up the house so the price of his house is lower than it should be. Ditto for PM.

I hit my 10 year mark this year . ![]() I need to ramp up

I need to ramp up

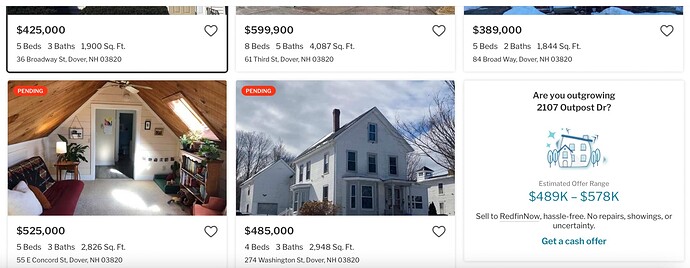

Dover, NH

$5M rep 70% loan means worth of property portfolio = $7M, and means equity = $2M.

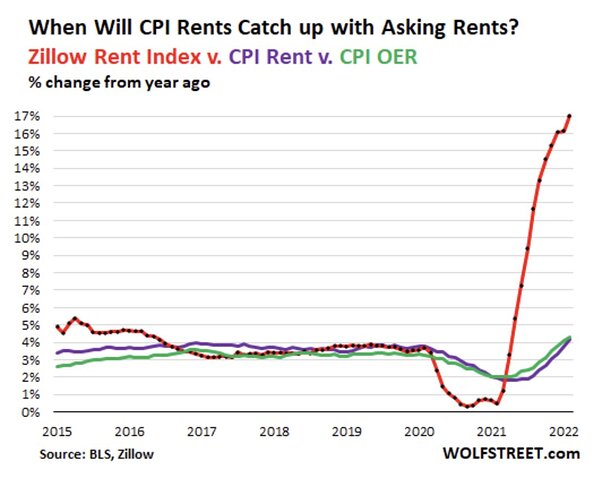

Six figures gross rental income = $100k+ means 17% rent2worth, so high?

I scan a few multi-family properties (using Zillow) only give rent2price of 3%?

Something wrong with my maths?

May be appraisal is lower. 36 properties of $500k each = $18M.

$100k+ rent means 6.7% rent2worth, sound reasonable, comparably with Austin.

10-20% price decline i.e. a correction, may be ok for him to speculate for that type of decline but really not very interested. Frankly, I don’t see any possibility of correction for another 1-2 years, not with the rising demand by millennials forming family and rising cost of new construction.